-

B2BROKER x Finery Markets: Partnership brings Finery Markets’ ECN liquidity and infrastructure to B2TRADER, enhancing institutional OTC execution.

-

OTC Review Q3 2025: OTC volumes grew 6× faster than exchanges, driven by stablecoins’ dominance and ETH’s +222% volume surge.

-

Market Analysis: $19B liquidation exposed exchange fragility — OTC venues saw +107% volume growth and maintained tighter spreads amid volatility.

-

The Flow Podcast: TP ICAP’s Duncan Trenholme joins to discuss crypto as the “Trojan horse” accelerating blockchain adoption in traditional finance.

-

RFQ on Finery Markets: Execute large trades privately with competitive quotes from multiple LPs — minimizing market impact and optimizing execution.

-

FM Days 2025: Our team gathered in Yerevan to align on 2025 goals, exchange ideas, and strengthen the culture driving Finery Markets forward.

-

FF Awards Finalist: Finery Markets shortlisted for the 2025 FF Awards, recognizing genuine innovation and transparency in fintech.

B2BROKER taps Finery Markets to power institutional crypto OTC on B2TRADER

B2BROKER has partnered with Finery Markets to enhance the institutional OTC capabilities of its multi-asset platform, B2TRADER. The integration brings Finery Markets’ non-custodial ECN technology and liquidity infrastructure directly to B2BROKER clients, enabling access to deep institutional spot liquidity, anonymous execution, and efficient post-trade settlement.

Amid a 106% surge in global OTC volumes and a 147% rise in stablecoin transactions over the past year, the partnership creates a “plug-and-trade” setup that allows brokers to offer crypto trading within 24 hours and expand with confidence.

“We selected Finery Markets for its proven ability to power institutional-grade operations,” commented Arthur Azizov, CEO and Founder of B2BROKER. “This partnership enhances our capacity to deliver deep OTC spot liquidity and efficient execution, ensuring clients operate in a high-performance, secure environment and expand faster with confidence.”

→ Learn more

OTC trading outpaces exchanges sixfold in 2025

Our latest FM OTC Review Q3 2025 reveals that institutional traders continue migrating from exchanges to OTC venues in search of better liquidity, control, and execution quality.

In the first nine months of 2025, OTC trading volumes grew 138% year-over-year, compared to 22% for the top 20 exchanges. Stablecoins accounted for 75% of OTC activity, while ETH volumes rose 222%, the fastest among major assets.

→ Download report

The Flow: Crypto as the Trojan Horse for Blockchain Adoption

In this episode of The Flow, Konstantin Shulga talks with Duncan Trenholme, Managing Director and Global Co-Head of Digital Assets at TP ICAP, about how crypto became the real driver of blockchain adoption in traditional finance.

They discuss the evolution of TP ICAP’s digital assets arm, the role of stablecoins, and why post-trade innovation may become the most transformative breakthrough yet.

→ Listen now

OTC stability vs. exchange volatility in a $19B liquidation

The recent $19 billion market liquidation was a live stress test for crypto infrastructure — and a clear demonstration of the stabilizing role OTC venues play during extreme volatility. As prices plunged across exchanges, Finery Markets’ OTC private rooms saw trading volumes surge 107% week-over-week, more than double the growth on exchanges (+48%), underscoring a rapid institutional flight to stability.

During the sell-off, Ethena’s synthetic dollar (USDe) briefly dropped to $0.65 on Binance, while staying near $0.92 on Bybit and stable elsewhere. This localized dislocation highlighted the fragility of centralized pricing models, which rely on single-exchange spot prices for collateral evaluation — a mechanism that can amplify volatility instead of absorbing it.

By contrast, OTC venues maintained tighter spreads and deeper liquidity throughout the event, signaling greater capital commitment and robust market function even at peak stress. The episode reaffirmed OTC infrastructure’s structural advantage: private, off-screen liquidity pools act as a firewall against contagion, helping preserve market integrity when volatility spikes.

→ Read analysis

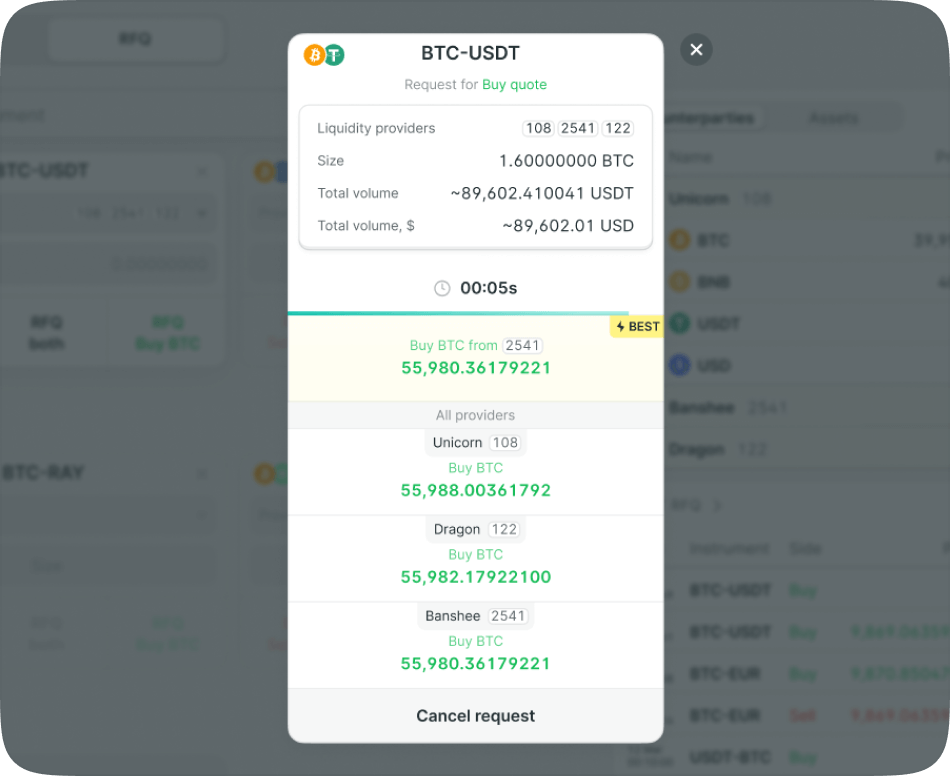

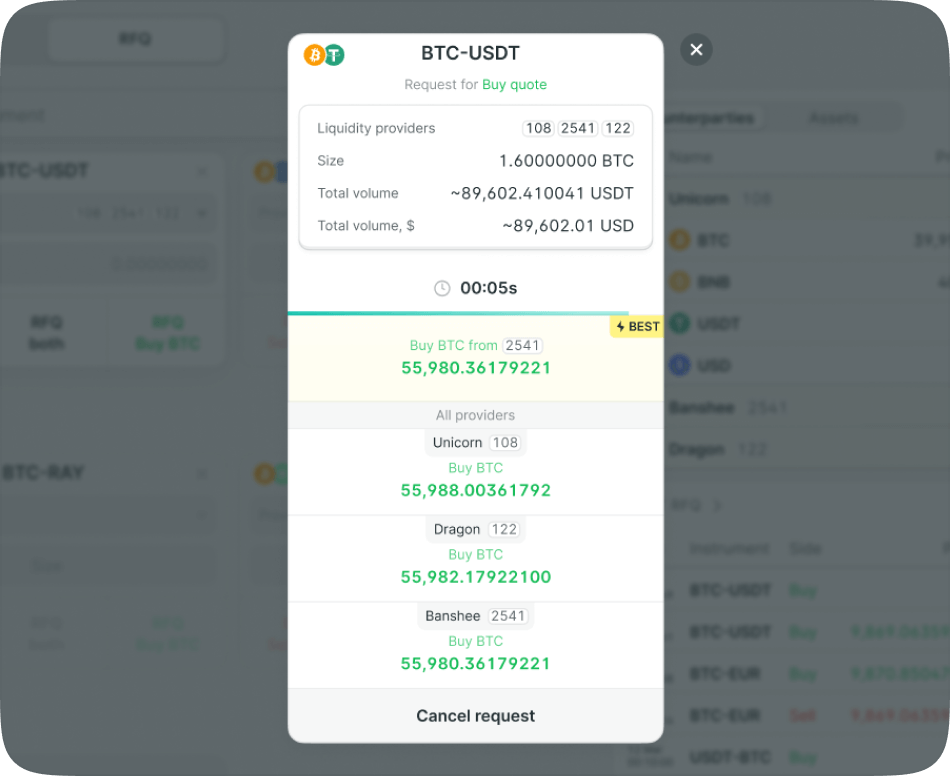

Why Use RFQ on Finery Markets?

The RFQ method is purpose-built to address the specific challenges of institutional crypto trading:

-

Minimize market impact: For large block trades, displaying your full size on an order book can move the market against you. With our RFQ, you request quotes for a defined volume, and multiple liquidity providers compete privately for your order. This process shields your trade from public view and helps achieve superior execution on large notional sizes.

-

Ideal for less liquid assets: RFQ is especially effective for trading pairs that are less frequently traded or lack consistently tight spreads on the order book.

-

Access deep, competitive liquidity: Each RFQ initiates real-time competition among our global liquidity providers, ensuring you receive the most favorable quotes directly aligned with your trade size and needs.

FM Days 2025 in Yerevan 🇦🇲

This year, our team gathered in Yerevan for FM Days — a moment to step away from screens and reconnect in person.

Across several days of workshops and open discussions, we reviewed our 2025 roadmap, revisited key milestones, and aligned on the next chapter of Finery Markets’ growth. But FM Days is never just about strategy — it’s about the people behind it.

Exploring Yerevan together, sharing ideas face to face, and building new connections reminded us why culture and collaboration remain at the core of everything we do. The energy we brought back from Armenia will fuel our momentum for the months ahead.

Finery Markets shortlisted for the 2025 FF Awards

We’re honored to be named a finalist for the 2025 FF Awards by Fintech Finance News.

This recognition celebrates genuine fintech innovation — no pay-to-play, only impact and creativity. We thank our clients and partners for being part of this journey and congratulate all other finalists. Winners will be announced on November 25th in London.