- Finery Markets named among the world’s top 300 fintech companies by CNBC.

- New The Flow episode explores the role of ECNs in institutional crypto.

- Stablecoins now make up 75% of OTC spot trades on Finery Markets.

- Master accounts can now authorize trades for Quote Streams.

- Trading & settlement history consolidated into a single, UTC-standardized section.

- Client turnover has grown 3.4× YoY, hitting $2.3B in July

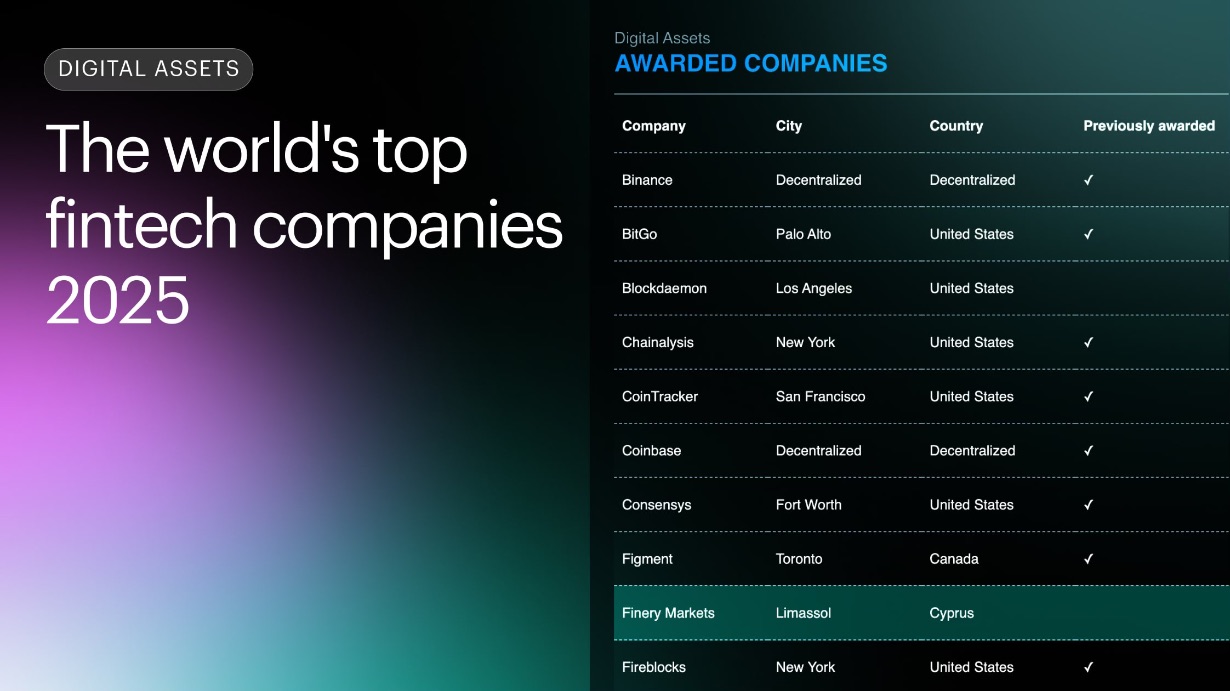

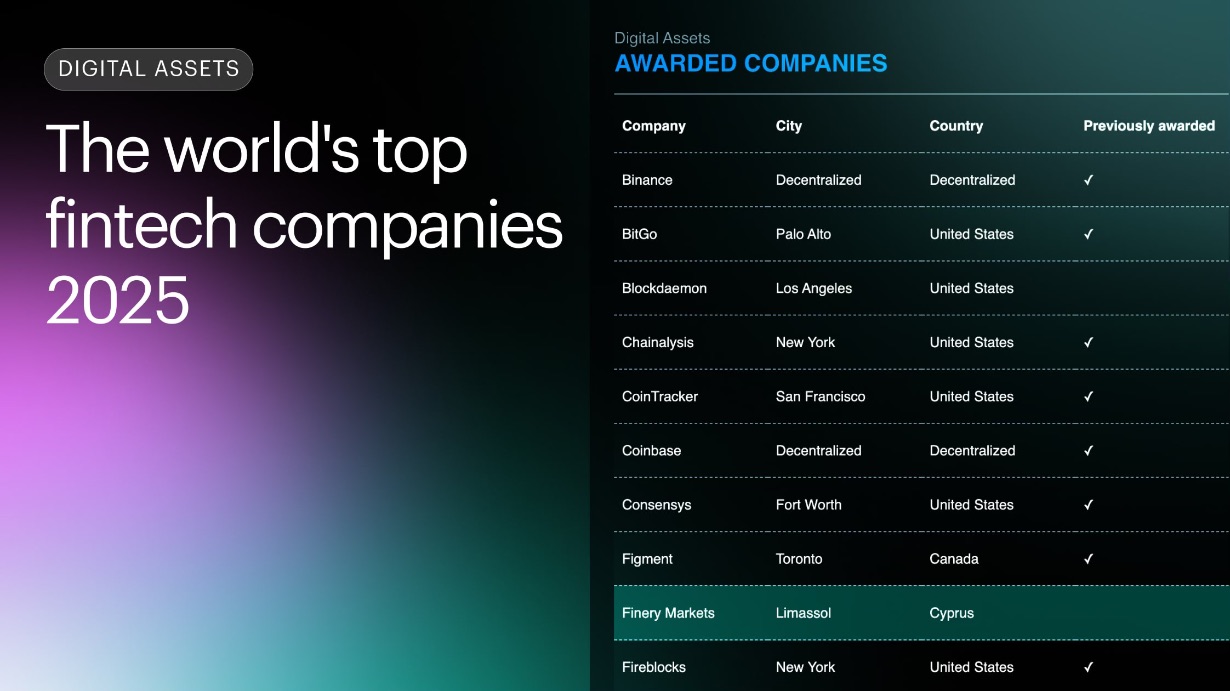

CNBC Recognizes Finery Markets Among World’s Top Fintech Companies

Finery Markets has been named among the world’s top 300 fintech companies in the 2025 CNBC × Statista ranking. The list spans startups, scaleups, and established players, measured against rigorous KPI-driven criteria. Finery Markets secured its place in the “Digital Assets” category, highlighting its long-term commitment to building infrastructure that prepares institutions for the crypto economy.

This milestone follows a year of record growth and reflects the trust of investors, clients, and strategic partners. “We’re honored to be included for the first time alongside major digital asset companies,” said Konstantin Shulga, CEO and co-founder. “This recognition strengthens our brand as we accelerate global expansion and technological innovation.”

→ Read more

Why Institutional Crypto Needs ECNs — The Flow Podcast

In a special episode of The Flow, FinanceFeeds’ Nikolai Isayev interviews Finery Markets CEO Konstantin Shulga to explore how a cloud-native ECN is reshaping institutional crypto. The discussion covers market structure, global regulations, hybrid execution models, and the practical advantages of non-custodial infrastructure.

Konstantin also shares why Cyprus is an ideal base for global operations, how stablecoin infrastructure is evolving, and why ECNs are critical in increasingly fragmented markets. It’s a rare deep dive into the mechanics behind institutional adoption.

→ Watch the episode

Institutional Demand for Stablecoins Hits Record High in H1 2025

Finery Markets’ Crypto OTC Review reveals that 75% of all OTC spot trades on its platform in H1 2025 involved stablecoins — up from 46% in 2024 and 23% in 2023. The data, drawn from over 4.1 million trades, signals a structural market shift toward stablecoin-based trading.

Year-on-year, stablecoin transactions grew 121%, while total OTC trading volume surged 154%. Crypto-to-stablecoin trades rose 277%, and altcoin activity (SOL, LTC, XRP) remained strong. The report also examines the rise of private-room trading and secondary market depth in managing depeg risks.

→ Read full report

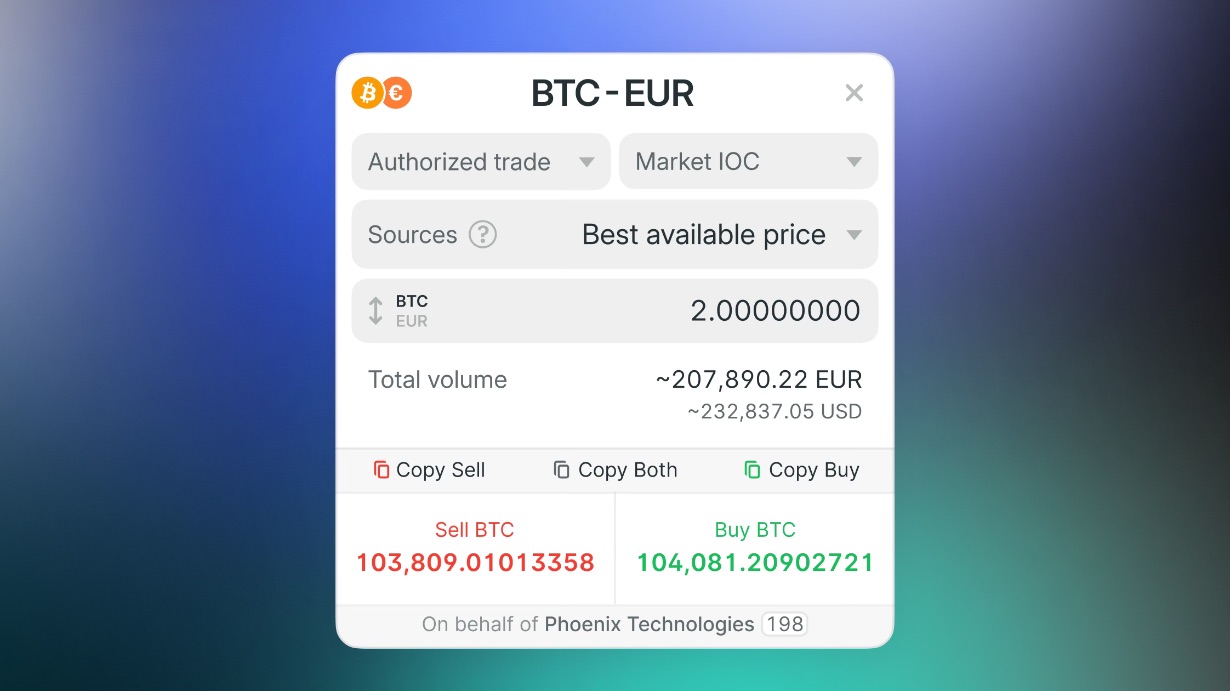

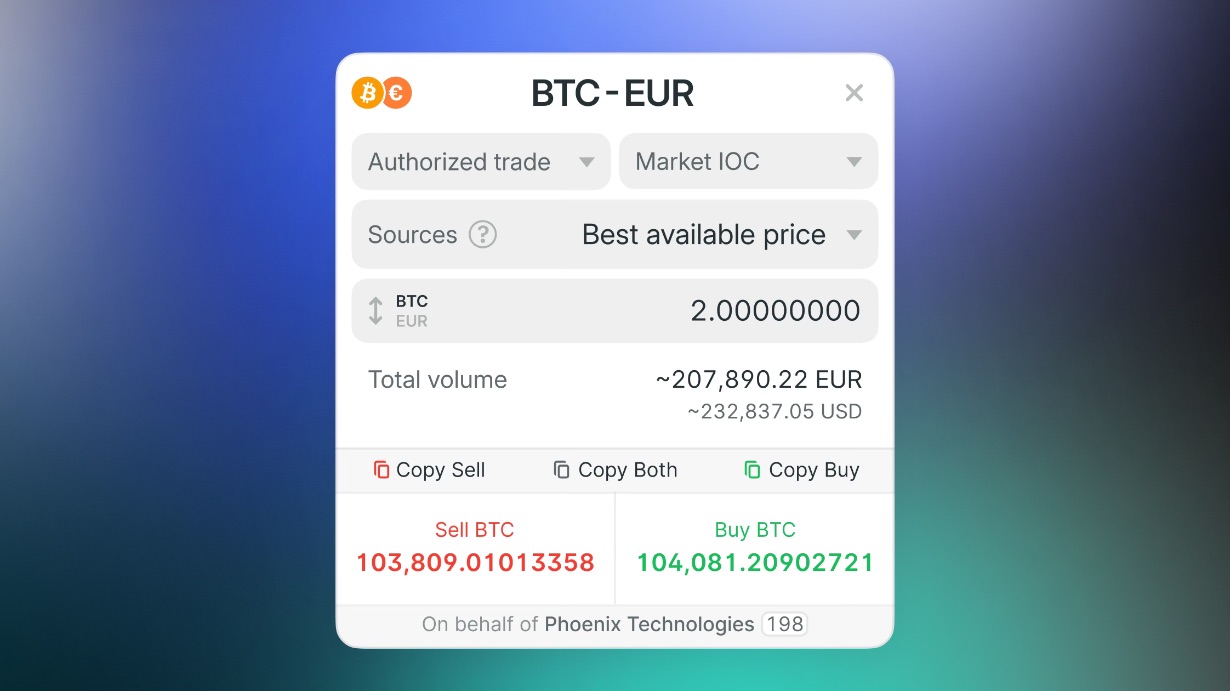

Authorized trading for quote streams

We enhanced Authorized Trading functionality for Master account holders. Trading authorization refers to the ability of a Master account holder, such as a broker or OTC desk, to execute trades on behalf of its clients. Previously limited to the order book, the updated feature now allows authorized trades to be executed by accessing external liquidity via Quote Streams, either directly or through connectivity providers. This advancement enables Masters to offer their clients a broader range of liquidity solutions and flexible execution methods, empowering them to scale their OTC business more effectively.

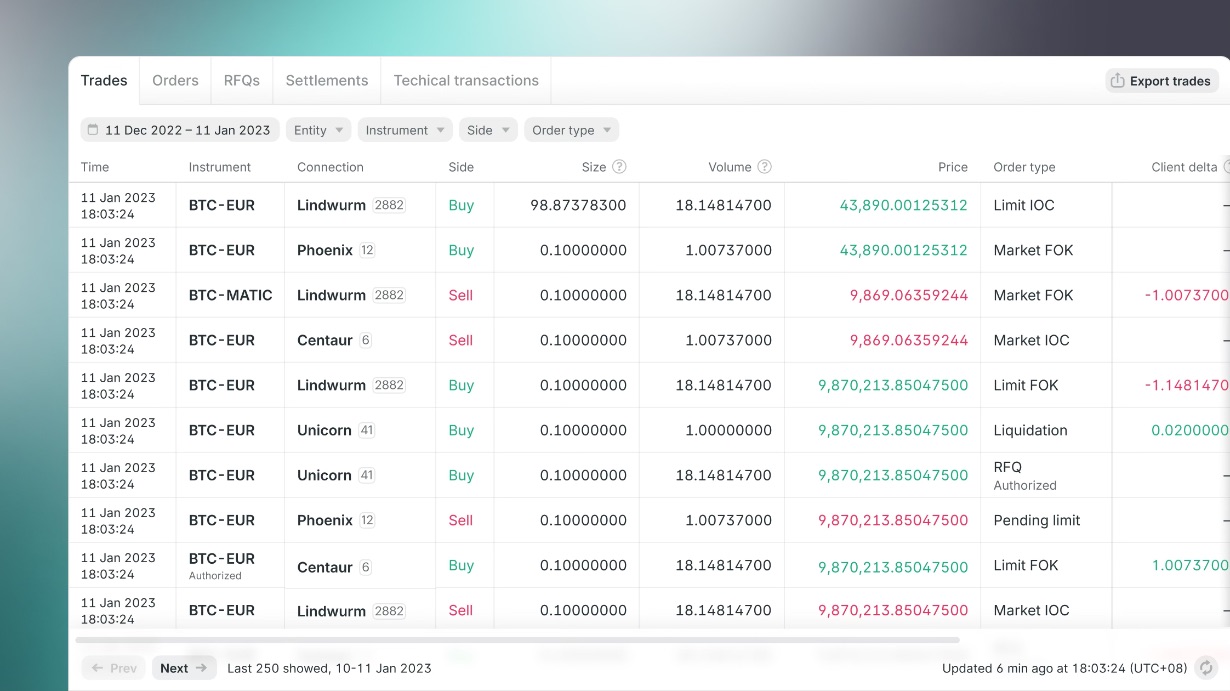

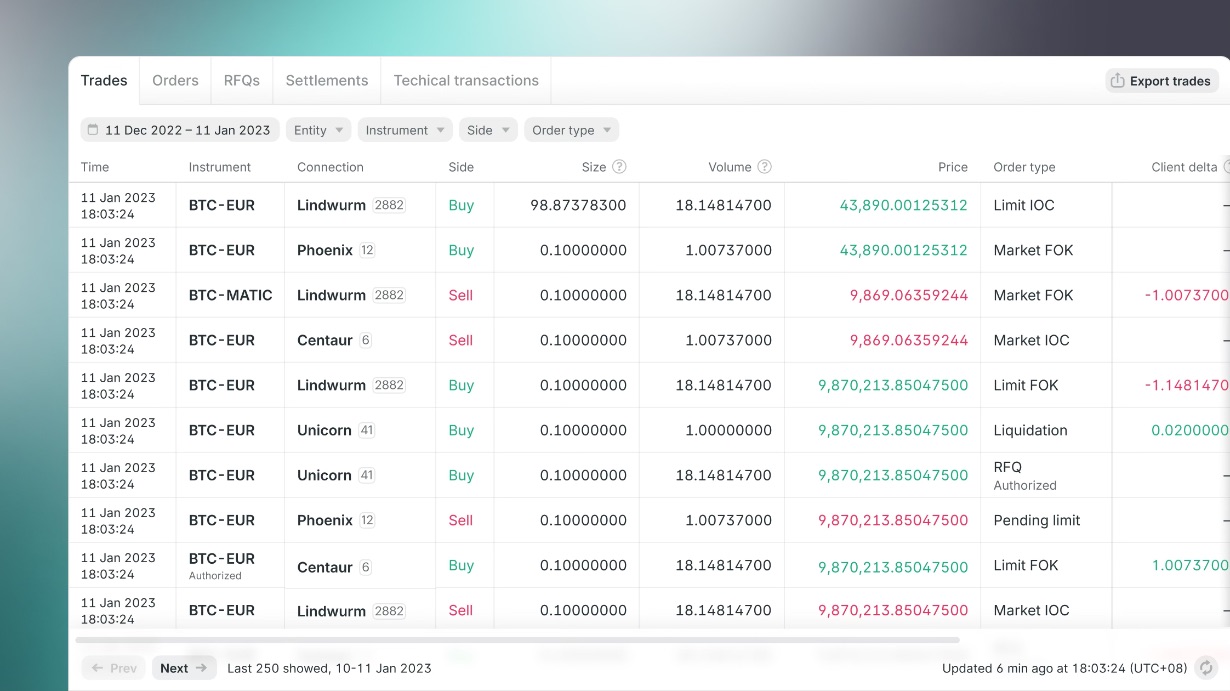

Enhanced Trading & Settlement History

We've simplified our clients' back-office operations by consolidating all trading and settlement history in one section. This powerful tool allows users to analyze, filter, and sort all transactions with a specific counterparty by date, trade size, or instrument. This approach simplifies both regulatory and management reporting, ensuring all data is easily accessible and auditable. All reporting is now standardized to UTC time, providing a single, consistent time zone for all global business transactions. This eliminates discrepancies and simplifies reconciliation for multi-jurisdictional teams. As with our other key features, all functions of this new history update are fully available via API.

Client Turnover on Finery Markets Accelerates by 3.4x YoY

Client activity on Finery Markets has surged, with turnover accelerating by an impressive 3.4x annual increase. In July alone, our platform facilitated over $2.3 billion in monthly client turnover, a testament to our robust technology and ever-expanding institutional network. This infrastructure empowers clients to focus entirely on their growth, ensuring optimal execution and significantly minimizing operational overhead from front to back office. We extend our gratitude to all clients actively building the institutional crypto space with us.

.png)