Get the global market access: spot crypto products delivered to your clients on our institutional-grade infrastructure

Reduce your trading costs: price aggregation and best execution principle with zero-slippage

Real-time spreadsNo capital lock-up: trading on credit lines

Cover your front-, mid- and back-office needs with comprehensive reporting, position management and flexible settlement options

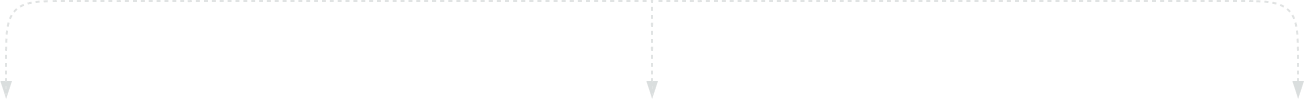

No need to maintain multiple connection: single API integration to multiple liquidity providers

Learn more

DAMEX, a fintech pioneer since 2017, struggled to scale operations amid a 25% surge in trading volume and mounting regulatory demands. Clients sought more automation, compliance, and seamless on/off-ramp integration.

Partnering with Finery Markets, DAMEX integrated FM Liquidity Match to automate client operations and unify OTC trading within a single, regulated platform. This eliminated the need to move funds to third-party exchanges like Binance, streamlining access to deep liquidity.

Match Liquidity, a proprietary trading firm, faced challenges in establishing a robust execution infrastructure capable of handling institutional-grade trading, managing liquidity from multiple providers, and reducing reliance on traditional OTC methods.

To address these challenges, the firm selected Finery Markets as its primary execution platform, leveraging its familiar ECN technology. This strategic move resulted in a remarkable 70% improvement in pricing, enhanced operational efficiency through advanced spread management tools, and a seamless transition from manual OTC workflows to automated execution and settlement processes.

Trade

Trade

Trade

Trade

Banks & brokers, OTC desks, Payment providers

tradable order book

Connects via API / GUI

100% fill ratio

High-performance C++ matching engine

Firm orders

Client GUI and API endpoints

Settlement

Settlement

| CEX | OTC Desks | AggregatorsOMS/EMS |

|

||

|---|---|---|---|---|---|

| Access to multiple liquidity providers via single API/GUI | No | No |

|

|

|

| Aggregated, predictable execution with 0% rejection rate |

|

No | No |

|

|

| Flexible, automated settlement across multiple banks & blockchains | No |

|

Yes/no |

|

|

| Partial pre-funding or non-collateralised trading | No |

|

Yes/no |

|

|

| Ease of adding new liquidity providers | No | No |

|

|

|

| OTC-as-a-Service with tailored mark-up and roll-over setup | No | No |

|

|

|

| Full trading cycle management with Master- and Sub-accounts | No | No | No |

|

|

| White-label solution to source and resell liquidity from global LPs | No | No | Yes/no |

|

Establish a legal relationship with the platform and LPs: mutual KYC and agreements

Agree on mutual trading limits with an LP and potential prefunding: 0-20%

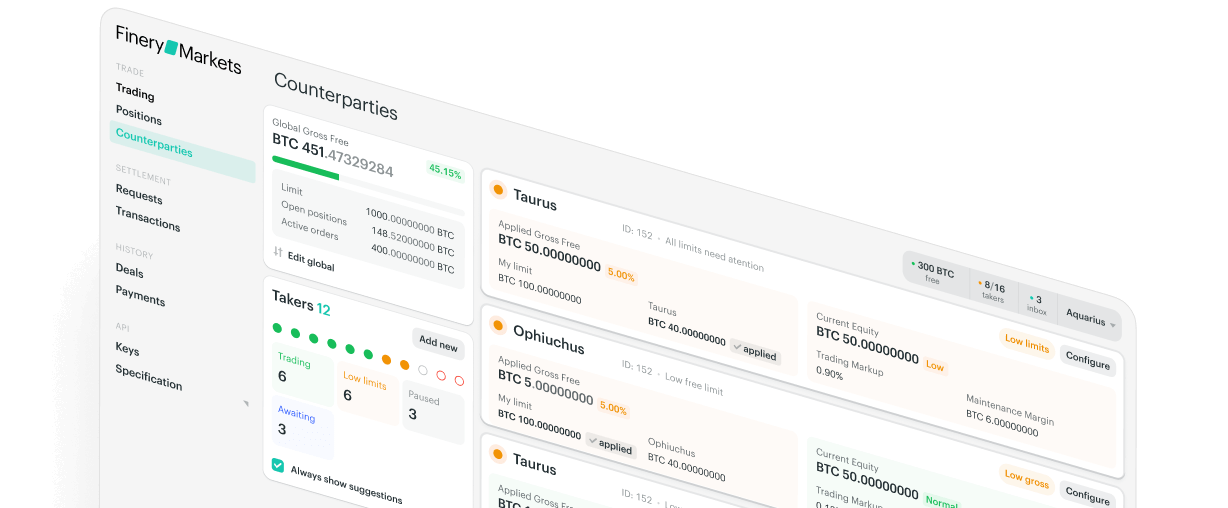

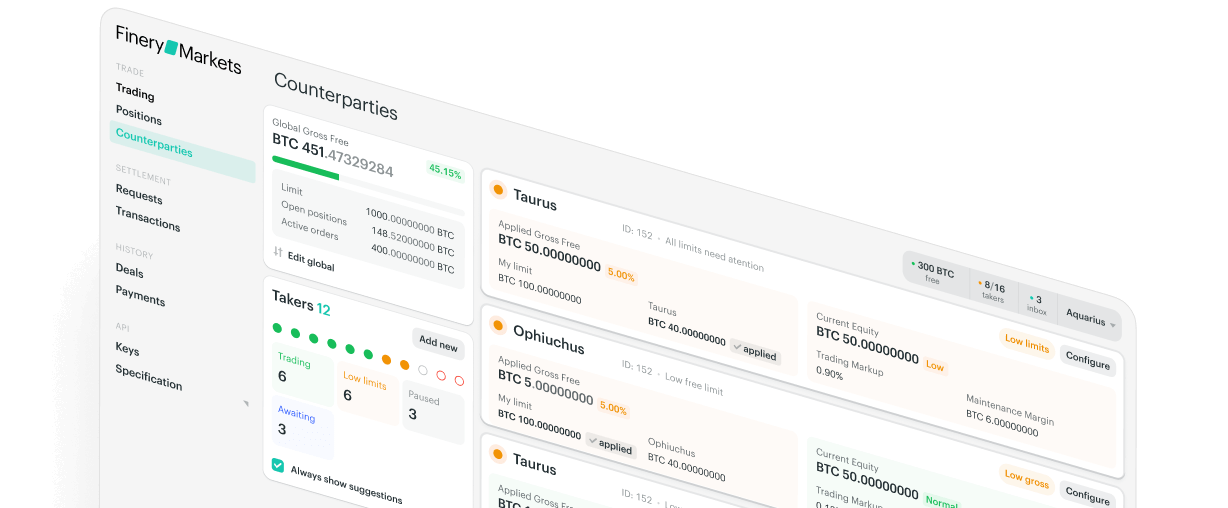

Access aggregated order book and monitor your positions via GUI or API

Settle with the LP whenever you are ready or rollover your open positions

You sign up on Finery Markets

Role-based access management

Secure 2FA authentication

You select your counterparties and pass through KYC

Electronic onboarding

Risk management

You agree on pre-funding terms Non-collateralized or partially collateralized trading

Price discovery: aggregation across LPs

Full pre-trade transparency

Credit-screened order book

You make a trade

Versatile trading modes:

Best execution principle

Market and limit orders

Order execution across 300 pairs fiat-to-crypto, crypto-to-crypto, fiat-to-stable

Position management

Automated or manual settlement

Settlement address book fiat and crypto

Flexible settlements

Position rollover tools

Record-keeping and multi-format reporting:

Alerts and notifications

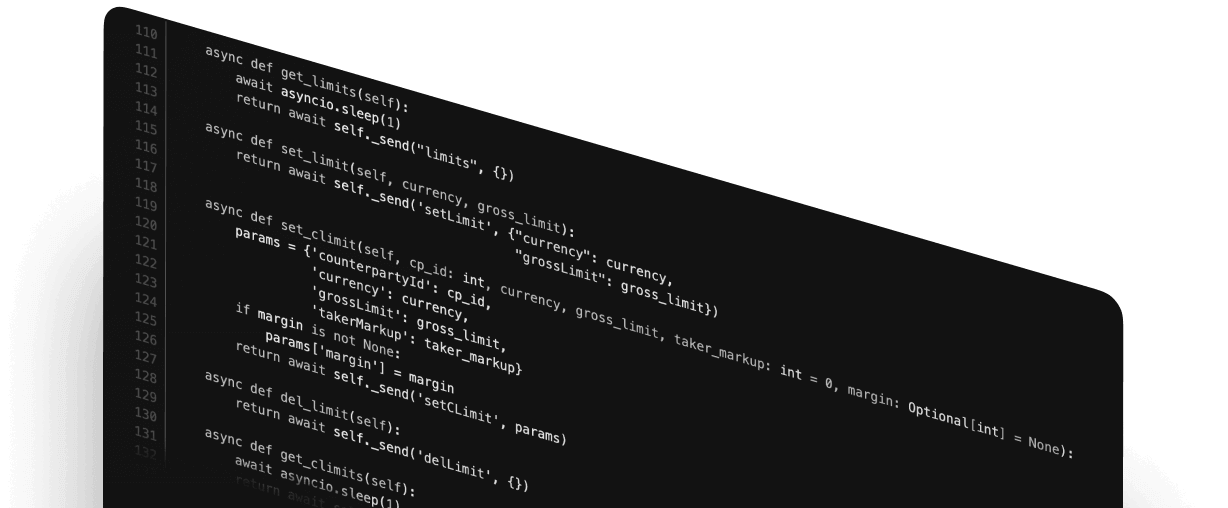

Create proprietary liquidity pool, providing your clients with end-to-end trading solution

Learn moreTake control of trading limits, coin lending, borrowing rates through GUI or API

Get started

DAMEX, a fintech pioneer since 2017, struggled to scale operations amid a 25% surge in trading volume and mounting regulatory demands. Clients sought more automation, compliance, and seamless on/off-ramp integration.

Partnering with Finery Markets, DAMEX integrated FM Liquidity Match to automate client operations and unify OTC trading within a single, regulated platform. This eliminated the need to move funds to third-party exchanges like Binance, streamlining access to deep liquidity.

Match Liquidity, a proprietary trading firm, faced challenges in establishing a robust execution infrastructure capable of handling institutional-grade trading, managing liquidity from multiple providers, and reducing reliance on traditional OTC methods.

To address these challenges, the firm selected Finery Markets as its primary execution platform, leveraging its familiar ECN technology. This strategic move resulted in a remarkable 70% improvement in pricing, enhanced operational efficiency through advanced spread management tools, and a seamless transition from manual OTC workflows to automated execution and settlement processes.

Trade

Trade

Trade

Trade

Banks & brokers, OTC desks, Payment providers

tradable order book

Connects via API / GUI

100% fill ratio

High-performance C++ matching engine

Firm orders

Client GUI and API endpoints

Settlement

Settlement

| CEX | OTC Desks | AggregatorsOMS/EMS |

|

||

|---|---|---|---|---|---|

| Access to multiple liquidity providers via single API/GUI | No | No |

|

|

|

| Aggregated, predictable execution with 0% rejection rate |

|

No | No |

|

|

| Flexible, automated settlement across multiple banks & blockchains | No |

|

Yes/no |

|

|

| Partial pre-funding or non-collateralised trading | No |

|

Yes/no |

|

|

| Ease of adding new liquidity providers | No | No |

|

|

|

| OTC-as-a-Service with tailored mark-up and roll-over setup | No | No |

|

|

|

| Full trading cycle management with Master- and Sub-accounts | No | No | No |

|

|

| White-label solution to source and resell liquidity from global LPs | No | No | Yes/no |

|

You sign-up on Finery Markets

White-glove support

Full customization colors & logo, domains, emails & API endpoints

Role-based access management

Secure 2FA authentication

Your client opens an account with you

Client management tool: invite/disable sub-accounts via your master accout

Secure 2FA authentication

Your client funds the account Non-collateralized, collateralized or partially collateralized trading

Risk management

Spread management

Your client makes trades, with you as the counterparty

Order execution across 300 pairs fiat-to-crypto, crypto-to-crypto, fiat-to-stable

Flexible trading modes:

Credit-screened order book

Auto-hedging against LPs

Trading authorization

Position management

Automated or manual settlement You initiate settlements against your sub-accounts and your LPs.

Settlement address book

Flexible settlements fiat and crypto

Position rollover tools

Record-keeping and multi-format reporting:

Alerts and notifications

Automated clearing and settlement via BitGo

Over-the-counter (OTC) trading in cryptocurrency refers to the direct exchange of digital assets between two parties without the use of a centralized exchange. This method allows traders to negotiate prices and execute trades privately, typically through intermediaries like ECNs, OTC trading platforms or an OTC desk. Unlike traditional exchanges that operate on order books and can influence market prices, OTC trading enables participants to buy or sell large quantities of cryptocurrency without causing significant price fluctuations, thus providing a more discreet trading environment.

OTC trading is particularly popular among institutional investors and high-net-worth individuals who seek to execute large transactions efficiently. The process is facilitated by brokers (or OTC desks themselves) who connect buyers and sellers, ensuring that the trade terms are mutually agreed upon before execution. This approach not only enhances liquidity but also minimizes slippage, making it a preferred option for those looking to manage substantial trades.

To learn more about Crypto OTC Trading, please click here.

A crypto OTC trading platform operates by connecting buyers and sellers directly, allowing them to negotiate trades outside of traditional exchanges. When a trader wishes to buy or sell a specific amount of cryptocurrency, they contact the OTC desk, which then matches them with a counterparty interested in executing the opposite transaction. Once both parties agree on the trade parameters—such as price and settlement date—the transaction is executed privately.

The OTC platform acts as a tech layer, ensuring that all commitments are fulfilled while maintaining confidentiality throughout the process. This structure allows for faster settlement times compared to conventional exchanges, making it an attractive option for traders who require flexibility and efficiency in their transactions.

Crypto OTC desks exist primarily to serve the needs of traders looking to execute large-volume transactions discreetly and efficiently. Traditional exchanges may struggle with liquidity for substantial trades, leading to price slippage and increased costs. In contrast, OTC desks provide a tailored service that accommodates high-net-worth individuals and institutional investors who require privacy and personalized support during their trading activities.

Moreover, these desks help mitigate risks associated with market volatility by facilitating direct negotiations between parties. They offer enhanced security measures and compliance with regulatory standards, ensuring that clients can trade confidently while minimizing exposure to market fluctuations.

Crypto OTC trading typically occurs through specialized platforms known as crypto ECNs or OTC desks, which facilitate transactions between buyers and sellers outside of public exchanges. These players operate in various locations globally, providing access to deep liquidity pools and enabling traders to execute large orders without affecting market prices. The transactions are often conducted via electronic networks or directly through brokers who have established relationships with multiple liquidity providers.

Yes, Finery Markets provides a white label solution for crypto OTC desk services. This allows institutions to brand Finery’s advanced trading technology as their own while leveraging its capabilities for executing trades. By utilizing Finery Markets' technology, institutions can enhance their product offerings without incurring significant development costs or time delays associated with building an in-house solution.

To learn more about FM White Label, please click here.

Finery Markets supports existing crypto OTC desks by providing them access to advanced trading technology and deep liquidity pools necessary for facilitatinge large transactions efficiently. Our platform connects OTC desks with well-established liquidity providers globally, allowing desks to offer competitive pricing and enhanced execution capabilities to their clients.

Additionally, Finery Markets’ infrastructure includes risk management tools and settlement solutions that streamline back-office operations for existing trading desks. By integrating these features into their services, existing OTC desks can improve their full-cycle operational efficiency while focusing on delivering superior customer service.

Setting up a crypto OTC desk using Finery Markets involves several steps aimed at integrating our advanced technological infrastructure. First, potential OTC desks need to reach out to Finery Markets for a detailed assessment and demo session, following up with a fully-guided onboarding procedure where our team assists you in setting up with the required documentation, desired features and customization options. Once all agreements are signed and technical aspects settled, OTC crypto platforms can start using Finery Markets.

Finery Markets supports a wide range of digital assets available for trading. Crypto OTC desks can trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), along with over 200 other digital assets across various fiat pairs.

This extensive selection allows clients flexibility in choosing which assets they wish to transact while benefiting from competitive pricing facilitated by deep liquidity pools within the Finery Markets ecosystem.

To inquire about specific assets, please click here.

The fee structure is designed to be competitive while ensuring transparency for users engaging in large transactions. Crypto OTC desks are encouraged to discuss their specific needs with the Finery team during preliminary discussions so they can receive tailored information regarding applicable fees based on their trading activities.

To schedule a meeting with our team, please click here.

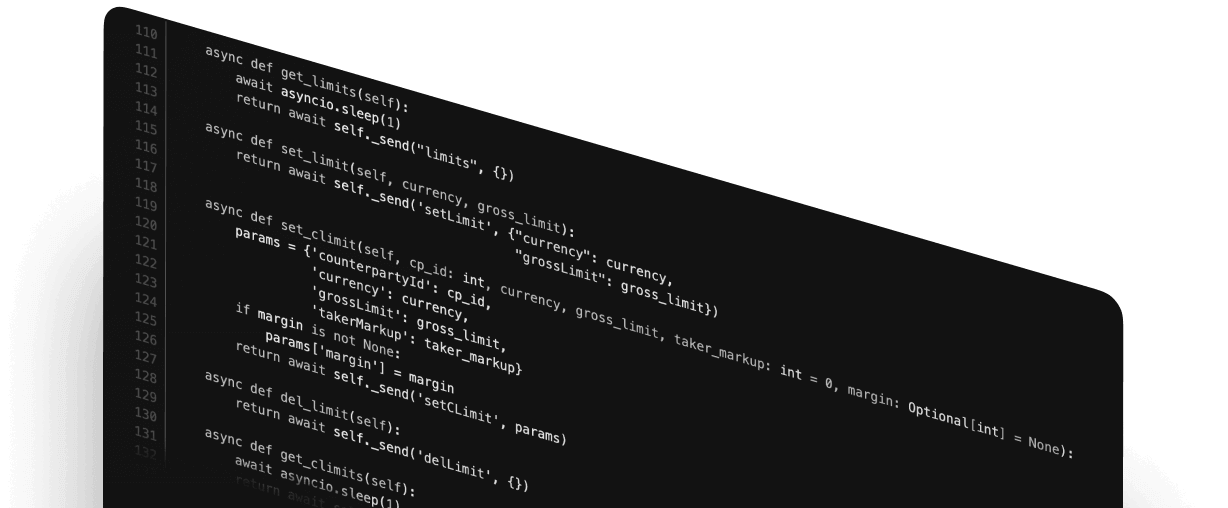

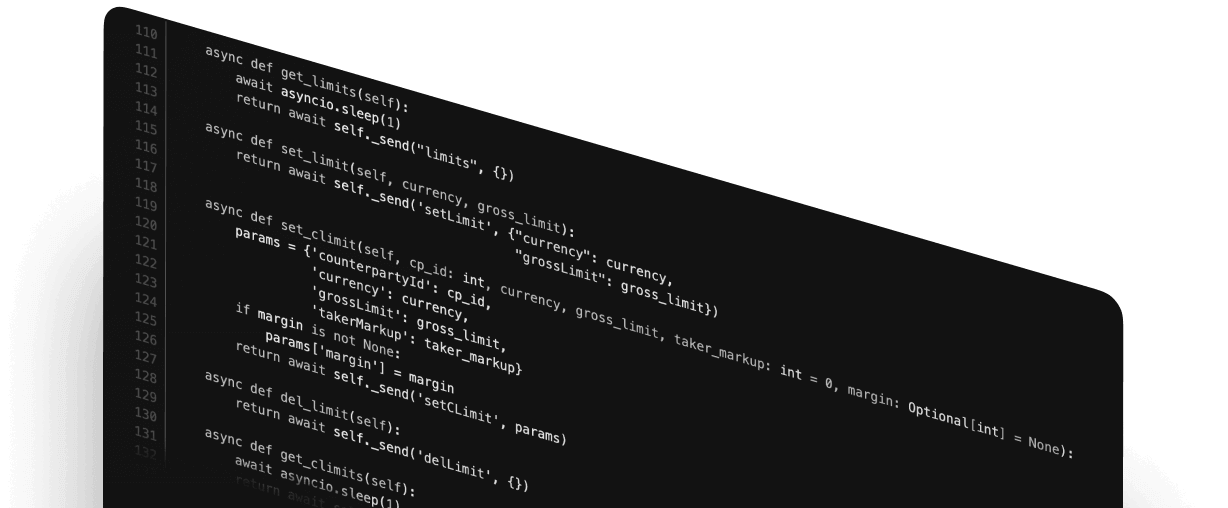

Yes, Finery Markets offers API access for OTC crypto desks. This feature allows institutional clients seamless integration into their existing systems while facilitating efficient trade execution through automated processes. API connectivity enhances operational efficiency by enabling clients to programmatically access real-time market data and execute trades directly from their platforms without manual intervention.

Reduce your integration costs and operational risk across multiple access points with our platform

Get startedFinery Markets BVI Limited (“Finery Markets”) provides software, technology infrastructure, and related Information and Communication Technology (ICT) services on a Software-as-a-Service (“SaaS”) basis. Finery Markets acts solely as a software vendor and does not operate a trading platform, does not intermediate, match, execute, clear, or settle transactions, and does not engage in any activities that would require regulatory authorisation under applicable laws.

Finery Markets’ software is non-custodial and is provided exclusively to licensed institutional entities that act as independent operators of their own environments. All counterparties are solely responsible for establishing and maintaining their own bilateral trading and settlement relationships. Finery Markets is not a party to any such arrangements and assumes no responsibility for the conduct, verification, or compliance obligations of any users of the software.

Nothing on this website shall be construed as a financial promotion, investment advice, or an offer to engage in regulated activities. Access to and use of the software is strictly limited to clients who have entered into a software licensing agreement with Finery Markets. Persons located in jurisdictions where such access is restricted should not rely on this website or any of its contents.

![]() Additional notice to UK visitors: This website and associated communications are not intended to constitute a financial promotion under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) and related guidance. Access to services provided by Finery Markets is limited to regulated entities, professional clients and eligible counterparties as set out by the Financial Conduct Authority. UK users are not permitted to use this website for the services of Finery Markets if they don't fall within these categories.

Additional notice to UK visitors: This website and associated communications are not intended to constitute a financial promotion under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) and related guidance. Access to services provided by Finery Markets is limited to regulated entities, professional clients and eligible counterparties as set out by the Financial Conduct Authority. UK users are not permitted to use this website for the services of Finery Markets if they don't fall within these categories.