- Caladan partnership: $170B institutional trading firm expands liquidity reach via Finery Markets amid 112% surge in OTC activity.

-

DeFi & staking embedded: Finery Markets integrates Yield.xyz, giving institutions access to 1,000+ yield opportunities across 75 blockchains.

-

Liquidity pools launched: Master account holders can now curate and manage liquidity streams with full customization.

-

The Flow podcast: Konstantin Shulga on why institutional crypto needs ECNs and the future of market structure.

-

BitGo’s From the Vault: Discussion on stablecoins, liquidity fragmentation, and why flows are shifting beyond centralized exchanges.

Caladan expands global liquidity reach via Finery Markets amid OTC surge

Institutional trading firm Caladan, with over $170B in annual volume, has selected Finery Markets as its infrastructure partner to broaden institutional access to digital asset liquidity across 35 countries. The partnership comes as global OTC crypto activity surged 112.6% in H1 2025, according to Finery Markets’ latest review, with Caladan aiming to capitalize on this fast-growing segment.

Powered by Finery Markets’ ECN technology — the only crypto ECN offering RFQ, order book, and quote stream execution under one roof — Caladan can now deliver multi-venue price distribution seamlessly across 1,000+ assets and 70+ exchanges. CEO Konstantin Shulga noted that Caladan’s blend of TradFi experience and crypto-native strategy is well-aligned with Finery Markets’ mission, while COO Julia Zhou positioned the alliance as a deliberate step to redefine institutional liquidity infrastructure globally.

→ Learn more

Finery Markets embeds DeFi and staking via Yield.xyz partnership

Finery Markets has integrated Yield.xyz, a DeFi yield aggregator backed by a recent $5M round led by Multicoin Capital, into its trading interface. The collaboration simplifies institutional access to 1,000+ yield opportunities across 75 blockchains, including protocols such as Aave, Morpho, and Compound Finance on Ethereum, Arbitrum, and Polygon. Beyond DeFi yields, the integration also unlocks solo staking, liquid staking, and restaking through trusted validators, enabling institutions to manage treasury balances more efficiently.

This plug-and-play solution removes operational complexity for clients looking to diversify revenue streams while complementing Finery Markets’ stablecoin-first platform with seamless stablecoin staking. Commenting on the partnership, CEO and co-founder Konstantin Shulga emphasized the role of Finery Markets in reducing market fragmentation for institutions, while Yield.xyz co-founder Serafin Lion highlighted the joint mission to make DeFi yield as accessible and reliable as traditional financial infrastructure.

→ Learn more

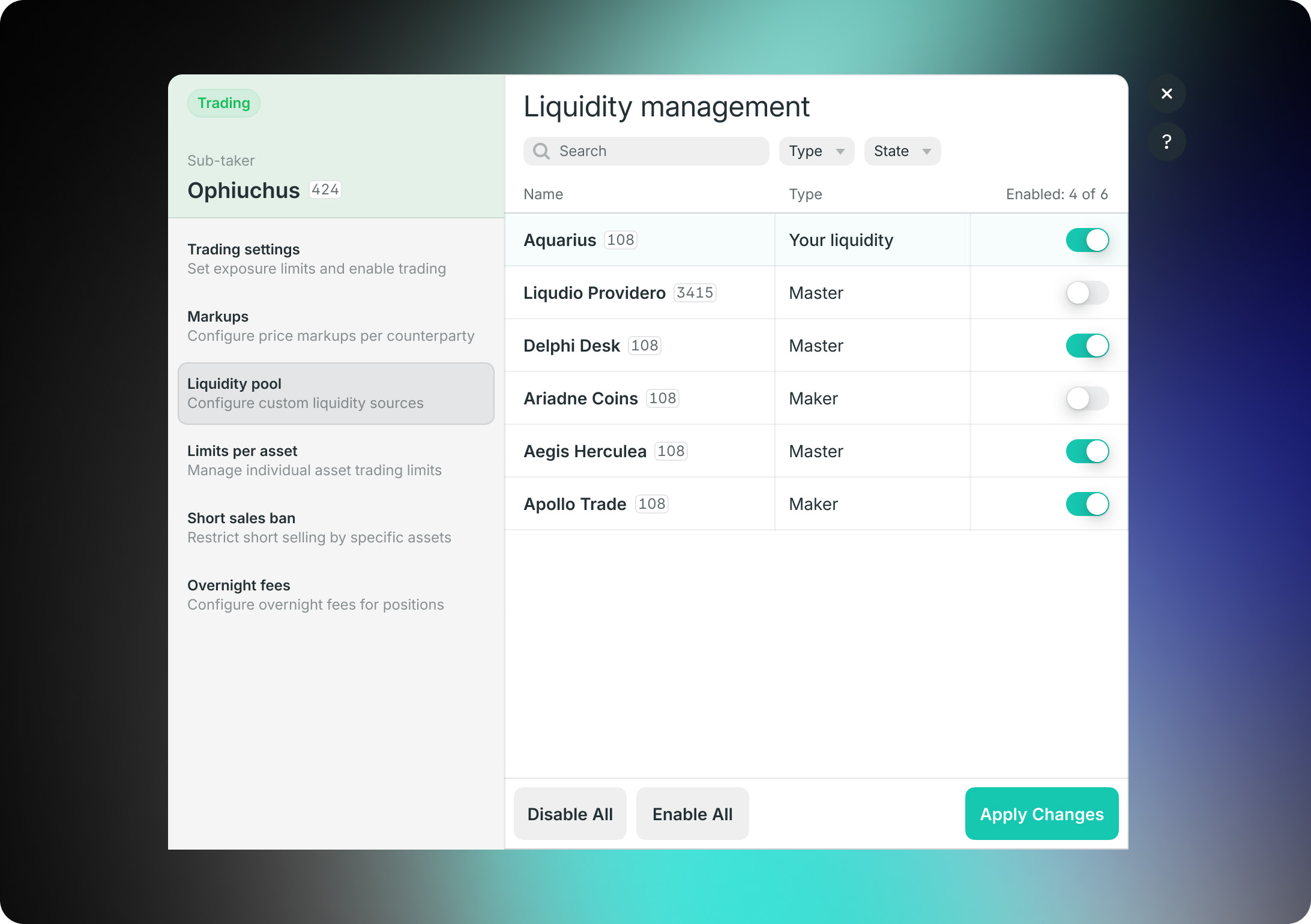

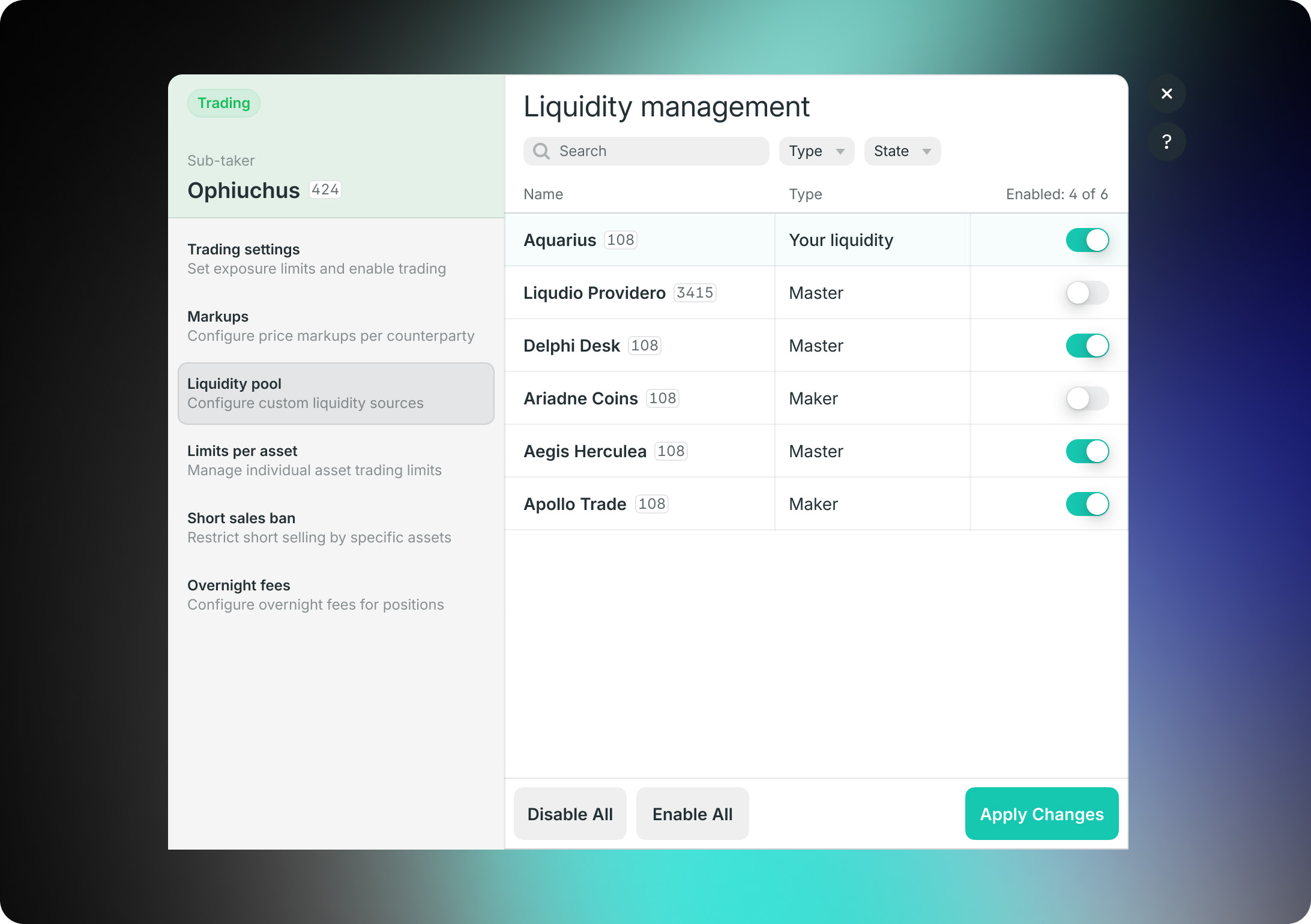

Introducing liquidity pools for master accounts

We're excited to announce a new platform enhancement: liquidity pools. This feature gives master account holders greater control to curate and manage liquidity streams from various providers for their clients. With a simple interface, you can now toggle liquidity on and off, tailoring the trading environment to your client's exact needs. This level of customization ensures you can precisely control the liquidity your clients access, optimizing their trading and settlement experience.

This functionality is a direct response to the needs of our institutional clients. By enabling master account holders to create custom liquidity pools, we empower them to offer their clients unique trading conditions. The introduction of liquidity pools reinforces our commitment to delivering solutions that give our master account holders a distinct advantage in the crypto market.

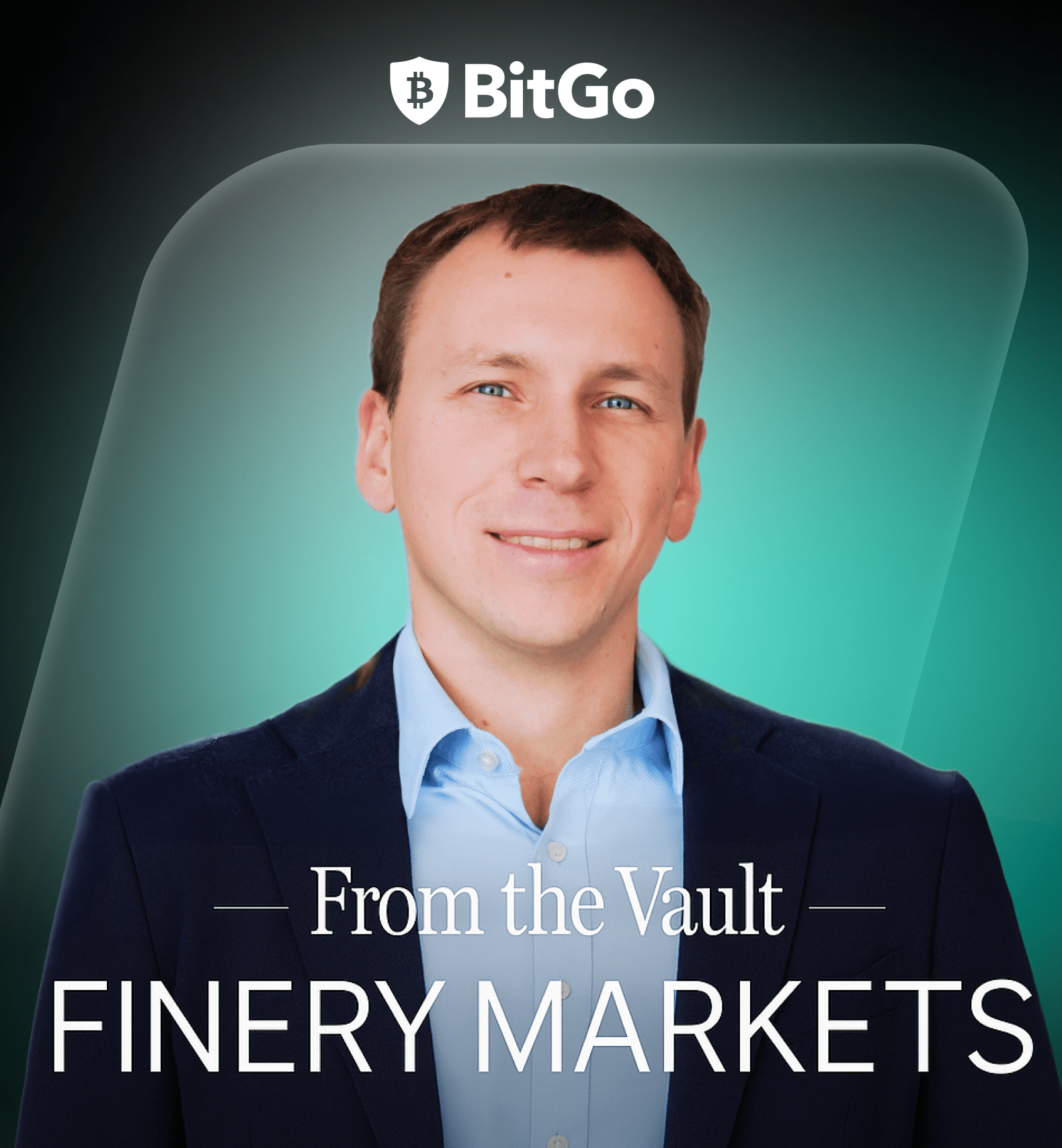

Finery Markets CEO featured on BitGo’s From the Vault

Konstantin Shulga, CEO and co-founder of Finery Markets, joined Mike Gross on BitGo’s From the Vault podcast to discuss the changing landscape of digital asset trading. The conversation explored how ECN technology is addressing liquidity fragmentation, why stablecoins are driving structural shifts, and how institutional flows are increasingly moving beyond centralized exchanges.

→ Watch on Youtube

Why institutional crypto needs ECNs — featuring Konstantin Shulga on The Flow

In a special edition of The Flow, FinanceFeeds’ Editor-in-Chief Nikolai Isayev sits down with Finery Markets CEO and co-founder Konstantin Shulga to discuss how cloud-native ECNs are shaping the next chapter of institutional crypto. The episode covers the evolution of market structures, regulatory developments, and the role of non-custodial infrastructure in bridging gaps across fragmented digital asset markets.

Konstantin also shared insights into Finery Markets’ recent recognition as a top 20 global fintech by CNBC and a Deloitte Fast 50 Rising Star, highlighting Cyprus as a strategic base for expansion across Europe and MENA. The conversation concludes with forward-looking perspectives on stablecoin infrastructure, hybrid execution models, and how Finery Markets is building technology to make institutions crypto-ready.

→ Tune in now