The role of prime brokerage in digital assets is rapidly evolving, reshaping the crypto market as we know it. But what exactly does a prime broker do in the digital asset space? And how is this transformation impacting the broader crypto industry?

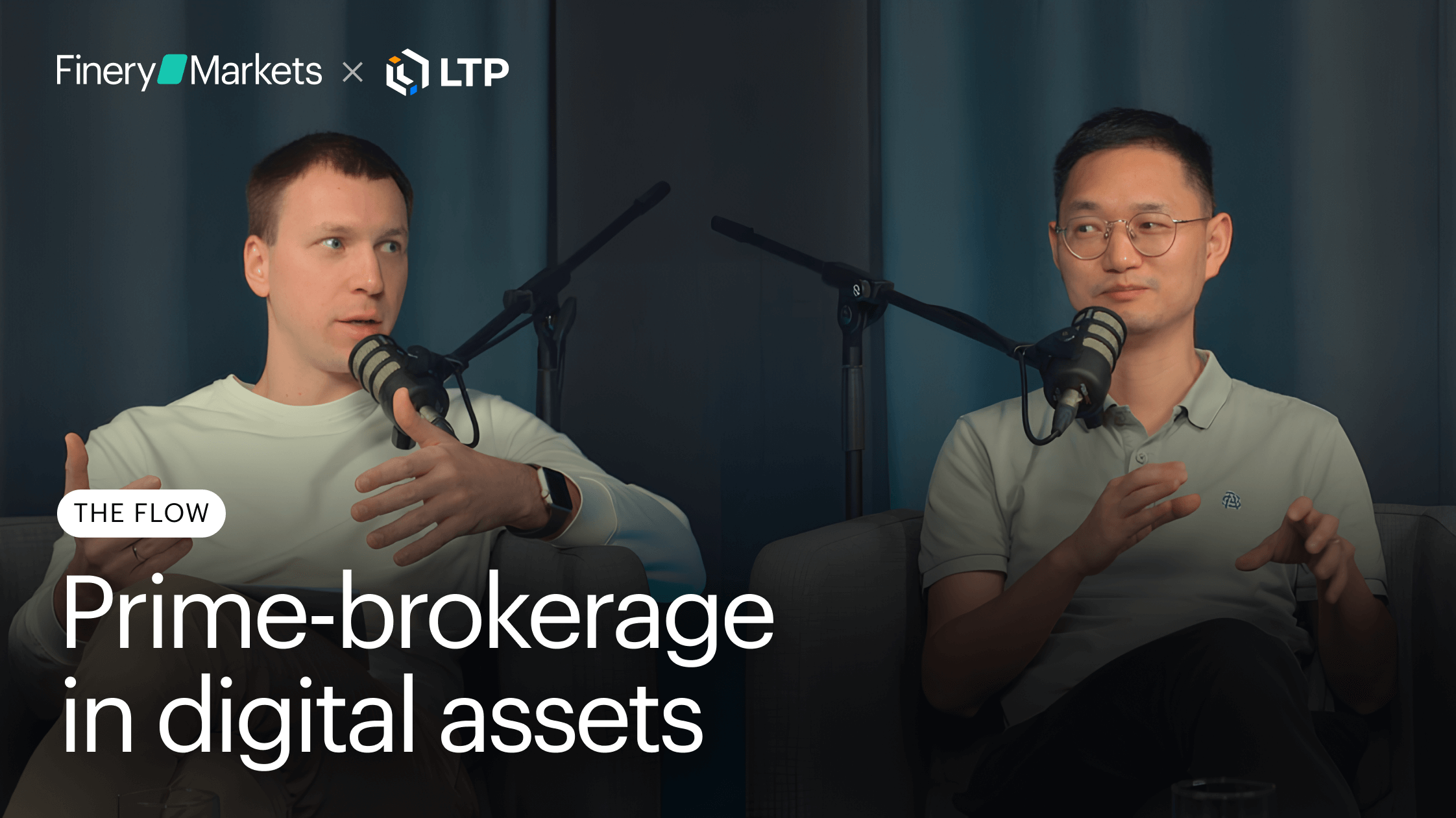

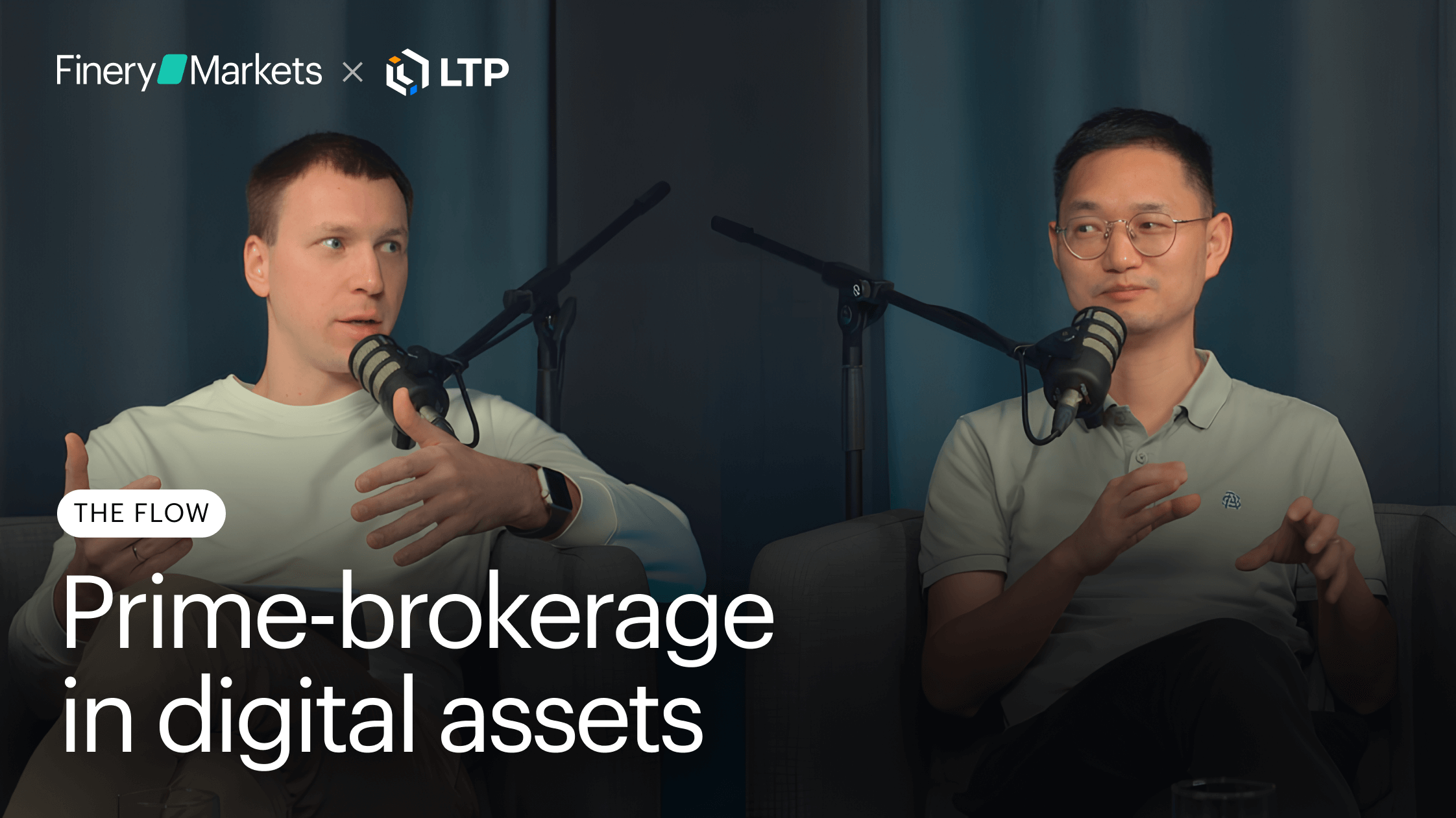

In the latest episode of The Flow podcast, Konstantin Shulga, CEO and co-founder of Finery Markets, sits down with Jack Yang, CEO of LTP, the leading prime broker in digital assets across the APAC region, to explore these compelling questions.

During this engaging one-hour episode, Jack and Konstantin delve into the intricacies of prime brokerage within the digital asset sector. They discuss how prime brokers are incorporating best practices from traditional finance to manage risks and enhance market structure. The conversation highlights the crucial role of prime brokers in the crypto ecosystem and debates whether their development will lead to market consolidation or continued fragmentation.

Listeners will gain valuable insights into the future of decentralized finance (De-Fi) for institutional players and how the increased accessibility offered by prime brokerage services could drive overall market growth. The episode also covers a range of fascinating topics, from the impact of the Bitcoin whitepaper on Jack’s vision to the evolution of the industry post-FTX.

We invite you to watch or listen to this episode for expert perspectives on the latest trends and predictions in the world of prime brokerage and digital assets.

Watch on Youtube

Or listen on:

About The Flow

The Flow is Finery Markets' branded podcast series, dedicated to exploring the exciting world of institutional crypto trading. Each episode explores the currents shaping the digital asset markets, offering listeners a unique blend of expert insights, industry trends, and forward-thinking strategies. Hosted by Finery Markets’ thought leaders and featuring a roster of distinguished guests from across the financial and technological landscapes, The Flow navigates through the complexities of electronic trading infrastructure, regulatory landscapes, and the evolving dynamics of liquidity and market making.