In the ever-evolving landscape of global finance, 2023 marked a pivotal year for the digital assets market. The doubling of the total crypto market cap signaled a robust rebound from the so-called "crypto winter," challenging skeptics and affirming the resilience of this burgeoning asset class. Amidst geopolitical upheavals around the globe and banking crises, crypto's allure as a safe haven strengthened, bolstered by moves like the proposal of spot Bitcoin and Ethereum ETFs by leading US financial institutions. These developments hinted at imminent regulatory clarity, paving the way for more capital influx into the realm of digital assets.

Yet, the journey of crypto is far from linear. As the market matures, the focus shifts to constructing a robust ecosystem with real-world applications, bridging the gap between early adopters and the mainstream. Innovative strides in areas like decentralized identities and infrastructures hint at a transformative future, while the tokenization of traditional financial instruments underscores the growing convergence of conventional and digital finance.

The influence of institutional investors has largely shaped the 2023 crypto arena, with an increasing number of macro funds to high-net-worth individuals gravitating towards crypto, a trend likely to be amplified by the advent of compliant ETFs. As this progression continues to unfold, market participants expect the emergence of more sophisticated derivative products, as well as enhanced liquidity and price discovery.

Core team members of Finery Markets have gathered and shared insightful opinions and thoughts on the future of B2B crypto fintech and the outcomes of the last twelve months. As we look towards 2024, we invite you to dive into our conclusions.

Regulatory-Driven Liquidity Fragmentation

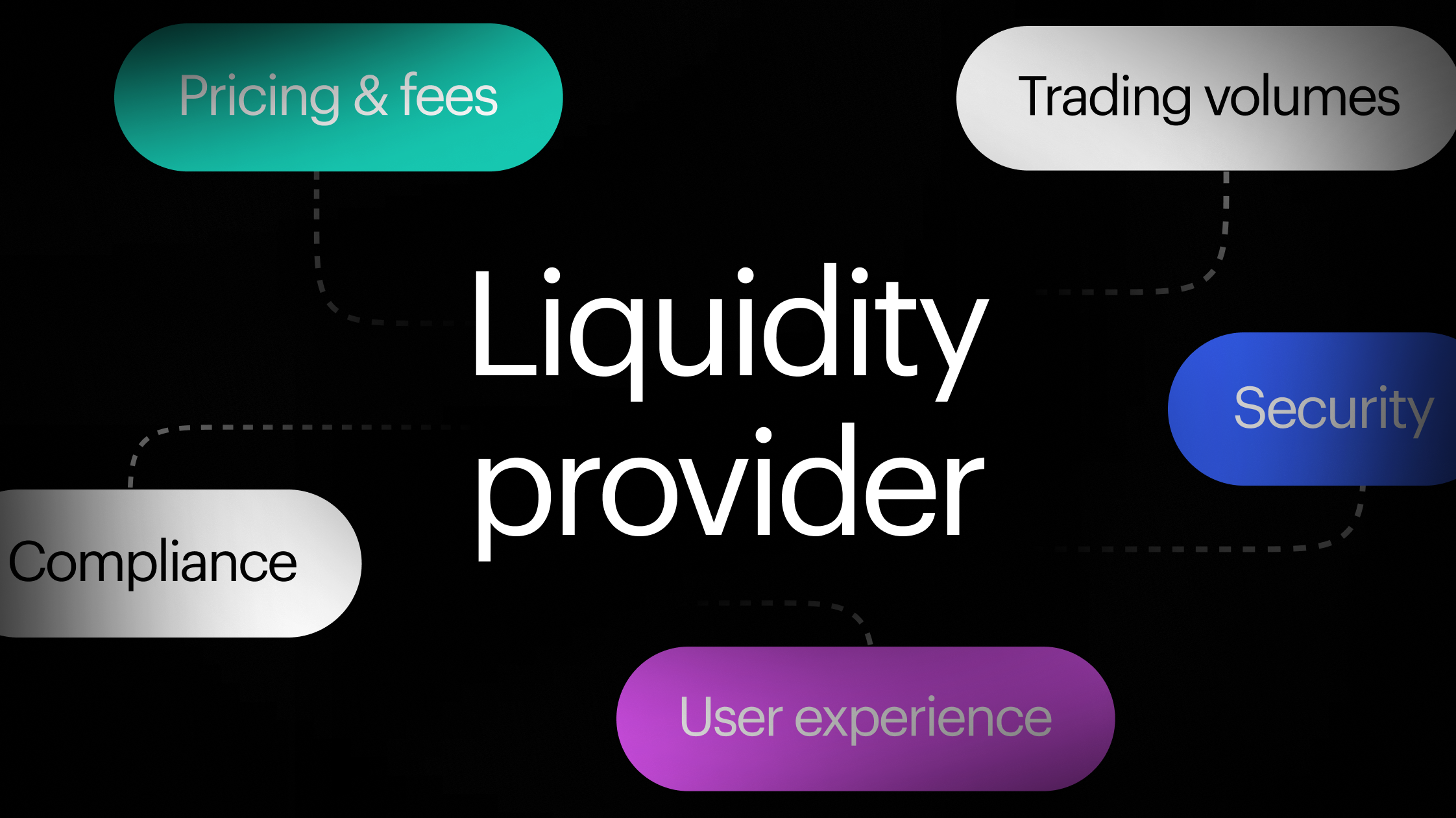

With the growing adoption of cryptocurrencies, governments and regulatory bodies globally are introducing unique rules and regulations. This trend is leading to increased fragmentation of liquidity as regions enforce diverse requirements and restrictions. Consequently, smaller exchanges may face challenges in maintaining adequate liquidity levels compared to their larger, more established counterparts. Such fragmentation not only poses challenges for traders but may also lead to pricing discrepancies across exchanges, potentially creating arbitrage opportunities.

Debundling in the Crypto Sphere

Traditionally, the roles of brokers, exchanges, custodians, and market makers in the cryptocurrency sector have been consolidated within single entities. However, with the industry's evolution, there's a noticeable shift towards separating these functions. This movement towards debundling is driven by a demand for greater market transparency, enhanced security, and increased efficiency. Separating these roles simplifies the process of holding each entity accountable for its specific duties.

The Rise of OTC Trading over CEXs

Over-the-counter (OTC) trading, which involves direct cryptocurrency transactions between two parties outside of an exchange, is becoming increasingly popular, particularly among institutional investors. This preference stems from its advantages over centralized exchanges (CEXs), including diminished counterparty risks, improved privacy, reduced price slippage, and the capacity to execute large-scale trades without significantly affecting the market. As a result, a notable shift in market share from CEXs to OTC trading is anticipated.

The Return of Volatility

Following a subdued 2023 marked by indecisiveness from the US Federal Reserve, we anticipate a strong resurgence of market volatility in 2024. The markets are already factoring in potential rate cuts for 2024, signaling a relief rally. However, the prevailing uncertainty suggests potential for significant market fluctuations, offering lucrative opportunities for astute short-term traders.

Brokers' Shift Toward OTC Products

The expected volatility, coupled with a rally in crypto markets, will likely encourage more brokers to pivot towards Over-the-Counter (OTC) products. This shift represents an adaptation to the evolving market dynamics and a response to changing investor preferences.

Increased Regulatory Oversight

In the upcoming year, regulators are expected to intensify their scrutiny of market makers and brokers, primarily to safeguard retail investors from potentially exploitative practices and aggressive marketing strategies. While this increased oversight may pose challenges, it is anticipated to ultimately bolster the industry by weeding out unethical players and fostering a landscape where transparent and honest brokers can flourish.

Wider Adoption of Crypto Payments and Transfers

2024 is poised to be a pivotal year for the widespread adoption of crypto payments and money transfers. This trend is expected to mark the beginning of a global shift towards embracing cryptocurrencies more broadly, signaling a significant milestone in the journey towards mainstream crypto integration.

OTC Liquidity Pools On The Rise

We foresee a significant shift in trading infrastructure, with a move away from bundled services to a more segmented approach. This change will likely lead to a surge in OTC liquidity pools managed by Prime Brokers, Custodians, and Market Makers. As a result, smaller exchanges may transition to an "agency model," focusing on reselling wholesale OTC pools, which could reduce the market share for major centralized exchanges (CEXs).

Tokenization Amid Global Debt Crisis

In light of the looming global debt crisis, we anticipate a substantial increase in the tokenization of sovereign debt assets and commodity tokens. This move will likely cause trading volumes in these areas to skyrocket, marking a pivotal shift in the financial landscape.

Bitcoin Solidifies Its Position As An Alternative Store of Value

With the financial market fluctuating between inflation and dropping interest rates, Bitcoin is expected to gain increased attention as a viable alternative store of value. This shift in perception could significantly impact its adoption and valuation.

Regulatory Focus on Mining Pools and DEXs

Following the pattern set in the current year, mining pools and Decentralized Exchanges (DEXs) will likely face heightened regulatory scrutiny. This increased focus will probably lead to more stringent compliance regulations for on-chain transactions, mirroring the regulatory trends observed in centralized exchanges.

Blockchain Adoption in Payment Processing

We predict a major move in payment processing, with leading institutions adopting blockchain technology for cross-border payments, replacing traditional systems like SWIFT. This transition, bolstered by the Markets in Crypto-Assets (MiCA) regulation and improvements in stablecoin regulation, will mark a significant step towards high-performance blockchain-based payment messaging systems.

The Emergence of Regulated CEXs

The landscape of centralized exchanges (CEXs) is undergoing a significant transformation. In the period from 2016/17 to 2022/23, we witnessed the rise of unregulated CEXs across the globe. However, the next 3-5 years are set to be dominated by regulated CEXs. This shift will be driven by factors such as improved fiat on/off ramps, clear classification of cryptocurrencies, and laws defining the roles and responsibilities within the crypto sector. Additionally, regulatory clarity regarding taxation is expected to attract institutional investments and enhance the legitimacy of the crypto space.

Shift from Traditional to e-OTC Trading

Despite the current prevalence of centralized exchanges and voice calls for executing large Over-the-Counter (OTC) transactions, a significant shift towards electronic OTC (e-OTC) trading and Business-to-Business (B2B) trading venues is anticipated. This change is expected to involve regulated CEXs, liquidity providers, institutional investors, and financial institutions, potentially leading to a decrease in exchange volumes.

Stablecoins Revolutionizing Payments

The usage of stablecoins for payments has seen a substantial rise since 2021/22. The introduction of regulatory standards for stablecoin issuance and guidelines from various nations, including the USA, Singapore, and the European Union, is set to revolutionize both B2B payments and Consumer-to-Consumer (C2C) remittance industries. Many major payment acquirers are already utilizing cryptocurrency rails, with others in the process of implementing pilot projects.