• New explainers: FM Marketplace & FM White Label

• Enhanced risk management flexibility with modular, bypass-ready architecture

• Improved platform navigation for faster day-to-day operations

• Crypto OTC Report reminder: 2025 Results & Trends

FM Marketplace & FM White Label: new product explainer videos

We’ve released two short explainer videos for FM Marketplace and FM White Label, created to clearly show how these products are used in real institutional trading environments. Rather than feature walkthroughs, the videos focus on operating models, deployment logic, and where each solution fits within trading, risk, and settlement workflows for regulated market participants.

FM Marketplace

Built as a high-performance institutional crypto liquidity marketplace, FM Marketplace gives firms reliable access to deep OTC liquidity through a multi-dealer environment. Powered by Finery Markets’ ECN technology, it enables firm-price trading without last look, as well as indicative pricing via RFQ and Quote streams, supporting efficient execution and scalable OTC operations within a non-custodial model.

-

Multi-dealer ECN with firm pricing and no last look, RFQ and Quote streams

-

Access to deep OTC liquidity via a smart order router

-

Full pre-trade, trade, and post-trade workflow support

-

GUI and API access with granular role-based permissions

-

Non-custodial model, which enhances capital efficiency while preserving bilateral settlement relationships.

FM White Label

Designed as a turnkey offering, FM White Label allows institutions to launch their own fully branded, institutional-grade crypto trading platform in under a week. Delivered as the market’s first ECN-as-a-Service, it eliminates long development cycles and heavy CAPEX while providing immediate access to proven trading infrastructure and institutional liquidity.

-

Sub-1 millisecond C++ matching engine with 99.99% uptime

-

Fully branded platform operating under the client’s own name

-

End-to-end trading lifecycle via GUI and API

-

Built-in risk controls, real-time notifications, and test environment

-

Flexible spread and markup management for scalable revenue models

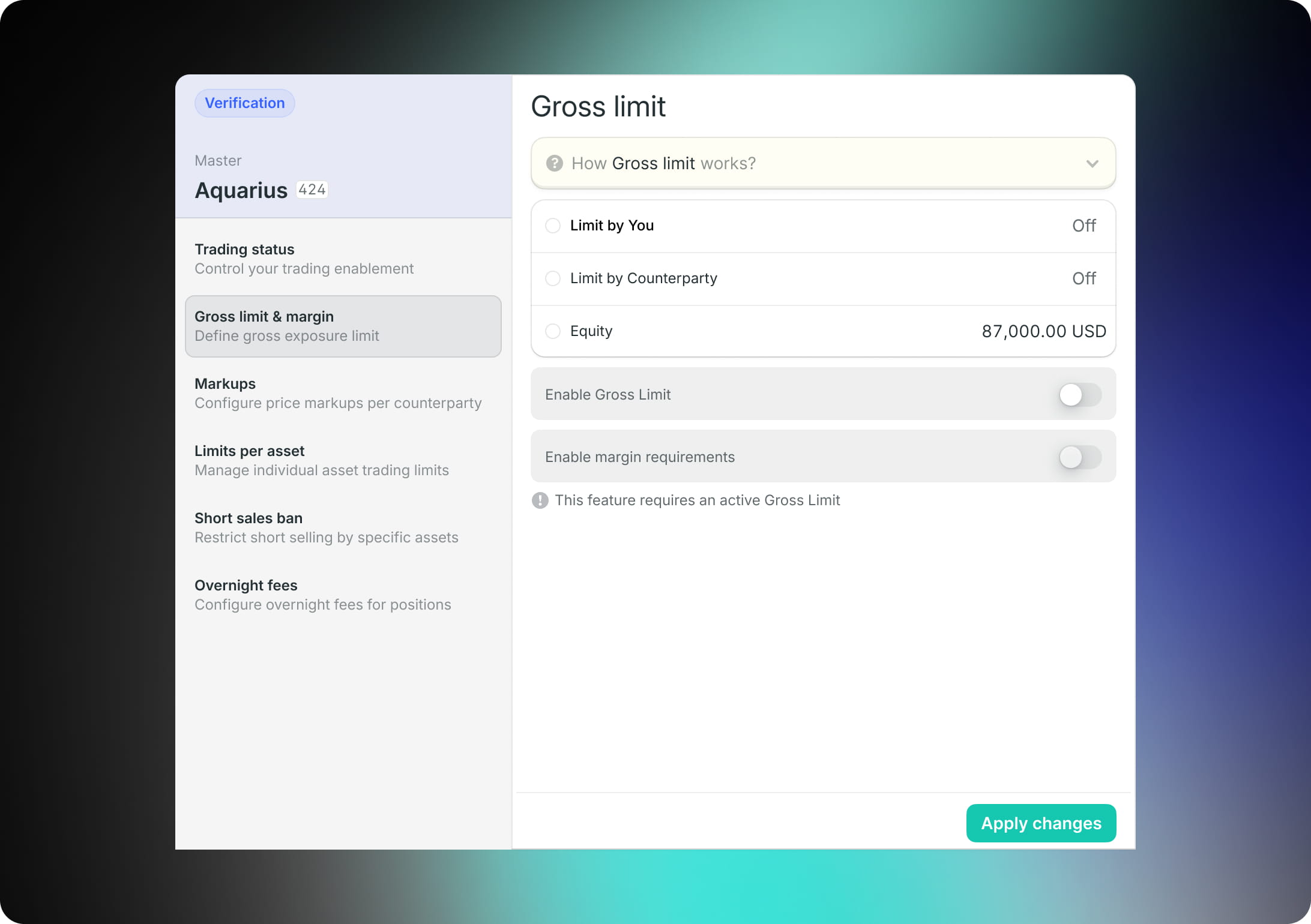

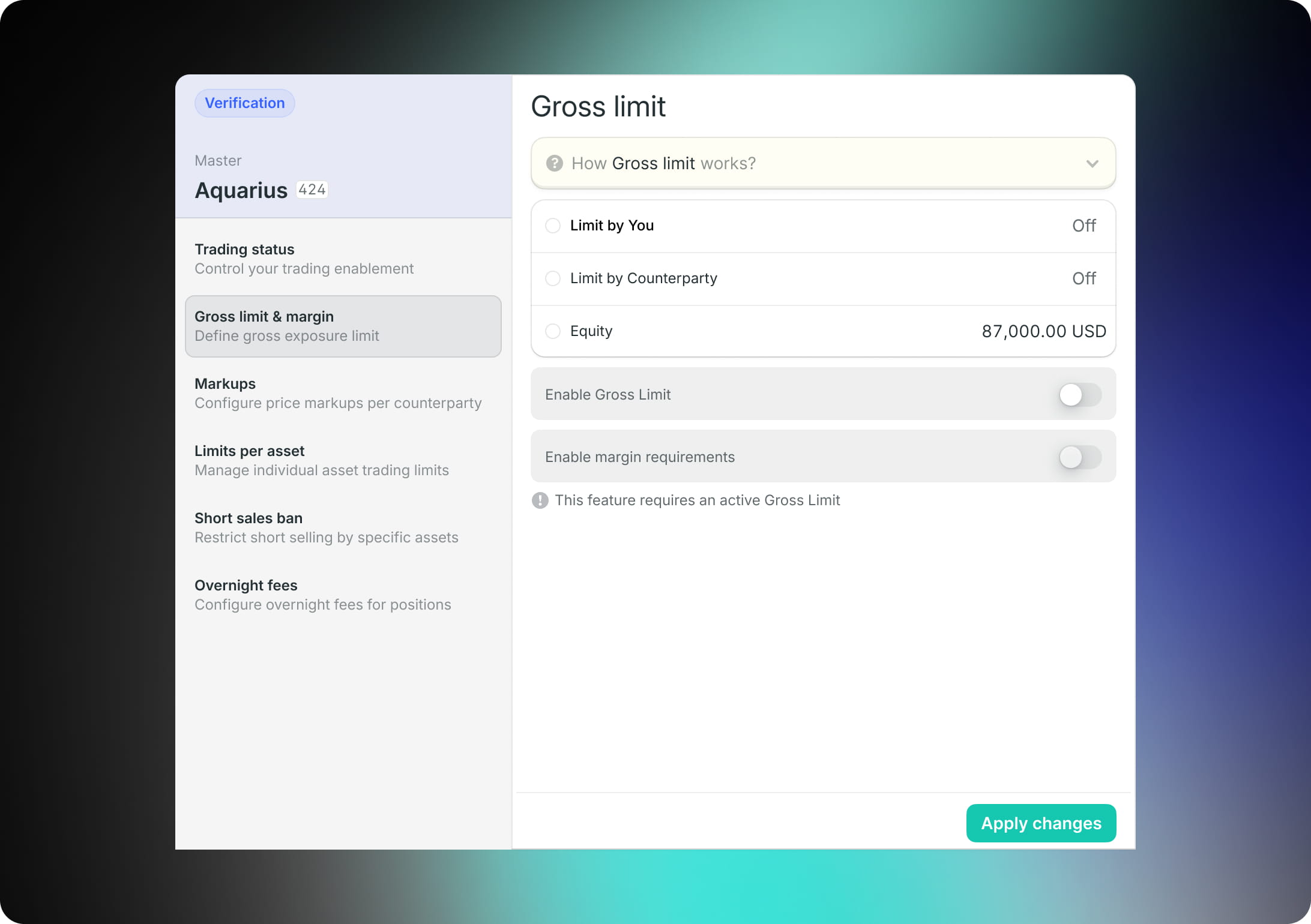

Enhanced Risk Management Flexibility

The Finery Markets risk management engine has been significantly upgraded to better meet the operational requirements of institutional participants. While the core system remains a robust tool for setting global and asset-specific limits, managing instruments, and defining collateral requirements, it has evolved into a fully modular framework designed for greater flexibility.

Recognizing that many professional firms operate proprietary risk engines, the platform now supports a bypass architecture, allowing internal risk controls to be partially or fully deactivated in favor of external systems. This level of granular control enables seamless integration into existing workflows, eliminates redundant layers of risk processing, and gives institutions finer control over how risk is managed across their operations.

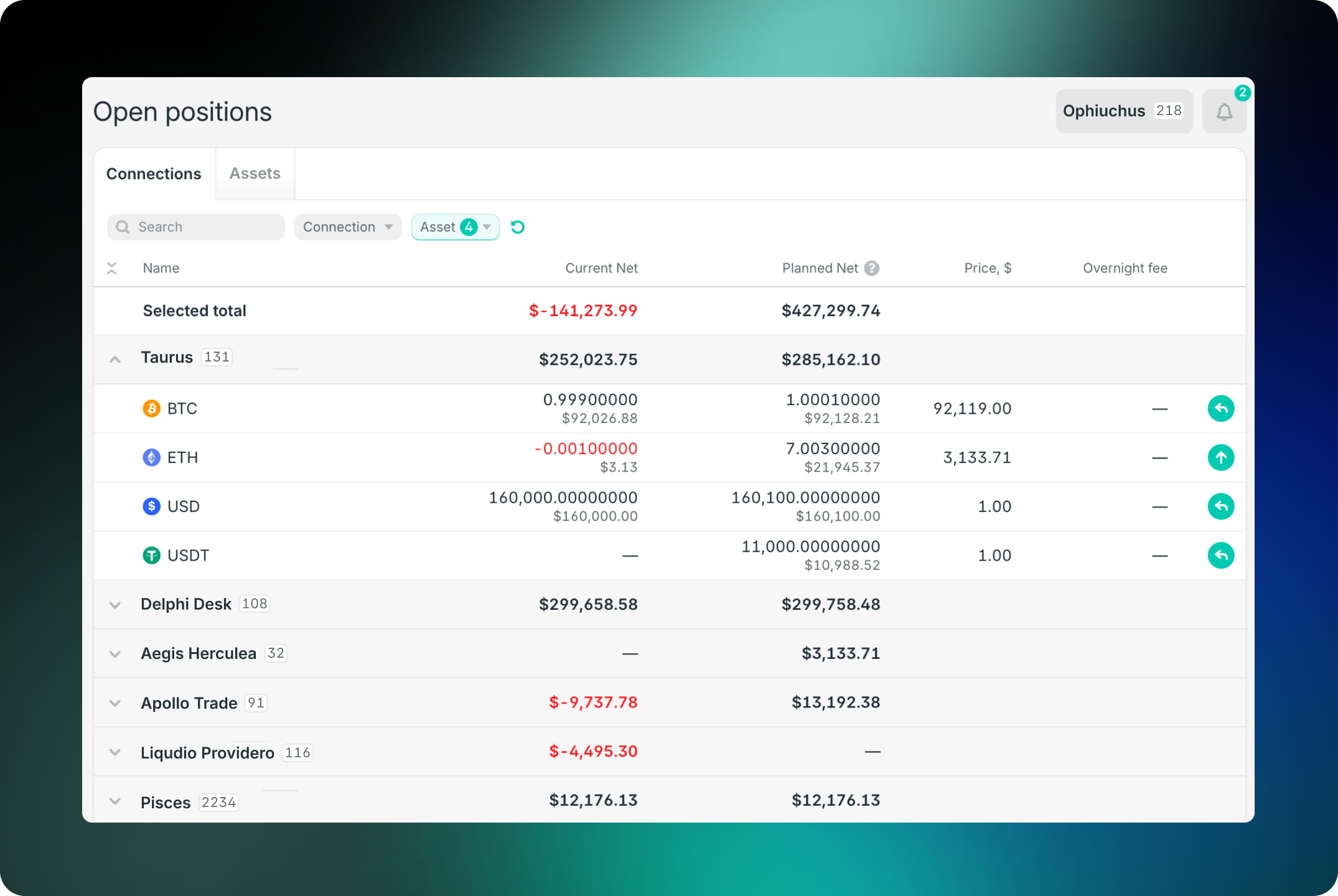

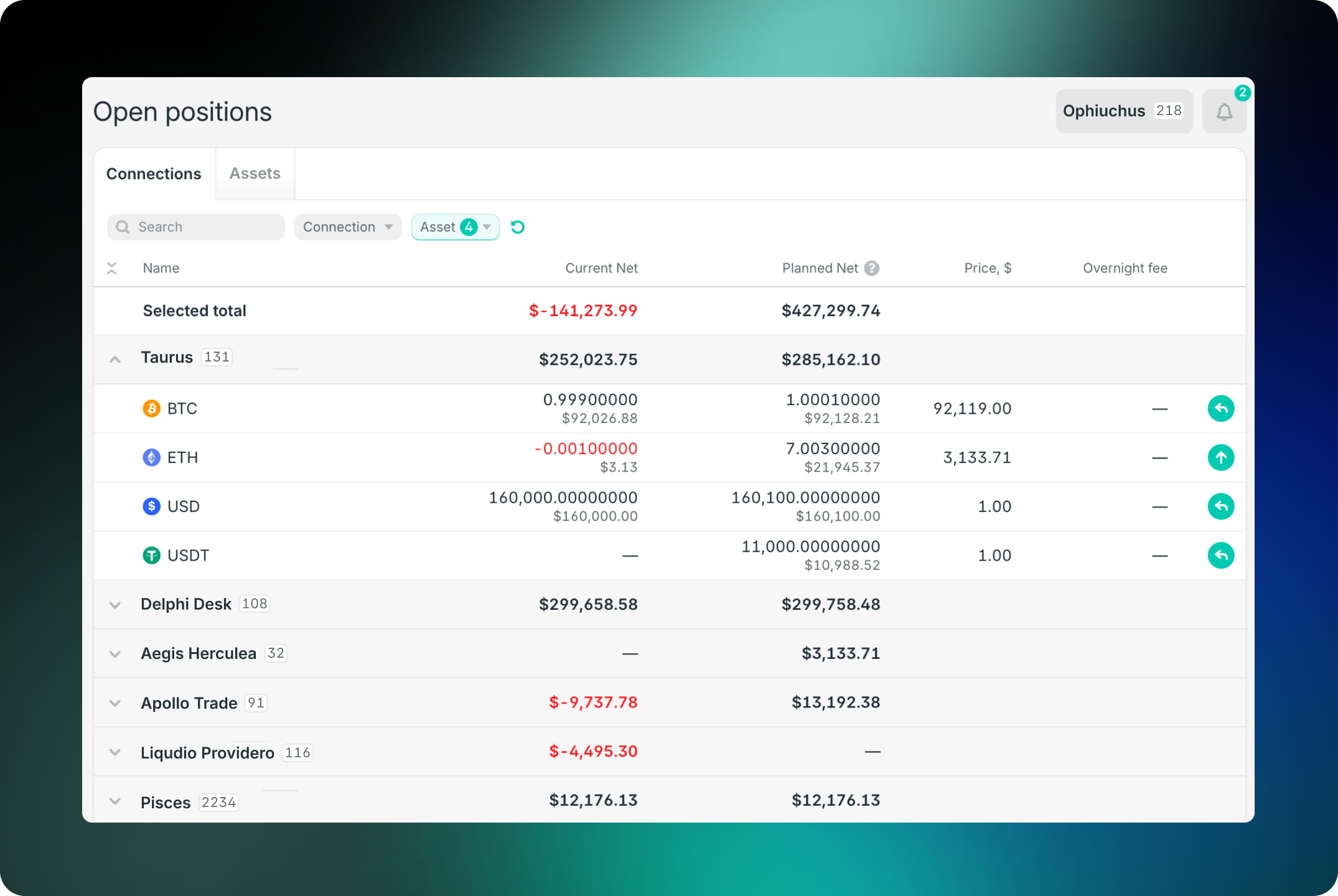

More intuitive platform navigation

Platform navigation has been redesigned to make daily workflows faster and easier to navigate. Features are now grouped into two clear areas, reducing visual clutter while keeping all functionality intact. The upgrade includes:

-

Operations hub: Quick access to front-, mid-, and back-office tasks, including trading, positions, and settlements

-

Settings hub: A dedicated space for managing limits, markups, users, sub-accounts, and API keys

-

One-click features: Shortcuts for common actions such as sub-account creation and Authorized Trading

Crypto OTC Report: 2025 Results & Trends

.jpg)

As a reminder, our annual Crypto OTC Report is now available for download, offering a data-driven view of how institutional crypto trading evolved across 2024–2025 — a formative period for the market’s maturation beyond exchange-centric models. The analysis is based on more than 15 million institutional spot trades executed on the Finery Markets platform, providing a detailed look at volume dynamics, asset composition, and structural shifts in OTC trading.

Key 12M’25 insights include:

-

Crypto spot OTC volumes grew 109% YoY in 2025, far exceeding early-year market forecasts of 10–60%

-

Stablecoins accounted for 78% of institutional OTC trades, up from 26% two years earlier

-

ETH led asset-class growth at 152%, outpacing BTC’s 86%, while BTC remained the largest asset by total volume

-

Institutional OTC adoption continued to outpace CEX-driven growth, with Top-20 CEX spot OTC volumes rising 9% YoY versus 109% growth across the broader OTC market

Download the report

.jpg)