As Web3 emerges, it promises a decentralized internet less influenced by major corporations. Blockchain's security, data storage, and decentralization are central to this vision, especially for decentralized financial applications. However, transitioning between fiat currency and the digital ecosystem poses challenges. The gap between offline fiat and digital assets can be a hindrance.

For many, entering the crypto world is intimidating due to its complexity, intermediaries, and learning requirements. Yet, bridging traditional and cryptocurrency flows is vital to unlocking blockchain and Web3's full potential. That’s where crypto ramps enter into play: these gateways enable easy movement between fiat and cryptocurrency. Understanding on-ramps and off-ramps is crucial for everyone involved in crypto. This article explores their significance, available options, and implications for the industry.

What is a crypto ramp?

A crypto on-ramp is essentially a bridge between the traditional fiat system and the cryptocurrency world. It represents platforms or exchanges that enable fiat money conversion into digital assets. For newcomers to crypto, the first step typically involves purchasing a digital asset by exchanging fiat money, marking their entry or "on-ramp" to the crypto space.

While exchanges are a common on-ramp, not all allow direct fiat purchases. However, this is shifting as more, particularly well-known exchanges, are adding this capability. Over-the-counter (OTC) markets offer an alternative, allowing parties to agree on a price, often diverging from standard exchange rates. These markets mainly serve large-scale transactions, attracting institutional players. Cryptocurrency ATMs also serve as on-ramps where users can exchange physical cash for digital assets, although availability and asset variety may vary by location.

Contrary to some beliefs, entering crypto isn't anonymous. Most on-ramping methods require users to provide documentation, such as photo ID or address proof, depending on the platform and transaction size. These steps trace the origins of crypto transactions and aim to prevent illegal activities. Therefore, your first crypto purchase will link to your real identity, and subsequent transactions are usually recorded on a public ledger. With enough effort, any blockchain transaction can trace back to an individual.

Crypto on-ramp options

Centralized Exchanges

Centralized exchange (CEX) platforms, such as Binance and Coinbase, are popular for crypto beginners. Users register and undergo thorough KYC checks, including ID and address verification. After approval, they can buy crypto using credit or debit cards, and the assets are stored in the exchange's wallets. These steps aim to reduce fraud and provide clarity on wallet ownership.

Decentralized Exchanges with APIs

The challenge with decentralized exchanges was integrating fiat without a central body. Solutions like MoonPay and Wyre emerged, offering KYC-compliant ways for these exchanges to allow fiat-to-crypto conversions. Importantly, purchased crypto directly transfers to the user's wallet, ensuring they have immediate asset control.

NFT Marketplaces

NFT platforms, such as Rarible and OpenSea, have added a new dimension to on-ramping. They support crypto acquisition through NFT transactions, with standard KYC checks. This highlights NFTs' growing role, not just as collectibles but also as gateways to digital assets.

Bitcoin ATMs

Bitcoin ATMs deserve mention, even if they're less commonly used. These physical kiosks connect to the Bitcoin network, allowing users to exchange cash for Bitcoin. Uniquely, they often don't require identification, providing an anonymous on-ramp. However, their limited locations and transaction caps might make them less attractive to regular users.

What are crypto off-ramps?

Just as the crypto world allows entry, it also provides an exit, termed "crypto off-ramp." Off-ramps enable users to convert crypto assets back into fiat currency. While much attention is given to onboarding users via on-ramps, a smooth exit process is equally important.

With the evolution of the crypto landscape, the need for efficient off-ramps becomes evident due to the growing demand for seamless crypto-to-fiat transitions. Consequently, many on-ramp providers also offer off-ramp services, creating a cohesive platform for users to manage both their crypto entry and exit.

Crypto off-ramp options

Purchasing goods and services

A direct off-ramp method involves using cryptocurrency to buy goods or services. Countries like El Salvador recognize certain cryptocurrencies as legal tender, and companies such as Travala and Tesla accept crypto. However, widespread adoption as a standard payment method is still emerging, making this option less dominant for many.

Using CEXs for off-ramping

Centralized exchanges have long been gateways between cryptocurrency and fiat. Users looking to off-ramp this way should choose an exchange that supports their desired fiat conversion. This involves selling the cryptocurrency and receiving the fiat amount in a linked bank account. While service fees and potential wait times are considerations, the method's established role ensures its popularity.

Crypto payment cards

Combining traditional debit card functionality with cryptocurrency has given rise to crypto debit cards. These cards, loaded with cryptocurrency, can be used for regular purchases. This not only simplifies the off-ramp process but also lets users retain the value of their crypto until the point of transaction.

Why are crypto ramps crucial for the industry?

On-ramps and off-ramps are key to welcoming new users and capital into the cryptocurrency domain, serving as bridges to traditional finance. Buying Bitcoin (BTC) or other cryptocurrencies at exchanges using common payment methods like debit or credit cards has made the crypto world more accessible. This easy way of obtaining digital assets gives newcomers confidence, and understanding they can always convert back to fiat. Such ease of use places cryptocurrencies in a familiar context, making them akin to assets in conventional markets.

For institutions with substantial capital, platforms like OTC markets are vital. They allow these entities to trade in high volumes without causing abrupt market price changes due to large single orders.

The financial sector's continuous evolution amplifies the need for more channels to transfer value between traditional finance and the digital realm. Significant developments, like the partnership between payment processor Simplex and MakerDAO or Apple Pay's integration with MyEtherWallet, highlight the growing on-ramp possibilities. These strides ensure a more fluid shift for those transitioning from traditional finance to the decentralized landscape.

Enhancing on/off crypto ramps with Finery Markets

Accessing quality liquidity at all times is vital for on/off crypto ramp businesses. Finery Markets is revolutionizing the way payment providers interact with LPs, bridging gaps that have traditionally existed in the realm of cryptocurrency.

-

Gateway to Enhanced Flexibility: By connecting payment providers with domestic and international settlement gateways, Finery Markets ensures that these entities can offer services with a global reach, catering to diverse customer needs across different regions.

-

Expansive Payment Options for Providers: Through Finery Markets, payment providers can offer their users a vast array of over 200 cryptocurrencies and 10+ fiat options. This expansive selection not only satisfies user demands but also facilitates reduced transaction processing costs.

-

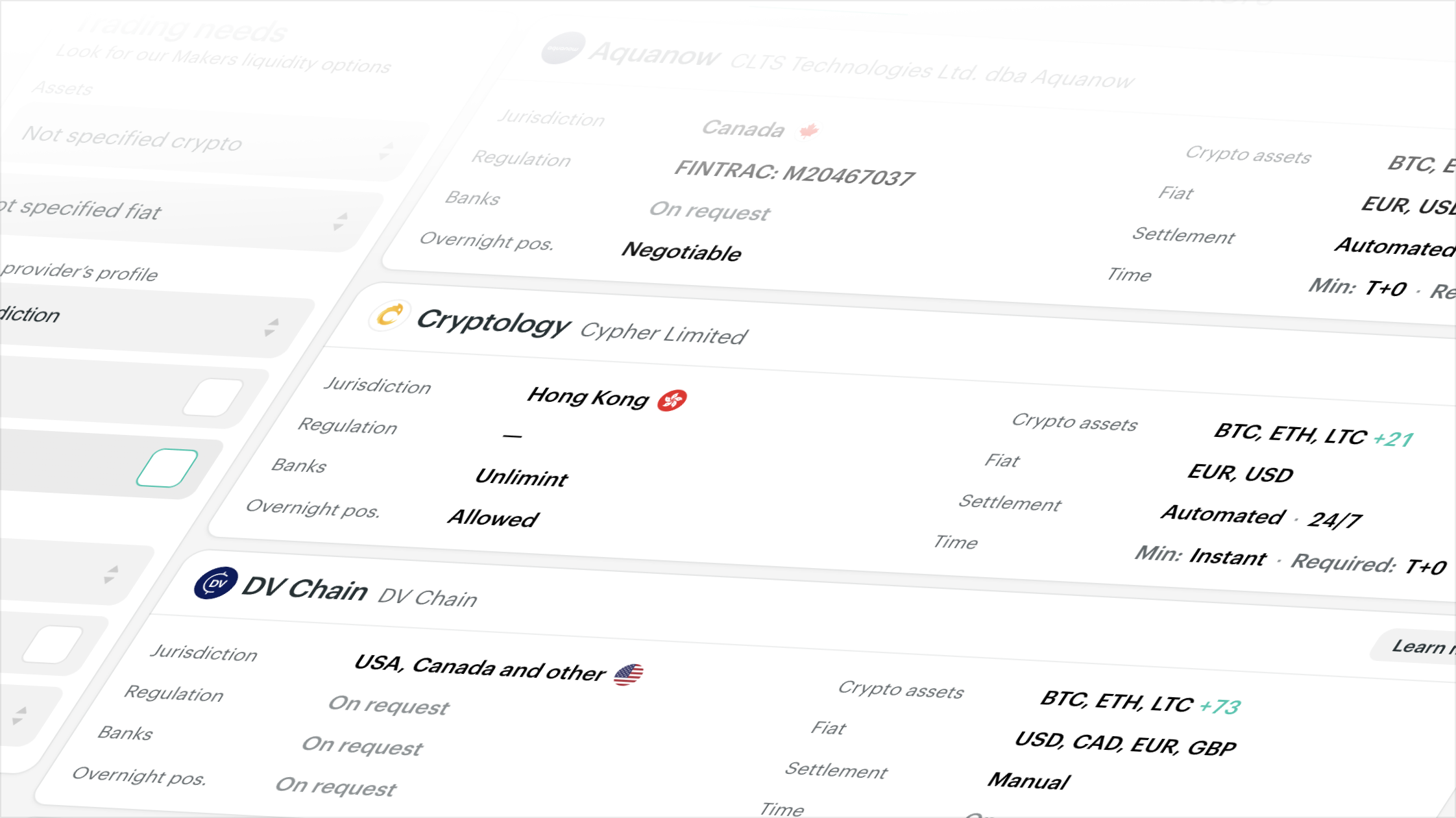

Connecting with Global Liquidity: By networking with a multitude of global liquidity providers, Finery Markets ensures payment providers can offer fiat-to-crypto currency pairings, from mainstream options like USD, EUR, and JPY to others, including GBP, HKD, CAD, and AUD.

-

24/7 Settlement Options: Through its partnerships, Finery Markets guarantees round-the-clock settlement capabilities, allowing payment providers to ensure seamless and uninterrupted services to their users.

-

Competitive Quotes through Global Ties: By integrating with top-tier liquidity providers worldwide, Finery Markets ensures payment providers can benefit from tight bid-ask spreads, ensuring competitive and value-driven rates for end-users.

Finery Markets not only strengthens the capabilities of payment providers but also ensures that the end-users, whether businesses or individuals have a seamless, efficient, and enhanced experience when transitioning between fiat and cryptocurrencies.

The bottom line

On-ramping and off-ramping in cryptocurrency refers to the process of exchanging fiat currency for digital assets, and vice versa. Centralized exchanges are popular for their ease of use, but being custodial, they face external regulatory oversight. Conversely, self-custodial wallets provide users with greater control and enhanced security, enabling direct crypto transactions without third-party involvement. This setup reduces risks associated with external breaches or institutional failures.

Understanding the diverse platforms and tools in the crypto world is essential. While centralized exchanges bring convenience, they come with inherent risks. Self-custodial wallets, meanwhile, embody the principles of decentralization and offer a secure, user-focused option.

In the dynamic crypto environment, the decision between centralized services and non-custodial wallets is crucial. Regardless of the choice, it's vital to opt for a reliable provider. As cryptocurrency's global presence grows, so do related risks, including scams. Hence, informed decisions, backed by thorough research, remain the cornerstone of safe and efficient crypto navigation.