Liquidity access: multiple institutional providers via a single API. Order book, RFQ, or Quote Streams

Full workflow automation: end-to-end workflow automation, including trading, mark-up management, risk controls and advanced reporting

Learn moreProprietary liquidity pools and advanced control over the price streams

Learn moreBilateral and prime-brokerage setups, including trade give-ups

Get started

Three months after launching, Constanta Finance needed a secure, compliant platform to support diverse crypto/fiat pairs—especially stablecoins to EUR—while onboarding liquidity providers and banking partners.

With FM Marketplace, Constanta fast-tracked its infrastructure, gaining access to top liquidity, integrated reporting, and secure operations under Finery Markets’ SOC-2 certification—cutting overhead and enabling future consolidation onto a single platform.

Kauri Finance needed to efficiently handle high trade volumes with reliable execution, multi-provider access, and integration with liquidity management—all while supporting manual pricing.

Through Finery Markets’ ECN and API integration, Kauri achieved 0% trade rejection and seamless, prefunding-free execution. Combined with Clear Junction’s fiat rails, the solution delivered predictable rates, faster settlements, and improved operational stability.

Trade

Trade

Trade

Trade

Banks & brokers, OTC desks, Payment providers

tradable order book

Connects via API / GUI

100% fill ratio

High-performance C++ matching engine

Firm orders

Client GUI and API endpoints

Settlement

Settlement

| CEX | OTC Desks | AggregatorsOMS/EMS |

|

||

|---|---|---|---|---|---|

| Access to multiple liquidity providers via single API/GUI | No | No |

|

|

|

| Aggregated, predictable execution with 0% rejection rate |

|

No | No |

|

|

| Flexible, automated settlement across multiple banks & blockchains | No |

|

Yes/no |

|

|

| Partial pre-funding or non-collateralised trading | No |

|

Yes/no |

|

|

| Ease of adding new liquidity providers | No | No |

|

|

|

| OTC-as-a-Service with tailored mark-up and roll-over setup | No | No |

|

|

|

| Full trading cycle management with Master- and Sub-accounts | No | No | No |

|

|

| White-label solution to source and resell liquidity from global LPs | No | No | Yes/no |

|

Establish a legal relationship with the platform and LPs: mutual KYC and agreements

Agree on mutual trading limits with an LP and potential prefunding: 0-20%

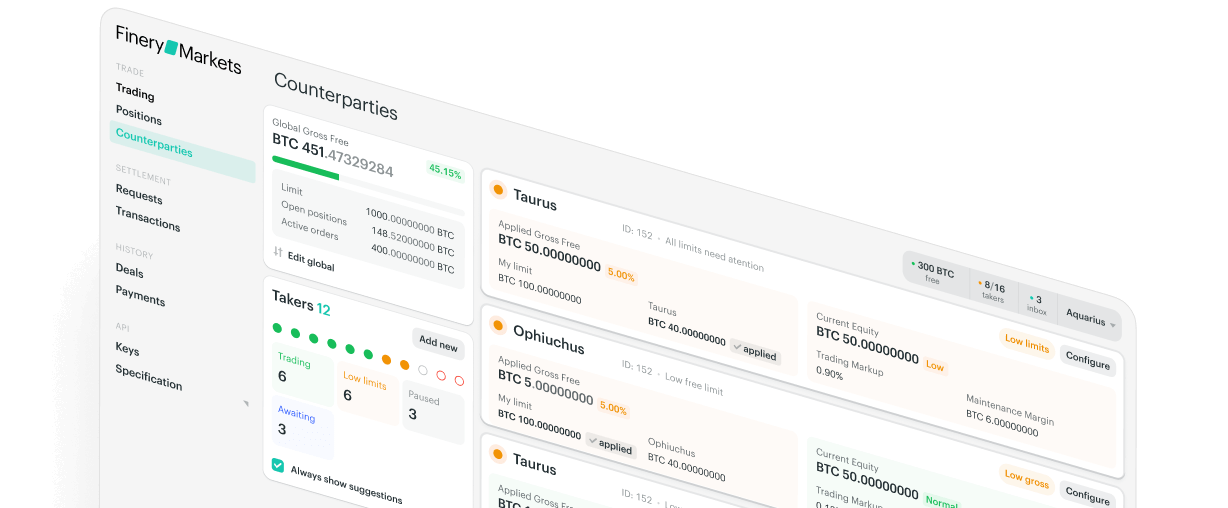

Access aggregated order book and monitor your positions via GUI or API

Settle with the LP whenever you are ready or rollover your open positions

You sign up on Finery Markets

Role-based access management

Secure 2FA authentication

You select your counterparties and pass through KYC

Electronic onboarding

Risk management

You agree on pre-funding terms Non-collateralized or partially collateralized trading

Price discovery: aggregation across LPs

Full pre-trade transparency

Credit-screened order book

Your client makes trades

Versatile trading modes:

Best execution principle

Market and limit orders

Order execution across 300 pairs fiat-to-crypto, crypto-to-crypto, fiat-to-stable

Position management

Automated or manual settlement

Settlement address book fiat and crypto

Flexible settlements

Position rollover tools

Record-keeping and multi-format reporting:

Alerts and notifications

Create proprietary liquidity pool, providing your clients with end-to-end trading solution

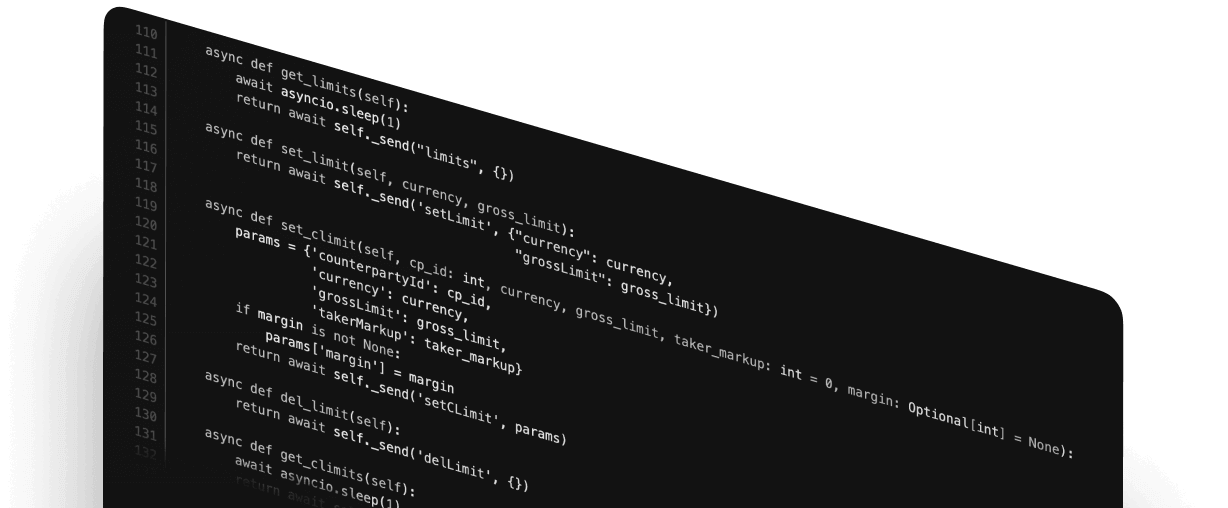

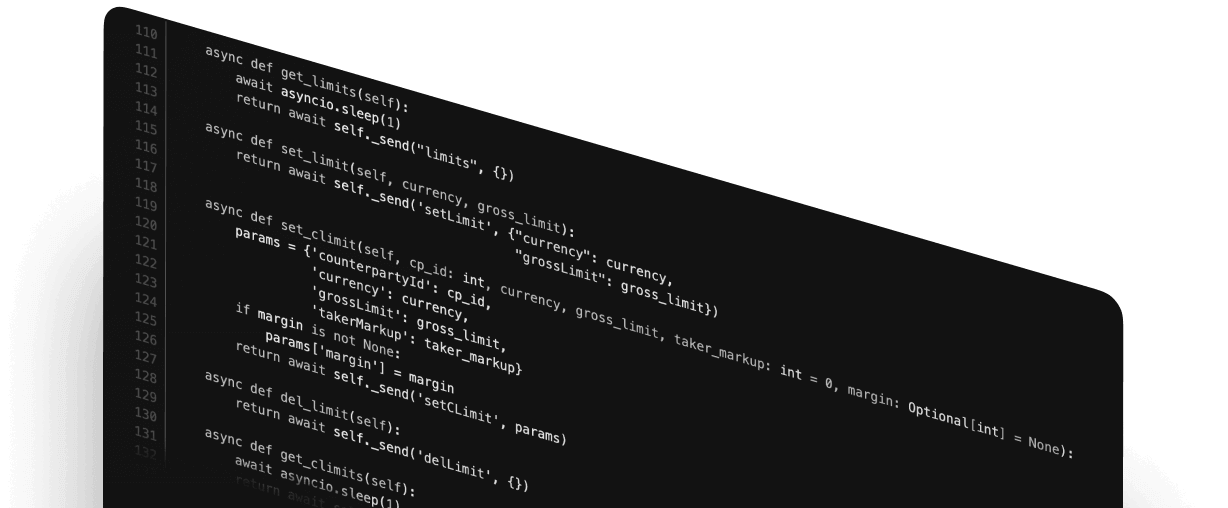

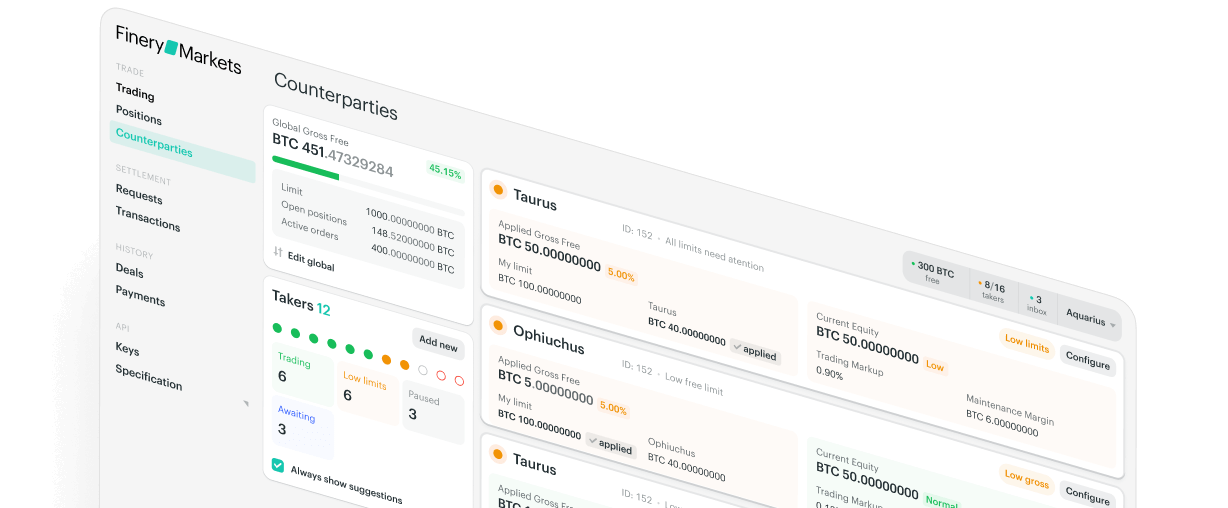

Learn moreTake control of trading limits, coin lending, borrowing rates through GUI or API

Get started

Three months after launching, Constanta Finance needed a secure, compliant platform to support diverse crypto/fiat pairs—especially stablecoins to EUR—while onboarding liquidity providers and banking partners.

With FM Marketplace, Constanta fast-tracked its infrastructure, gaining access to top liquidity, integrated reporting, and secure operations under Finery Markets’ SOC-2 certification—cutting overhead and enabling future consolidation onto a single platform.

Kauri Finance needed to efficiently handle high trade volumes with reliable execution, multi-provider access, and integration with liquidity management—all while supporting manual pricing.

Through Finery Markets’ ECN and API integration, Kauri achieved 0% trade rejection and seamless, prefunding-free execution. Combined with Clear Junction’s fiat rails, the solution delivered predictable rates, faster settlements, and improved operational stability.

Trade

Trade

Trade

Trade

Banks & brokers, OTC desks, Payment providers

tradable order book

Connects via API / GUI

100% fill ratio

High-performance C++ matching engine

Firm orders

Client GUI and API endpoints

Settlement

Settlement

| CEX | OTC Desks | AggregatorsOMS/EMS |

|

||

|---|---|---|---|---|---|

| Access to multiple liquidity providers via single API/GUI | No | No |

|

|

|

| Aggregated, predictable execution with 0% rejection rate |

|

No | No |

|

|

| Flexible, automated settlement across multiple banks & blockchains | No |

|

Yes/no |

|

|

| Partial pre-funding or non-collateralised trading | No |

|

Yes/no |

|

|

| Ease of adding new liquidity providers | No | No |

|

|

|

| OTC-as-a-Service with tailored mark-up and roll-over setup | No | No |

|

|

|

| Full trading cycle management with Master- and Sub-accounts | No | No | No |

|

|

| White-label solution to source and resell liquidity from global LPs | No | No | Yes/no |

|

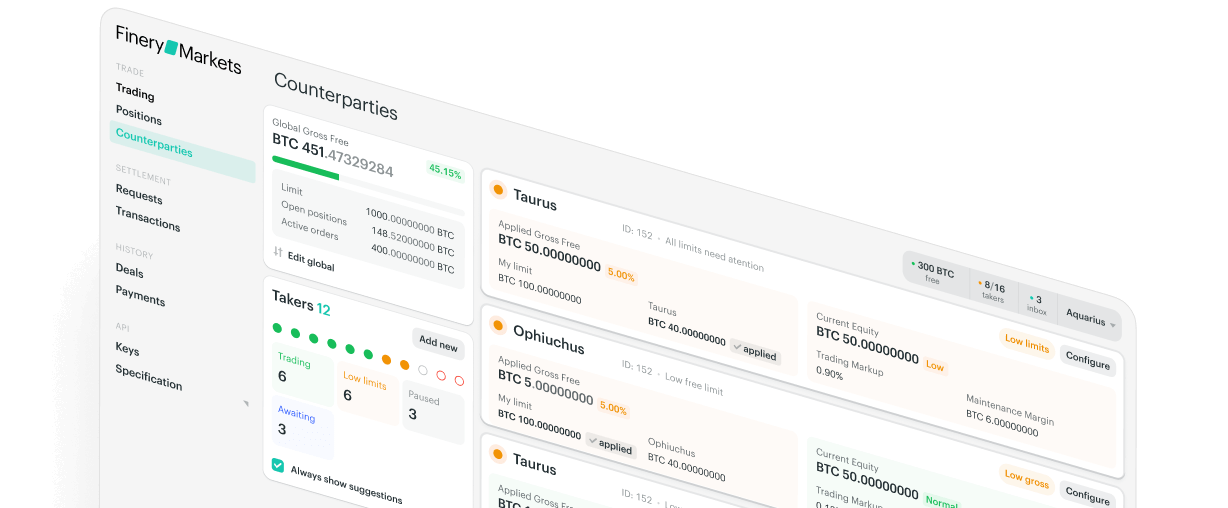

You sign-up on Finery Markets

White-glove support

Full customization colors & logo, domains, emails & API endpoints

Role-based access management

Secure 2FA authentication

Your client opens an account with you

Client management tool: invite/disable sub-accounts via your master accout

Secure 2FA authentication

Your client funds the account Non-collateralized, collateralized or partially collateralized trading

Risk management

Spread management

Your client makes trades, with you as the counterparty

Order execution across 300 pairs fiat-to-crypto, crypto-to-crypto, fiat-to-stable

Flexible trading modes:

Credit-screened order book

Auto-hedging against LPs

Trading authorization

Position management

Automated or manual settlement You initiate settlements against your sub-accounts and your LPs.

Settlement address book

Flexible settlements fiat and crypto

Position rollover tools

Record-keeping and multi-format reporting:

Alerts and notifications

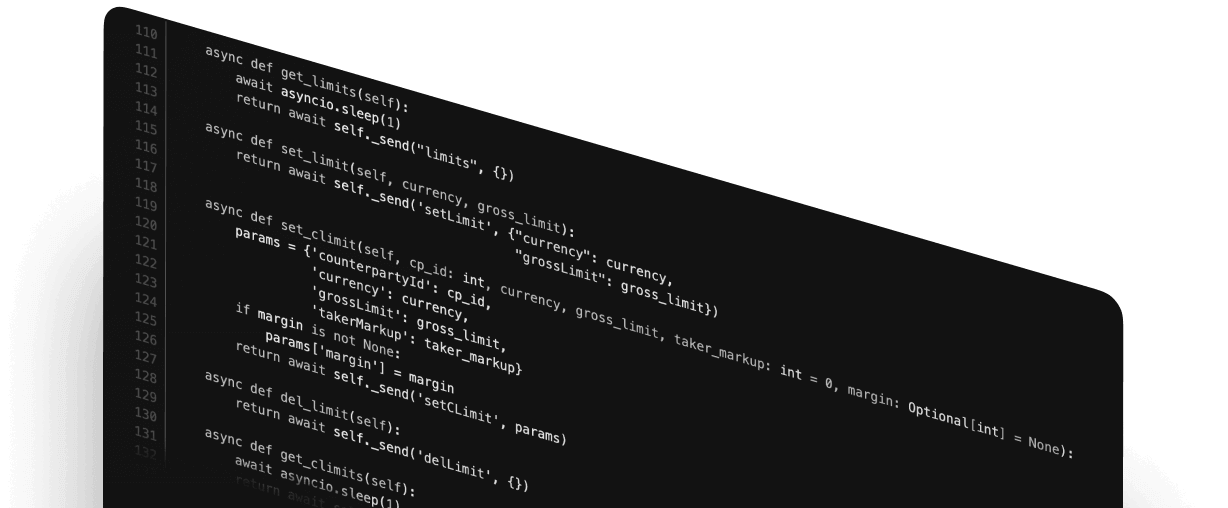

Automated clearing and settlement via BitGo

Reduce your integration costs and operational risk across multiple access points with our platform

Get startedFinery Markets BVI Limited (“Finery Markets”) provides software, technology infrastructure, and related Information and Communication Technology (ICT) services on a Software-as-a-Service (“SaaS”) basis. Finery Markets acts solely as a software vendor and does not operate a trading platform, does not intermediate, match, execute, clear, or settle transactions, and does not engage in any activities that would require regulatory authorisation under applicable laws.

Finery Markets’ software is non-custodial and is provided exclusively to licensed institutional entities that act as independent operators of their own environments. All counterparties are solely responsible for establishing and maintaining their own bilateral trading and settlement relationships. Finery Markets is not a party to any such arrangements and assumes no responsibility for the conduct, verification, or compliance obligations of any users of the software.

Nothing on this website shall be construed as a financial promotion, investment advice, or an offer to engage in regulated activities. Access to and use of the software is strictly limited to clients who have entered into a software licensing agreement with Finery Markets. Persons located in jurisdictions where such access is restricted should not rely on this website or any of its contents.

![]() Additional notice to UK visitors: This website and associated communications are not intended to constitute a financial promotion under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) and related guidance. Access to services provided by Finery Markets is limited to regulated entities, professional clients and eligible counterparties as set out by the Financial Conduct Authority. UK users are not permitted to use this website for the services of Finery Markets if they don't fall within these categories.

Additional notice to UK visitors: This website and associated communications are not intended to constitute a financial promotion under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) and related guidance. Access to services provided by Finery Markets is limited to regulated entities, professional clients and eligible counterparties as set out by the Financial Conduct Authority. UK users are not permitted to use this website for the services of Finery Markets if they don't fall within these categories.