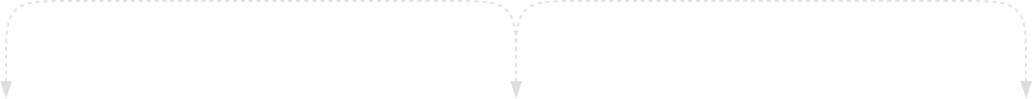

Lifecycle

We are more than a trading platform, we support complex workflows happening across the transaction lifecycle.

Transaction step

Our tasks

1 Pre-trade

- Account access management

- Setting up limits and risk checks

- Leverage and financing tools

- Mark-up management

- Firm streaming quotes

- Pre-trade cost analysis

2 Trade

- Order execution across 200 fiat-to-crypto, crypto-to-crypto, fiat-to-stable pairs

- Margin checks

- Risk Management

3 Post-trade

- Fiat & crypto settlement instructions, network agnostic

- Position management

- Settlement & trade history

- Reporting

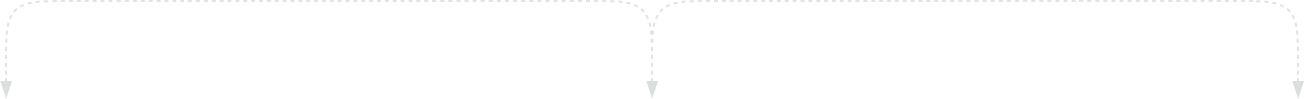

Trade

Trade

Trade

Trade

Takers

Banks & brokers, OTC desks, Payment providers

- Client 1

- Client 2

- Client 3

tradable order book

Connects via API / GUI

100% fill ratio

Finery markets

Finery markets

High-performance C++ matching engine

Global order

book

Firm orders

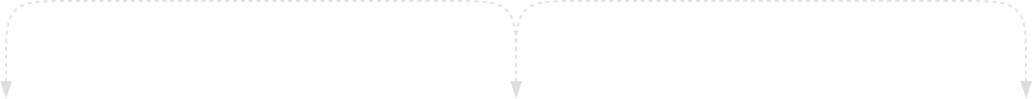

MASTER (White label)

Client GUI and API endpoints

- facilitating transactions between groups within a company,

- dividing up business lines

- creating access points for customers.

sub account

taker

- Customer 1

- Customer 2

MASTER

sub account

Maker

- MM 1

- MM 2

liquidity providers

- LP 1

- LP 2

- LP 3

Settlement

Settlement