Following our partnership announcement, we decided to sit down with Samuel Rondot, Managing Director at DAMEX, to better understand the company's challenges and how Finery Markets fits into their growth story and product roadmap.

DAMEX was established in 2017. We have one of the oldest DLT licenses with a proper framework around regulation. What is interesting is that when we started, there was no stablecoin, and payments were mostly done in Bitcoin and other currencies.

Samuel Rondot, Managing Director for Business at DAMEX

In the past 5 years, DAMEX has been witnessing sustained growth in business activity, particularly in the on-ramp and off-ramp areas, with a 25% increase in trading compared to the previous year. This growth is attributed to the rising adoption of stablecoins for payments, a trend bolstered by events like the World Cup, which saw a dramatic spike in transaction volumes. Despite the challenges presented by regulatory uncertainties, specifically surrounding major players like Binance, DAMEX has witnessed a profound shift in institutional behavior, signaling a new era of professionalism and maturity in the crypto space.

The partnership between Finery Markets and DAMEX stands as a beacon of innovation and client-centric solutions. This collaboration is rooted in a shared vision for the future of digital asset trading and is leading to a remarkable product scaling.

Enhancing OTC trading infrastructure

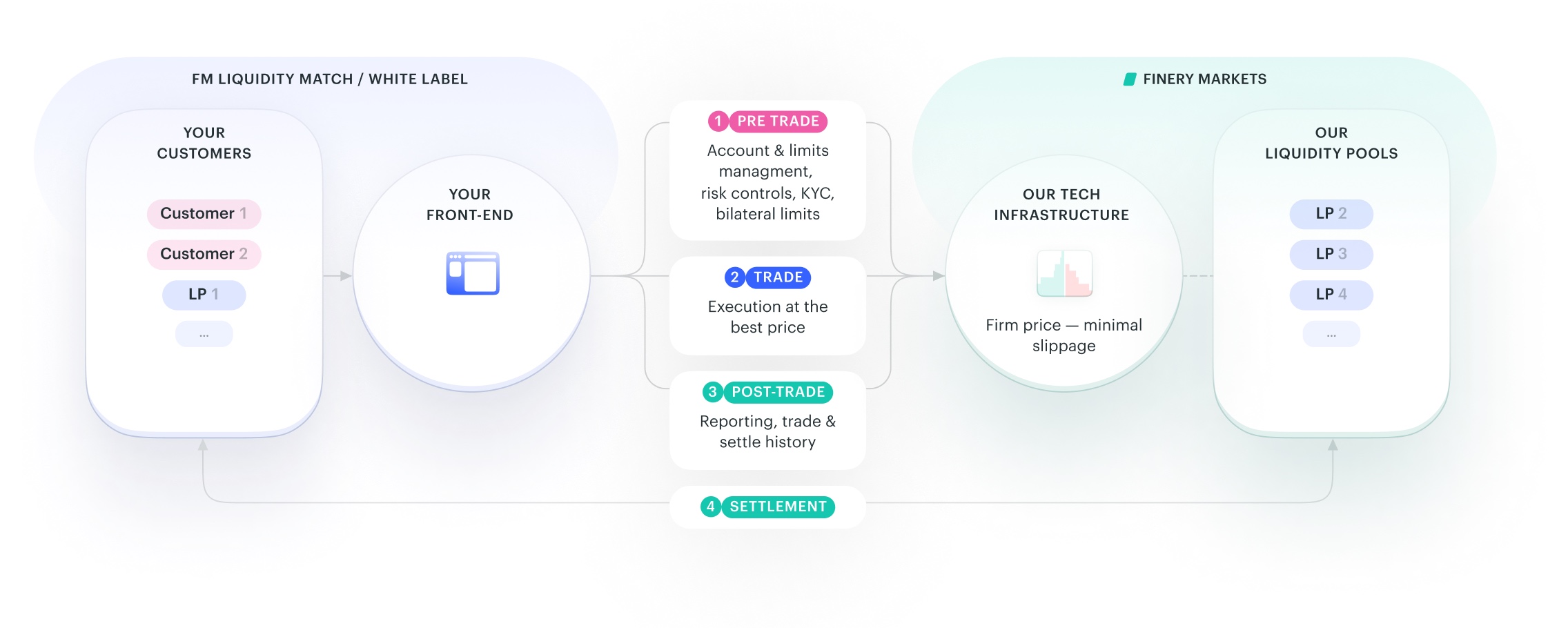

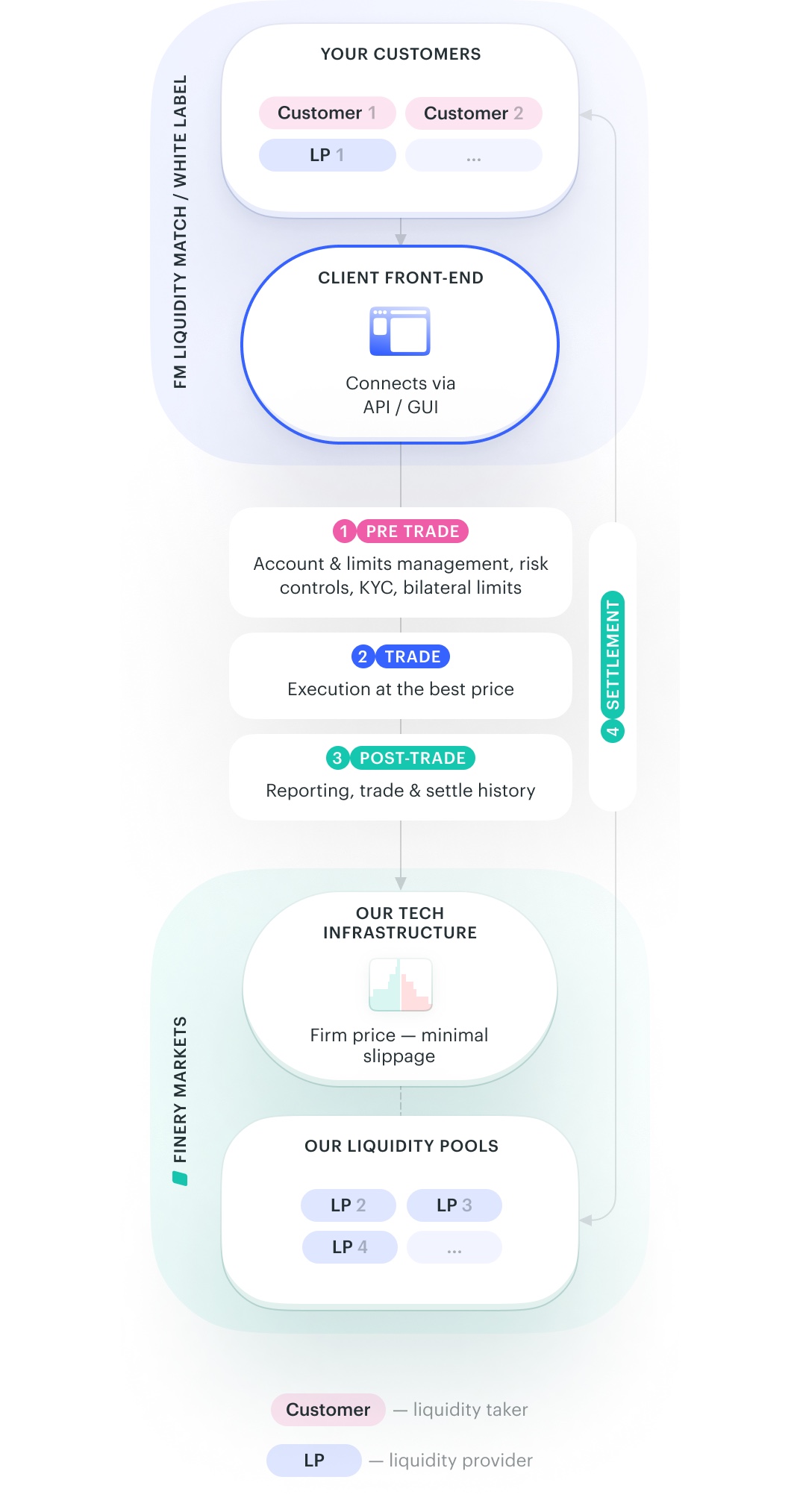

The decision to partner with Finery Markets and implement FM Liquidity Match solution was driven by the need to enhance DAMEX's Over-The-Counter (OTC) trading infrastructure

Client-facing interface:

DAMEX was dealing with a growing number of client requests demanding more granularity on the way they process their orders. From a product architecture perspective, DAMEX needed a client-facing interface that will provide some degree of automation on the floor and smoothen the operational workload.

One-stop compliant solution:

With the regulatory pressure on market participants and concerns on the operational reliability of centralized exchanges, DAMEX clients were asking for a fully compliant solution that will give them access to all solutions A to Z — from on/off ramping to OTC trading.

DAMEX is a regulated custodian and through settlements happening directly with us, we give access to the largest liquidity on the market. And when we can offer this client-facing proposition, basically they want to deal with DAMEX only. Before, there was a tendency to do on/off ramp with us, but then the stablecoins were moved to Binance or to OKX for the purpose of trading. But that was no longer the case. We were seeing a spiking demand from clients wanting to have the full suite of the relationship with a regulated actor.

Samuel Rondot, Managing Director for Business at DAMEX

This partnership has allowed DAMEX to offer a comprehensive suite of services, from on and off-ramp solutions to a client-facing platform for active traders. DAMEX's approach, which mirrors traditional financial industry best practices, offers clients the best of both worlds: top-tier pricing and execution alongside secure settlement and custody.

The power of collaboration

Despite legal challenges and the need to navigate complex licensing processes, DAMEX's commitment to regulation has set it apart, allowing for consistent growth and a solid reputation in exotic industries.

The addition of DAMEX Direct, which offers IBAN functionality within DAMEX's ecosystem, has been a game-changer. It addresses the challenges clients face with traditional banks hesitant to engage with crypto transactions. DAMEX's solution provides a secure and regulated space for managing both fiat and crypto transactions, catering to the growing demand for integrated financial services.

The partnership between Finery Markets and DAMEX exemplifies the power of collaboration in the fintech sector. By combining Finery Markets' innovative trading infrastructure with DAMEX's regulatory expertise and customer-centric approach, the two companies are paving the way for a more connected, efficient, and secure digital asset market.

.jpg)