Q1 2024 update

Following the approval of the BTC ETF in Q1 2024, there has been a significant increase in institutional interest in digital assets. As a result, we have observed a stunning 80% year-over-year growth in customer transactions through our OTC trading infrastructure, reaching a historical record in transaction amount.

➤ Read now

LTP launches OTC prime brokerage with toxic flow protection

We are excited to announce our collaboration with LTP, a leading digital assets prime broker. We will be launching a new OTC Prime Brokerage service that utilizes the infrastructure of Finery Markets. By leveraging FM Liquidity Match, LTP will offer its institutional clients seamless access to crypto spot transactions. This will ensure top-notch execution and protection against toxic flow.

This partnership is a testament to our commitment to enhancing institutional access to the OTC crypto markets, ensuring anonymity, and robust post-trade settlement, all within a fully compliant framework.

➤ Learn more

SOC 2 Type 1 Examination Success

Finery Markets has successfully completed our first SOC 2 Type 1 examination. As the first crypto-native ECN to accomplish this, we have set a new standard in security and compliance within the digital asset industry. This audit evaluates an organization's infrastructure, software, personnel, data handling, and policies to ensure robust protections are in place for customer data.

The completion of the SOC 2 Type 1 examination, conducted by 360 Advanced, emphasizes our dedication to upholding stringent security standards and reinforces our position as a trusted leader in the institutional crypto landscape.

➤ Learn more

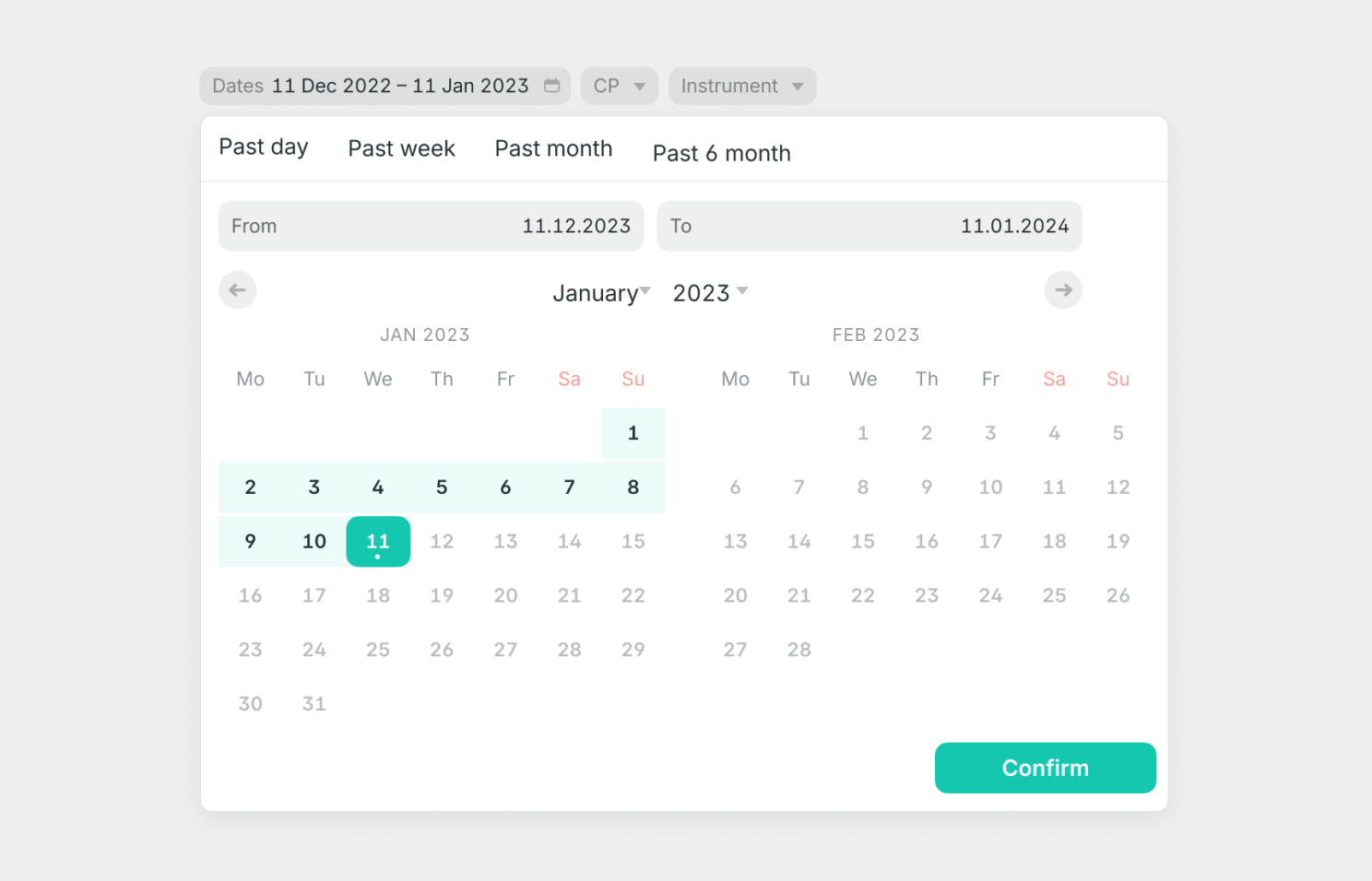

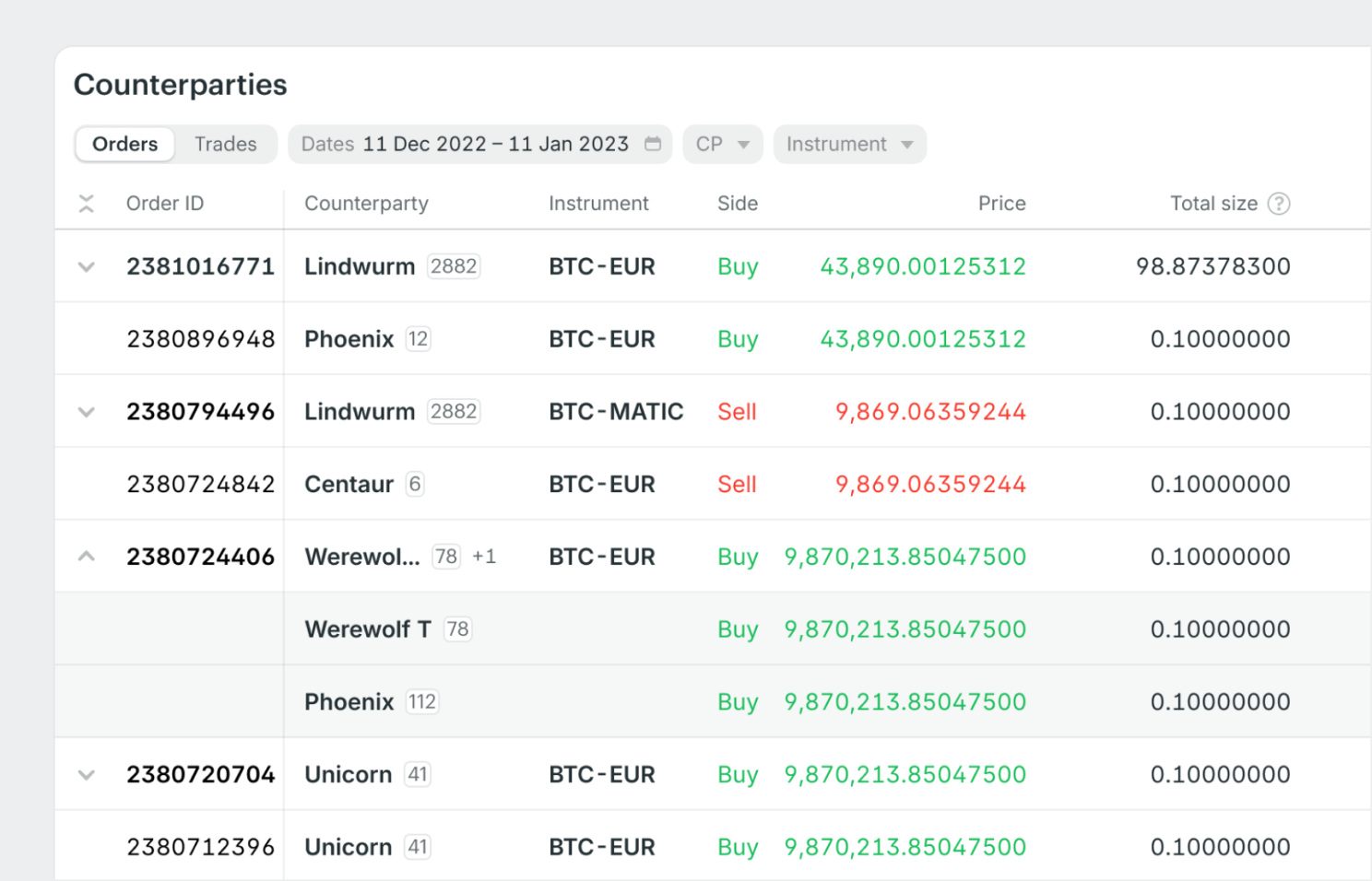

Trade history update

Now, you can easily navigate through all previous transactions and select specific time frames or use predefined ranges like the last day, week, month, or year.

With the new filters, you can sort trades by counterparties or instruments. You can even export the trade history as a .csv file and apply filters in Excel or parse the file. These enhancements provide a seamless and thorough trading experience, allowing you to effortlessly track and analyze your trading activities.

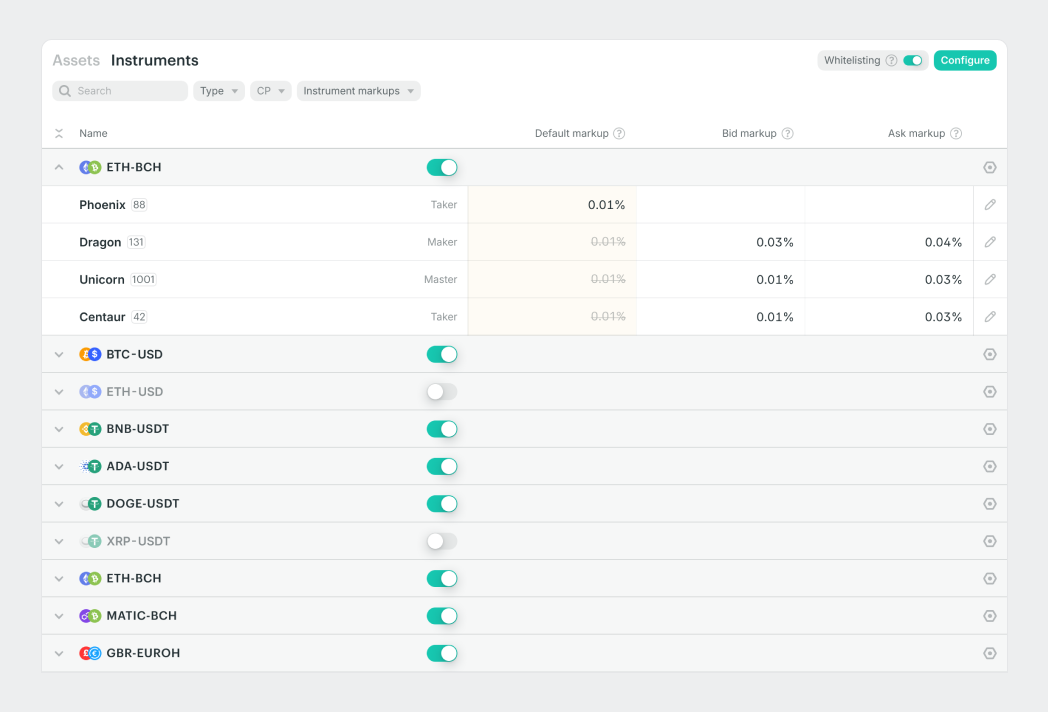

We have added the functionality of instrument whitelisting and made it accessible to all types of clients. Now, you can be even more specific with your trading capabilities. For example, you can whitelist BTC-EUR and BTC-USD, while disabling BTC-ETH and BTC-USDT.

When this feature is enabled, clients will see the order book and will be able to trade the whitelisted instruments only.

New case study: Nexdesk

Our journey with Nexdesk has been a remarkable example of how strategic partnerships can drive innovation and growth. This month, we’ve decided to put together a case study that delves into the evolution of Nexdesk from a traditional order book exchange to a specialized OTC desk powered by Finery Markets' FM Liquidity Match.

Our piece expands on how this collaboration addressed Nexdesk’s liquidity challenges, transforming their trading infrastructure and significantly improving their service offerings to a sophisticated corporate clientele.

We also highlight the importance of partnerships as a key driver for product development. For instance, Nexdesk has played a major role in the creation of FM Liquidity Match and the deployment of many of the features today available across our product ecosystem.

➤ Read now