- Zodia Markets joins Finery Markets ecosystem to deliver seamless RFQ-based access to FX and digital asset liquidity with T+0 settlement.

- Sage Capital powers Finery’s new quote streams functionality, streaming 24/7 institutional-grade pricing across 200+ digital assets.

- Finery Markets’ Q1 2025 OTC Review reveals record-breaking 141% YoY trading volume growth and a 158% surge in stablecoin activity.

- Finery Markets rolls out mobile-friendly updates across all products, enabling full trading and back-office capabilities on any device.

- New “give-up” setup with Hidden Road simplifies trade clearing, reduces onboarding friction, and enhances counterparty risk management.

- The Flow podcast returns: Coinroutes Co-Founder Mike Holstein on why crypto needs Wall Street’s trading toolkit.

- Finery Markets wins AIBC Eurasia Pitch Competition in Dubai, reinforcing its position as a leading institutional crypto trading platform.

Zodia Markets Joins Finery Markets to Expand Institutional Liquidity Access

Zodia Markets, the digital asset brokerage backed by Standard Chartered, has partnered with Finery Markets to deliver seamless access to digital asset and fiat liquidity for institutional clients. Through this collaboration, Finery Markets’ users can now benefit from Zodia’s competitive FX pricing and T+0 settlement—delivered via RFQ for streamlined execution and minimal technical overhead.

This integration empowers clients to access Zodia’s liquidity instantly across Finery Markets’ ecosystem, including FM Marketplace, FM Liquidity Match, and FM Whitelabel. With built-in support for prime brokers like Hidden Road, the setup simplifies onboarding and eliminates integration barriers, accelerating access for institutions.

Together, the two firms aim to set a new benchmark for institutional crypto infrastructure. “This partnership isn’t just about reach—it’s about purposeful access that meets the standards of traditional finance,” said Mark Richardson, CCO of Zodia Markets.

Learn more

Sage Capital Brings 24/7 Quote Stream Liquidity to Finery Markets

-min.jpg)

Finery Markets has partnered with Sage Capital Management to expand institutional access to high-quality crypto liquidity through a newly introduced trading method—quote streams. As a Prime of Prime solution provider, Sage Capital will offer real-time pricing and execution across 200+ digital assets via Finery’s infrastructure, delivering ultra-tight spreads and uninterrupted liquidity.

This collaboration positions Finery Markets as the only crypto ECN to support three distinct trading methods: order book, RFQ, and now quote streams via FIX. Available across FM Marketplace, FM Liquidity Match, and FM Whitelabel, the new setup empowers institutional clients with greater flexibility in managing execution strategies.

“We’re thrilled to stream our proprietary liquidity through Finery’s quote streams,” said Nathan Sage, CEO of Sage Capital. “Clients can now access consistent pricing and market depth 24/7.”

Read more

Record-Breaking Q1 2025: Finery Markets' Crypto OTC Review

Finery Markets' latest Crypto OTC Review for Q1 2025 unveils remarkable insights into the institutional OTC crypto market. This period, marking the first 100 days of a pro-crypto political shift, saw unprecedented activity with over 2 million institutional spot trades executed through our platform.

The review highlights a 141% YoY surge in trading volume, setting new records in both volume and client count. Regulatory advancements have also significantly impacted trading dynamics, especially in the stablecoin sector, reflecting a 158% growth in stablecoin transactions.

"This quarter’s performance underscores the accelerating adoption of crypto assets and Finery Markets’ pivotal role in providing robust trading solutions," said Konstantin Shulga, CEO of Finery Markets.

Download report

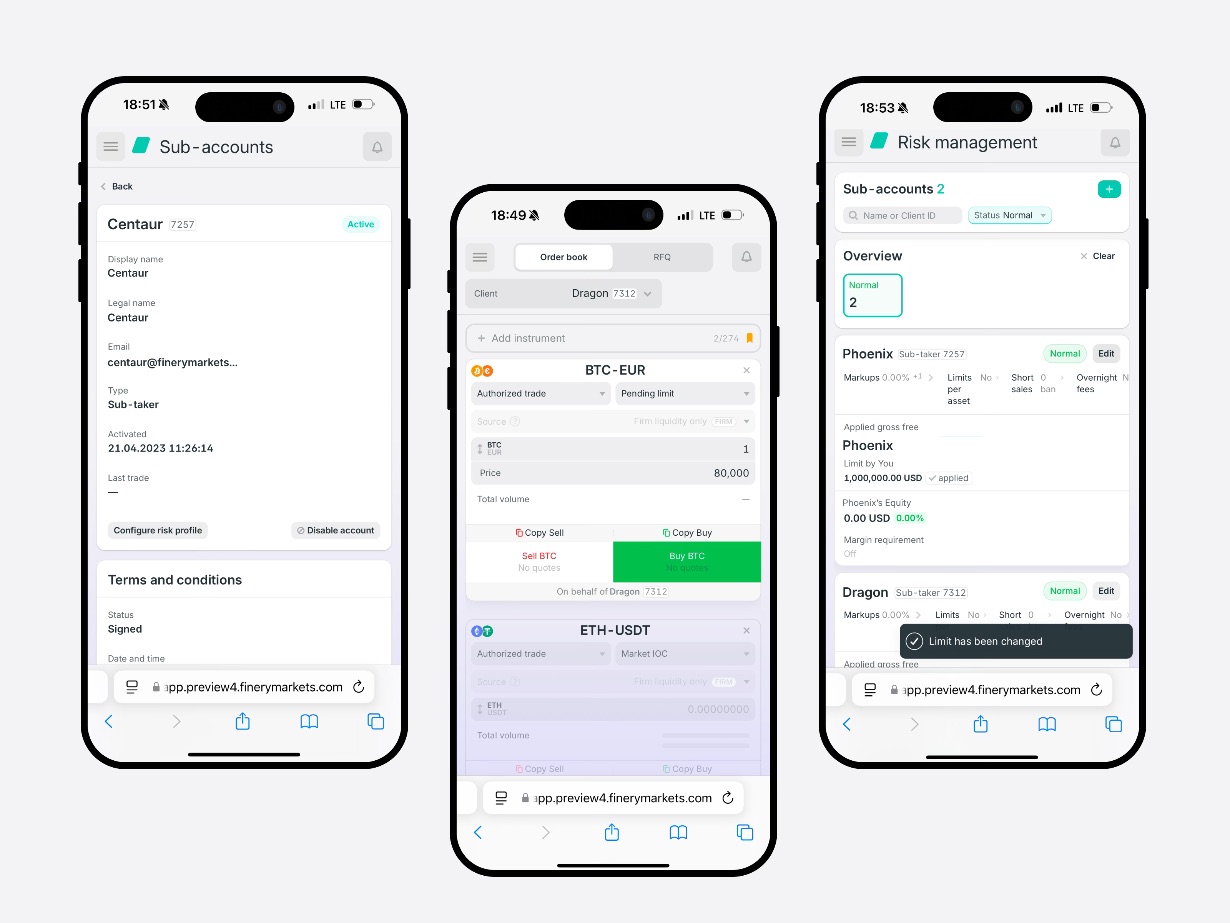

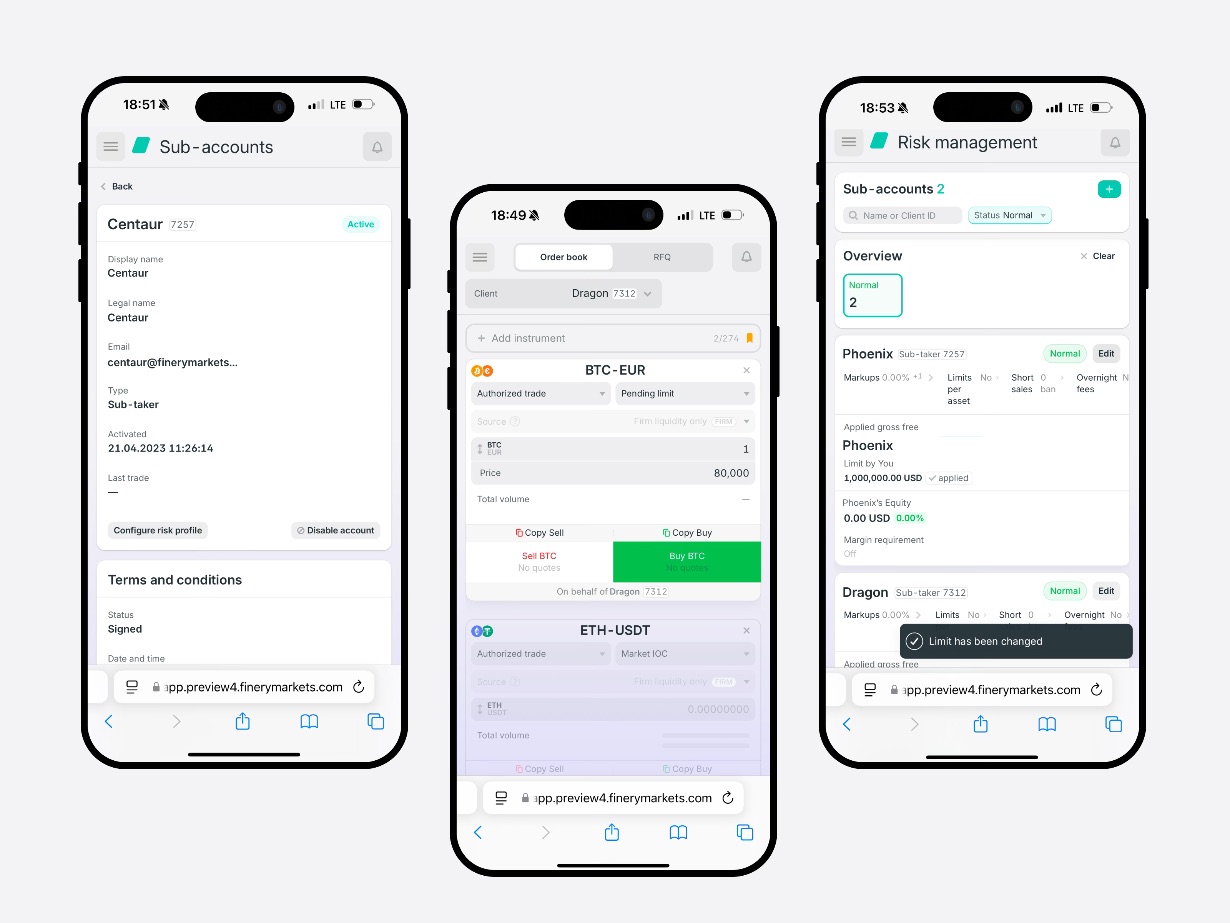

Access Finery Markets on the go with our Mobile-friendly update

We understand the importance of user experience in financial technologies. That's why we have updated our suite of products to a new mobile-friendly version. From now on, you can access FM Marketplace, FM Liquidity Match, and FM Whitelabel from any device, giving your operations even more flexibility. Front, mid, and back-office functionalities right at your fingertips, anywhere you go.

- Back office: Your back-office teams can leverage mobile functionalities to adjust risk management settings, impose short sales bans, manage settlements, and track transactions efficiently, ensuring smooth operational flow.

- Front office: Your trading desk can now execute trades and monitor market movements in real-time from their smartphones. Respond to market fluctuations and adjust trading strategies without being tethered to a web-version.

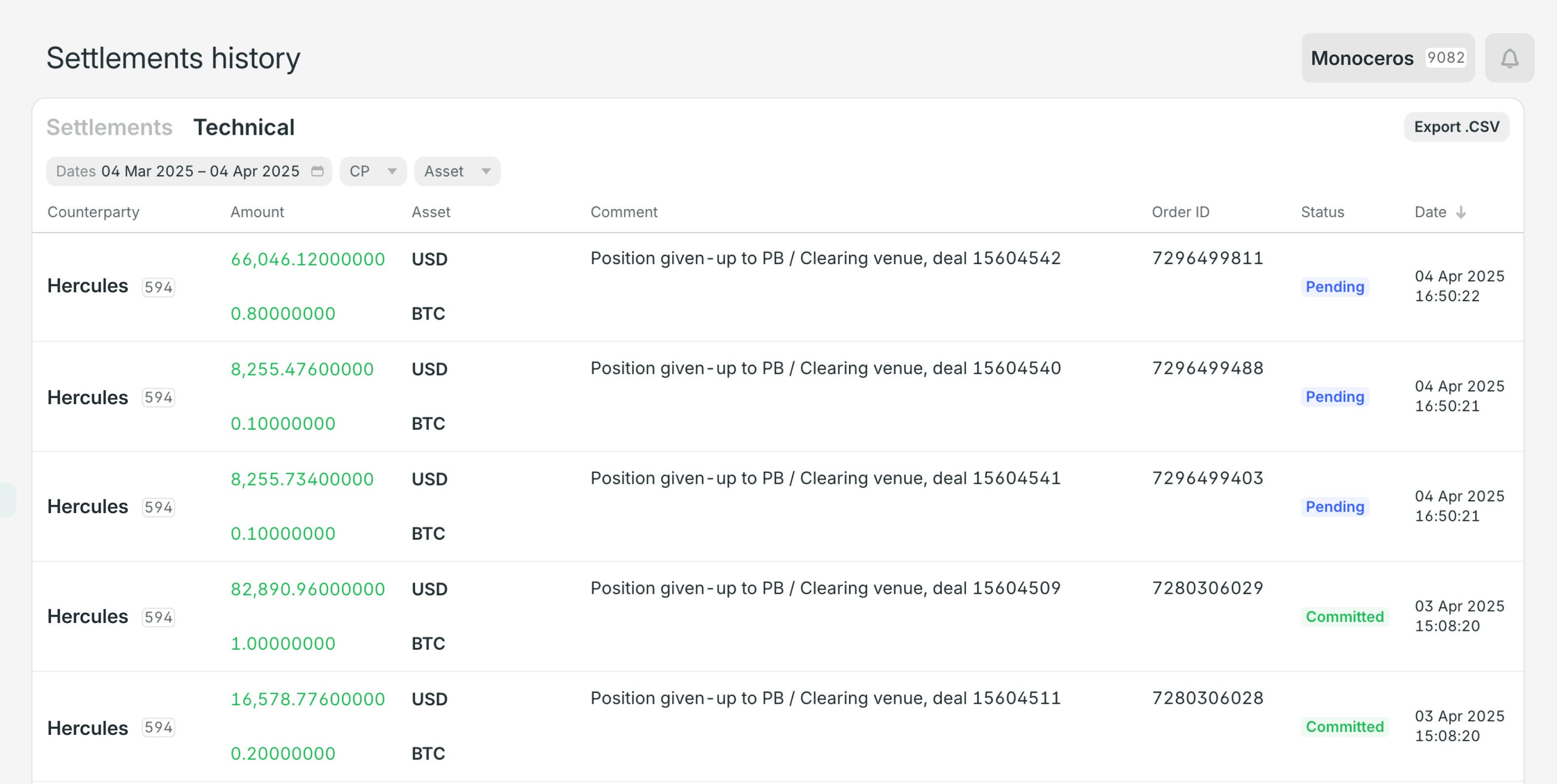

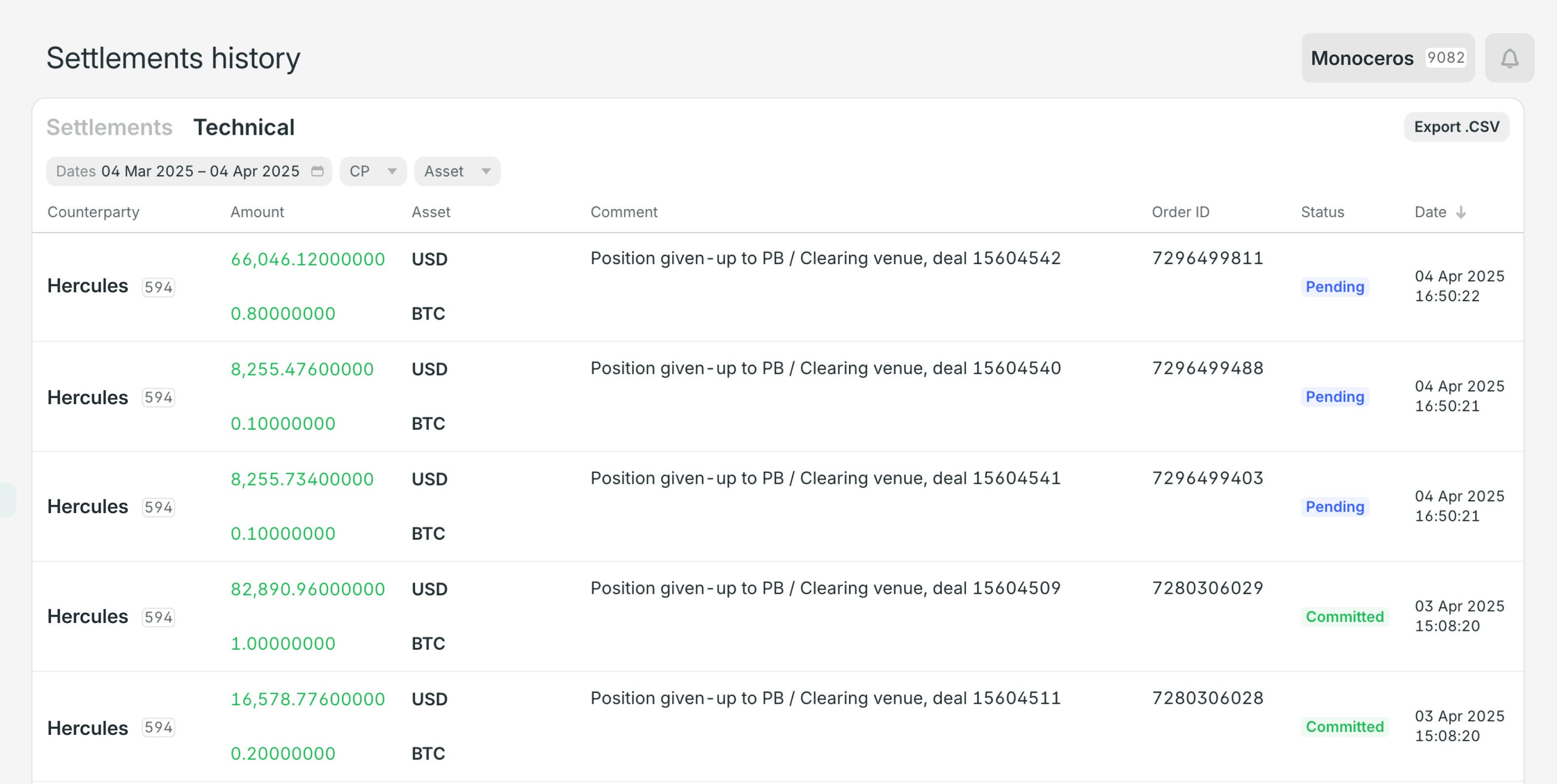

Finery Markets introduces 'Give-Up' setup in collaboration with HiddenRoad

Here's how it works: A liquidity taker places an order through FM Marketplace, FM Liquidity Match, or FM Whitelabel with a liquidity provider, who executes the trade. Thanks to the new setup between Finery Markets and HiddenRoad, Finery Markets transfers the trade details directly to HiddenRoad, which manages the clearing and settlement, ensuring the smooth processing of trades.

This arrangement elevates market standards in the institutional crypto space by reducing counterparty risks. It allows clients to engage with any liquidity provider while maintaining a clearing relationship with HiddenRoad. Additionally, it offers greater flexibility and eliminates the operational complexities involved in mutual onboarding between liquidity providers and liquidity takers.

Finery Markets offers options for fully-disclosed setups, where trust and relationship management are of utmost importance, as well as semi-disclosed setups facilitated by an intermediary, such as a broker, which can help minimize market impact.

The Flow Is Back! Why Crypto Needs Wall Street's Trading Toolkit (feat. Coinroutes Co-Founder & CRO Mike Holstein)

Season two of The Flow kicks off with Mike Holstein, Co-Founder and CRO of Coinroutes, joining Finery Markets CEO Konstantin Shulga for a deep dive into institutional crypto infrastructure. In this episode, Mike shares his journey from Wall Street giants like Citi and Virtu to building Coinroutes—a platform designed to bring algorithmic execution, redundancy, and transaction cost analysis to fragmented crypto markets.

The discussion explores how Coinroutes connects to over 50 trading venues, enabling precise execution across exchanges and OTC desks. Mike also breaks down the growing role of derivatives in crypto, explaining why strategies like delta-neutral trading are gaining traction among institutions seeking stability and efficiency.

Watch now

Finery Markets Wins AIBC Eurasia Pitch Competition

At the recent AIBC Eurasia event in Dubai, Finery Markets, represented by Egor Morozow, distinguished itself among emerging tech startups. Competing against notable companies such as One2All, Bit Okay Inc., and Cheeer, our team showcased a cutting-edge, non-custodial crypto ECN platform designed specifically for institutional players.

The pitch was judged by a panel of esteemed industry leaders, and our win underscores Finery Markets’ innovative approach and the robust value we deliver. This achievement further reinforces our reputation as a Deloitte Fast 50 Rising Star in the institutional crypto trading space.

This victory not only highlights our technology’s strength but also sets the stage for continued growth and market leadership.

-min.jpg)