Two months in and Bitcoin has already updated its ATH. February has been an eventful month in the crypto space, with Bitcoin ETF inflows showing no signs of slowing and market attention shifting to a batch of potential Ethereum ETFs. At Finery Markets, we’ve been matching this pace with exciting product developments.

Introducing FM White Label

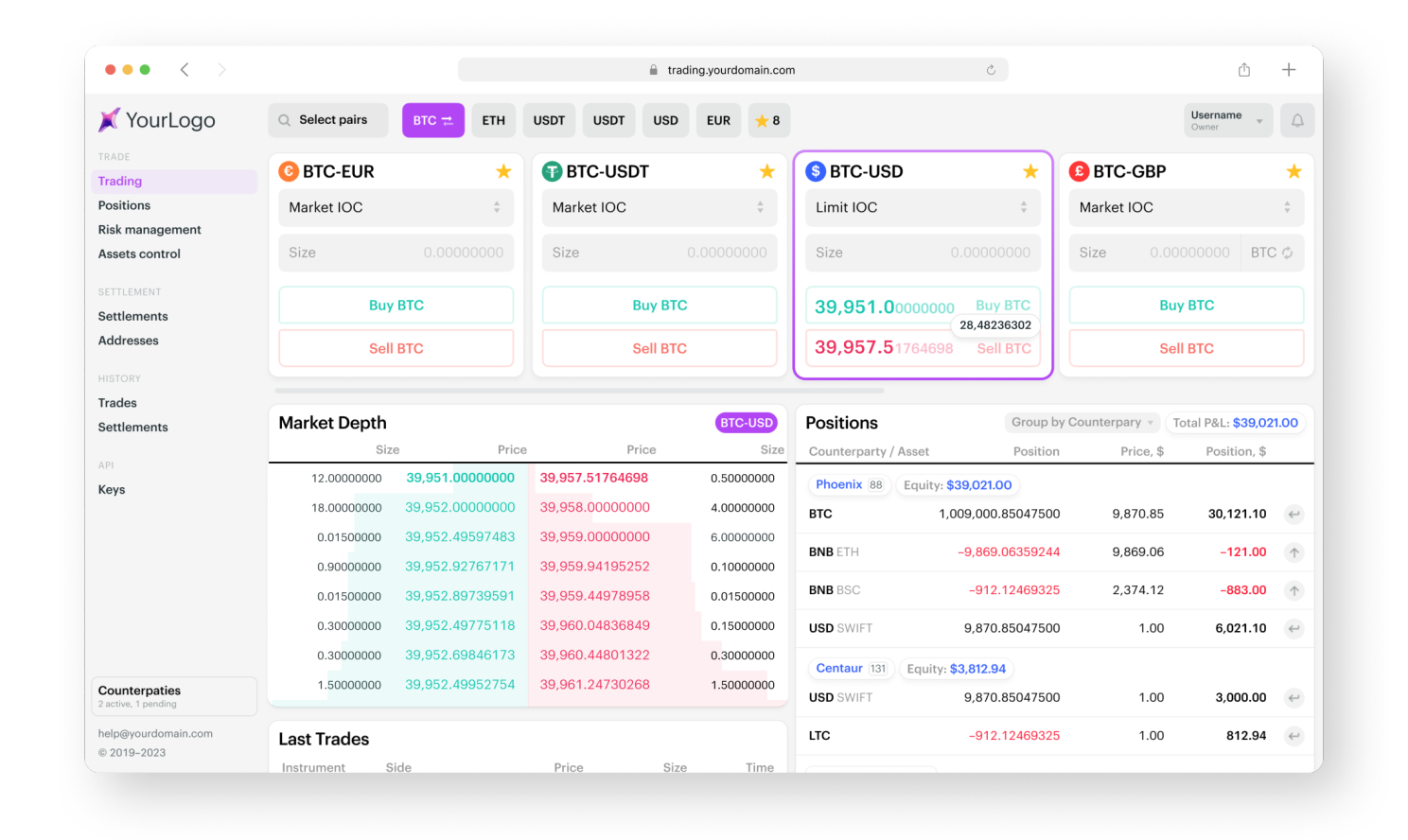

We're excited to introduce FM White Label, a turnkey solution for institutions aiming to establish a B2B crypto trading business swiftly. This platform allows you to launch a fully branded trading service, tapping into unparalleled crypto liquidity from top providers globally.

FM White Label is a customizable iteration of our pioneering ECN-as-a-Service platform, FM Liquidity Match, designed to integrate seamlessly with various business models, including OTC desks, payment providers, brokers, and online currency exchanges. It's a strategic tool to unlock new revenue streams while saving on development costs and automating client interactions.

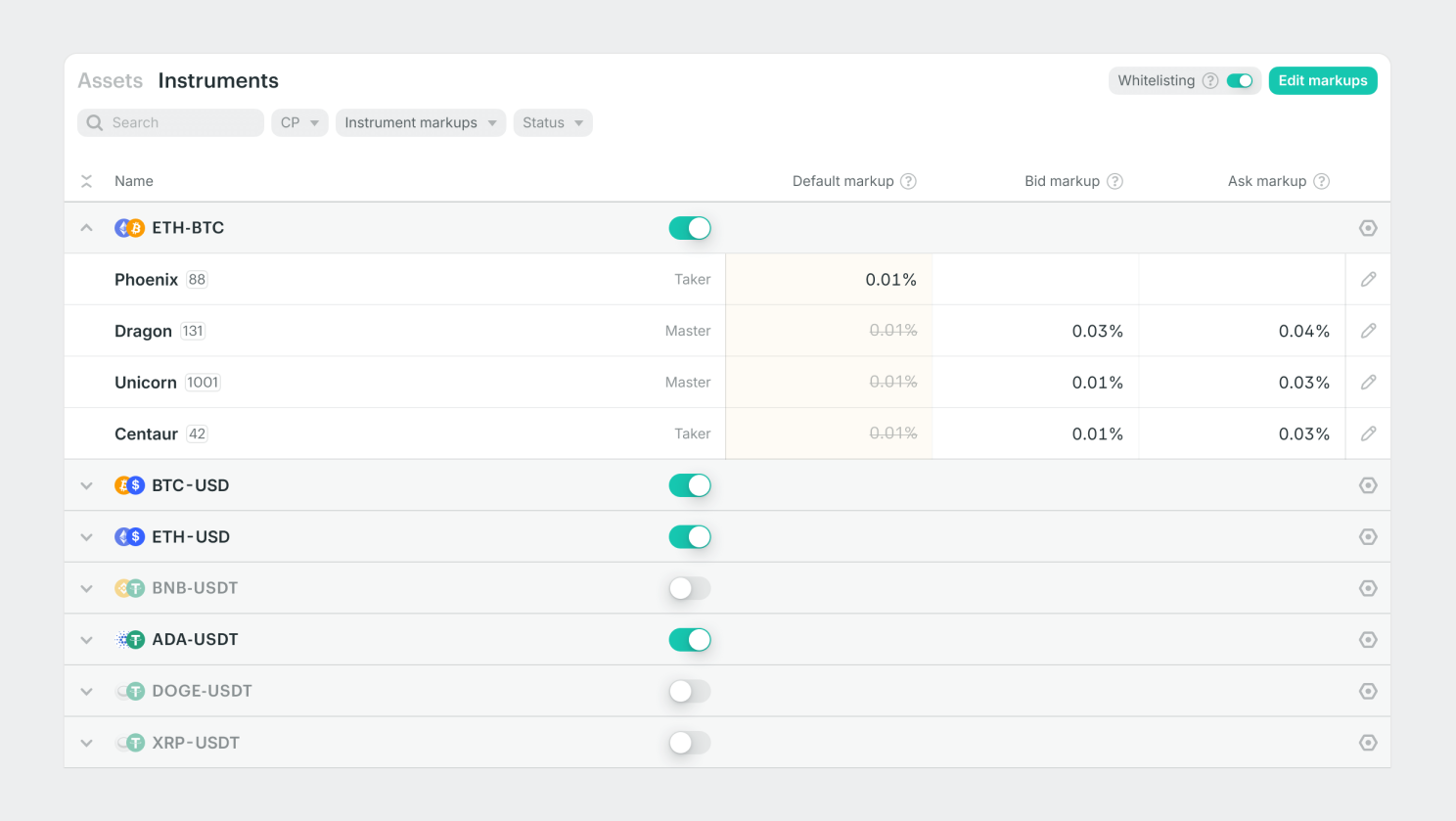

Enhanced pricing efficiency with multi-dimensional markups

We have redefined flexibility with our multi-dimensional markup management system for FM Liquidity Match and FM Whitelabel. This system provides our clients with the ability to customize markups by customer, specific asset pairs, and even differentiate between bid or ask. For your convenience, markups can be set through our user-friendly GUI or automated via our symmetric API.

This improvement is yet another example of our dedication to crafting flexible solutions for our clients to optimize their cryptocurrency trading operations. Now, users of FM Liquidity Match and FM Whitelabel can enhance pricing efficiency for their end clients and boost profitability.

FM Podcast: A Journey Through The History of Electronic Trading

We are thrilled to unveil the FM Podcast, starting with a deep dive into the history of electronic trading. In the inaugural episode, Finery Markets CEO Konstantin Shulga and electronic trading visionary Doug Atkin discuss the evolution from traditional to institutional crypto trading.

They explore the parallels between the market structures of yesterday and today, highlighting the challenges and opportunities that lie ahead for the digital assets industry. This enlightening conversation is available on our YouTube channel, providing valuable insights into the critical themes shaping the trading world.

A2ZCrypto Kicks Off OTC Operations Through FM Liquidity Match

We are delighted to announce our partnership with A2ZCrypto, which will employ FM Liquidity Match technology for its OTC crypto operations. This collaboration marks a significant step in our mission to create a more accessible and reliable trading infrastructure for global crypto institutions.

A2ZCrypto, focusing on Crypto-to-Fiat transactions and education in the digital asset space, will also contribute to FM Liquidity Match, FM Marketplace, and FM Interdealer as a liquidity provider, particularly adding the Indian Rupee (INR) to our fiat-to-crypto asset pairs.

How DAMEX elevated their client facing operations with FM Liquidity Match

Our partnership with DAMEX, a key player in bridging crypto and traditional finance, has led to notable enhancements in their client-facing operations. In our latest case study, we sit down with Samuel Rondot, Managing Director at DAMEX, to discuss their challenges and how our collaboration is shaping their growth and product roadmap.

The integration of FM Liquidity Match has significantly upgraded DAMEX's OTC trading infrastructure, providing a more granular, automated, and compliant client interface. This partnership is a testament to the transformative power of collaboration in the fintech sector, setting new standards for efficiency and security in the digital asset market.

Snapshot of the month: The Pre-Halving ATH Rollercoaster

Thank you for reading The Digest. To stay on top of our latest updates, make sure to Subscribe to our LinkedIn Page.

Disclaimer: This newsletter is for informational purposes only. None of the statements contained should be considered financial advice.