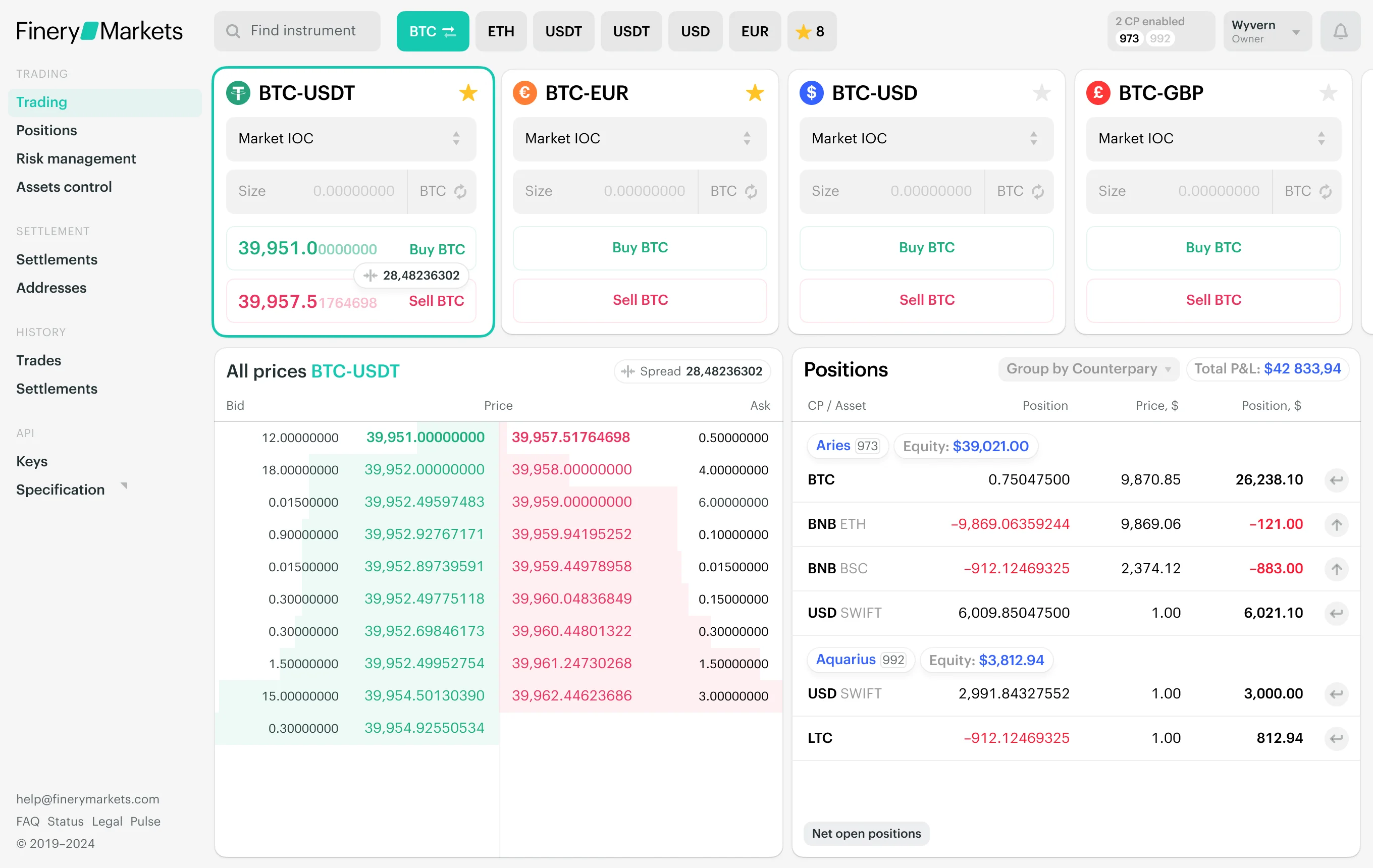

Important Disclaimer: Finery Markets BVI Limited (“Finery Markets”) provides software, technology infrastructure, and related Information and Communication Technology (ICT) services on a Software-as-a-Service (“SaaS”) basis. Finery Markets acts solely as a software vendor and does not operate a trading platform, does not intermediate, match, execute, clear, or settle transactions, and does not engage in any activities that would require regulatory authorisation under applicable laws.

Finery Markets’ software is non-custodial and is provided exclusively to licensed institutional entities that act as independent operators of their own environments. All counterparties are solely responsible for establishing and maintaining their own bilateral trading and settlement relationships. Finery Markets is not a party to any such arrangements and assumes no responsibility for the conduct, verification, or compliance obligations of any users of the software.

Nothing on this website shall be construed as a financial promotion, investment advice, or an offer to engage in regulated activities. Access to and use of the software is strictly limited to clients who have entered into a software licensing agreement with Finery Markets. Persons located in jurisdictions where such access is restricted should not rely on this website or any of its contents.

Additional notice to UK visitors: This website and associated communications are not intended to constitute a financial promotion under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) and related guidance. Access to services provided by Finery Markets is limited to regulated entities, professional clients and eligible counterparties as set out by the Financial Conduct Authority. UK users are not permitted to use this website for the services of Finery Markets if they don't fall within these categories.

Additional notice to UK visitors: This website and associated communications are not intended to constitute a financial promotion under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) and related guidance. Access to services provided by Finery Markets is limited to regulated entities, professional clients and eligible counterparties as set out by the Financial Conduct Authority. UK users are not permitted to use this website for the services of Finery Markets if they don't fall within these categories.