-

Stablecoin dominance grows: Stablecoins accounted for 75% of OTC spot trades on our platform in H1 2025, signaling a structural shift in institutional trading behavior.

-

Liquidity flow control unlocked: New features give Master accounts precise control over incoming and outgoing quotes, with support for markups and tailored roles.

-

Smarter institutional notifications: Platform alerts are now fully customizable by role and channel, streamlining front- and back-office coordination.

-

Private rooms for stablecoin trading: Issuers can now spin up secondary markets for asset-stablecoin pairs in under 24 hours—no listings or collateral required.

-

Fintech Unplugged 2025 in Limassol: Over 200 fintech professionals joined us for a standout night of networking, insights, and shared ambition.

-

The Flow with Damian Bunce: GTN ME’s CEO reflects on the evolution of market infrastructure and how TradFi lessons are shaping crypto’s next chapter.

-

Bridging the stablecoin gap: In a new interview with FinanceFeeds, our CEO explains why infrastructure—not regulation—is the next frontier for stablecoins.

New Report: Institutional Demand for Stablecoins Reaches New High in H1’25

Our Crypto OTC Review for H1 2025 reveals a decisive shift in institutional behavior toward stablecoins. Analyzing over 4.1 million institutional spot crypto trades executed on the Finery Markets platform in the first half of the year, the report highlights a surge in stablecoin activity—now accounting for 75% of all OTC spot trades, up from 46% in 2024 and just 23% in 2023.

The data points to a structural change in market preferences, with YoY growth of 121% in stablecoin transactions and 154% in total OTC trading volume. Crypto-to-stablecoin trades alone rose by 277%, while altcoin activity involving SOL, LTC, and XRP continued to grow steadily. The report also dives into the rising preference for private-room trading and the role of secondary market depth in mitigating depeg risks.

Read the full report

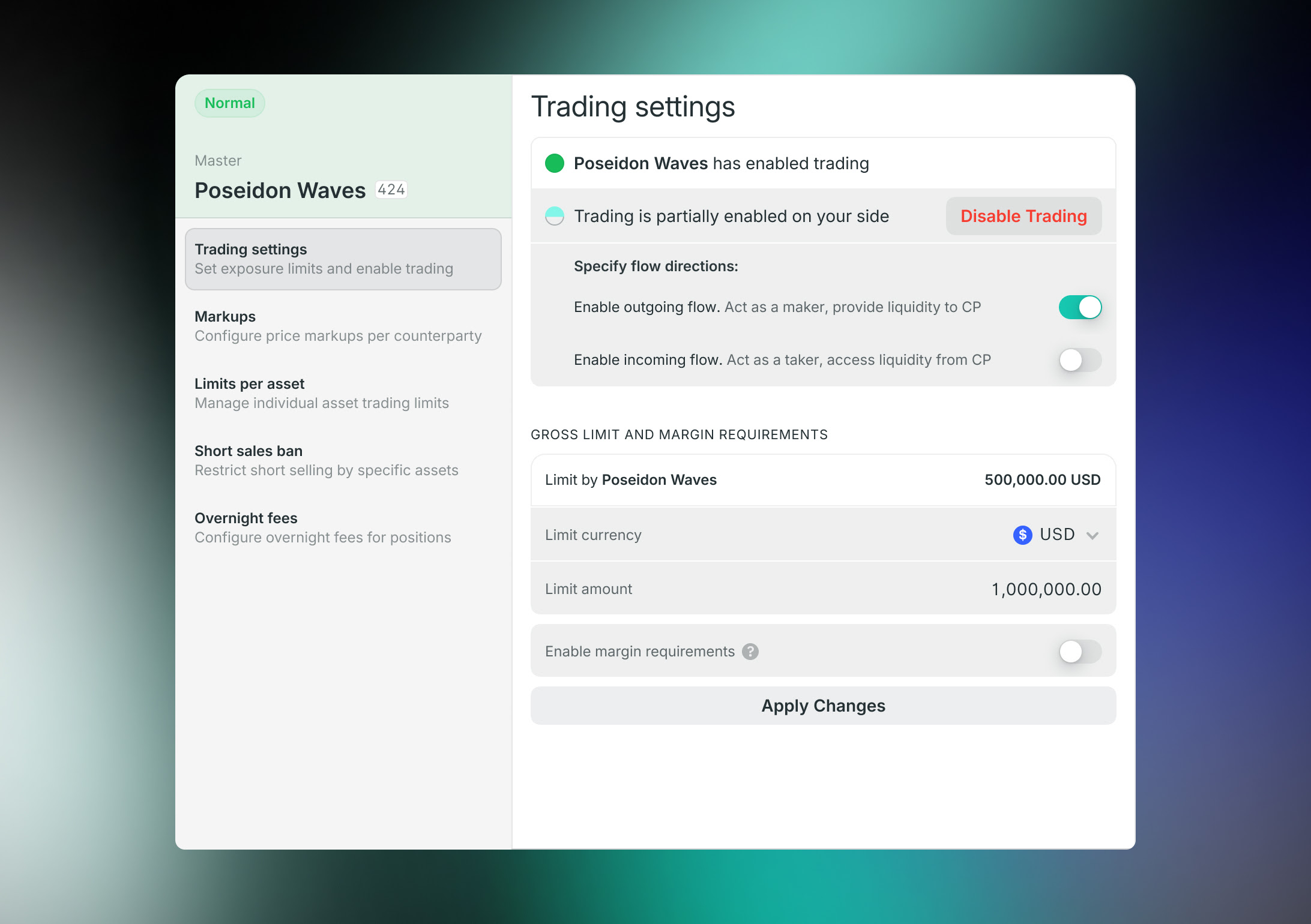

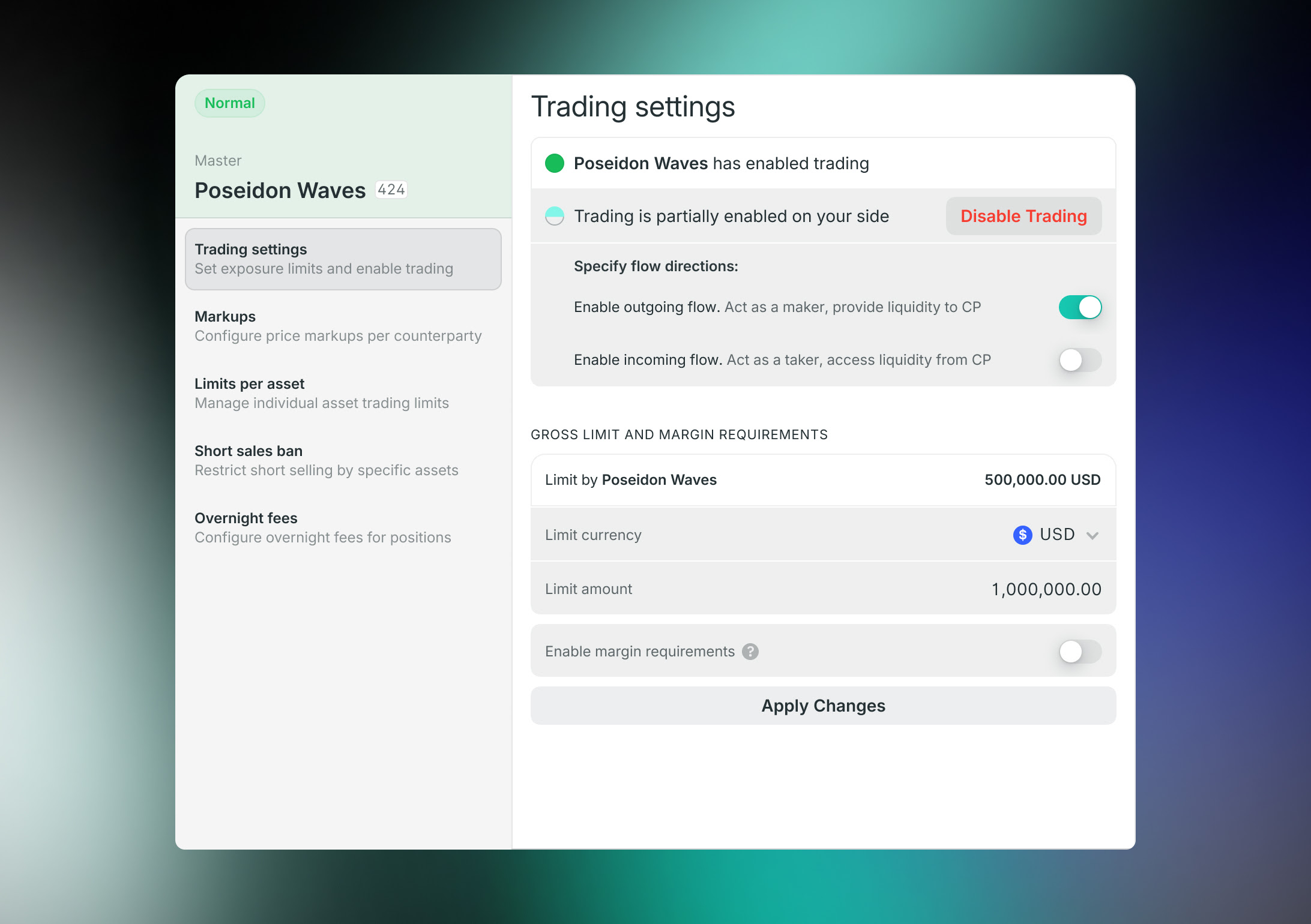

Enhanced Liquidity Control with New Flow Features

We have introduced granular control over incoming and outgoing quotation flows, a powerful new feature designed to optimize liquidity management for Master account holders on our platform. This functionality allows Masters to precisely define their role in relation to other Masters—whether sourcing liquidity for their clients or providing liquidity to others.

This innovation unlocks substantial growth potential for OTC businesses by enabling seamless integration within our vast liquidity network. To further enhance flexibility, we've also implemented the ability for Masters to set markups on incoming liquidity, providing greater control over business margins and client-specific liquidity streams.

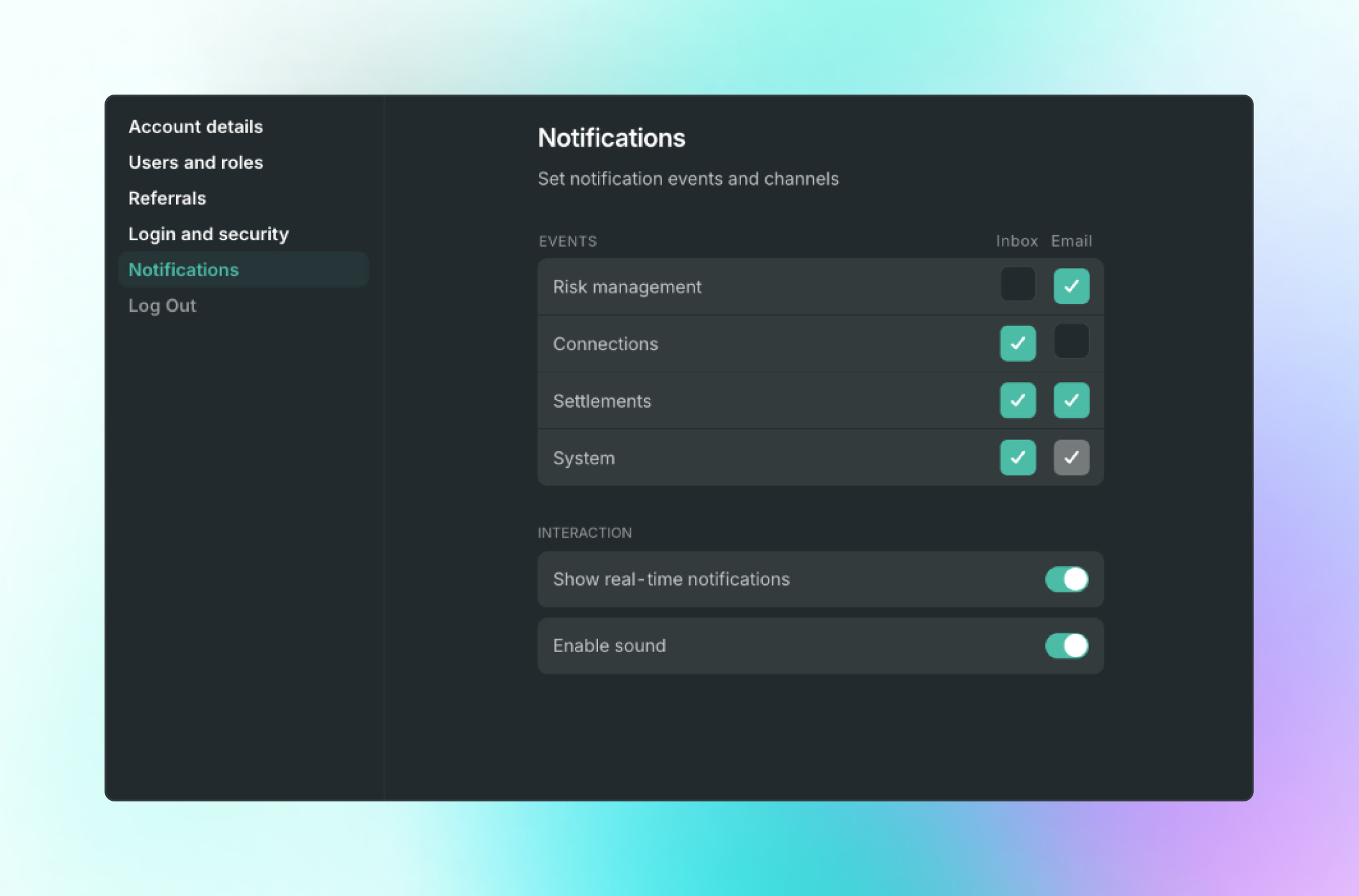

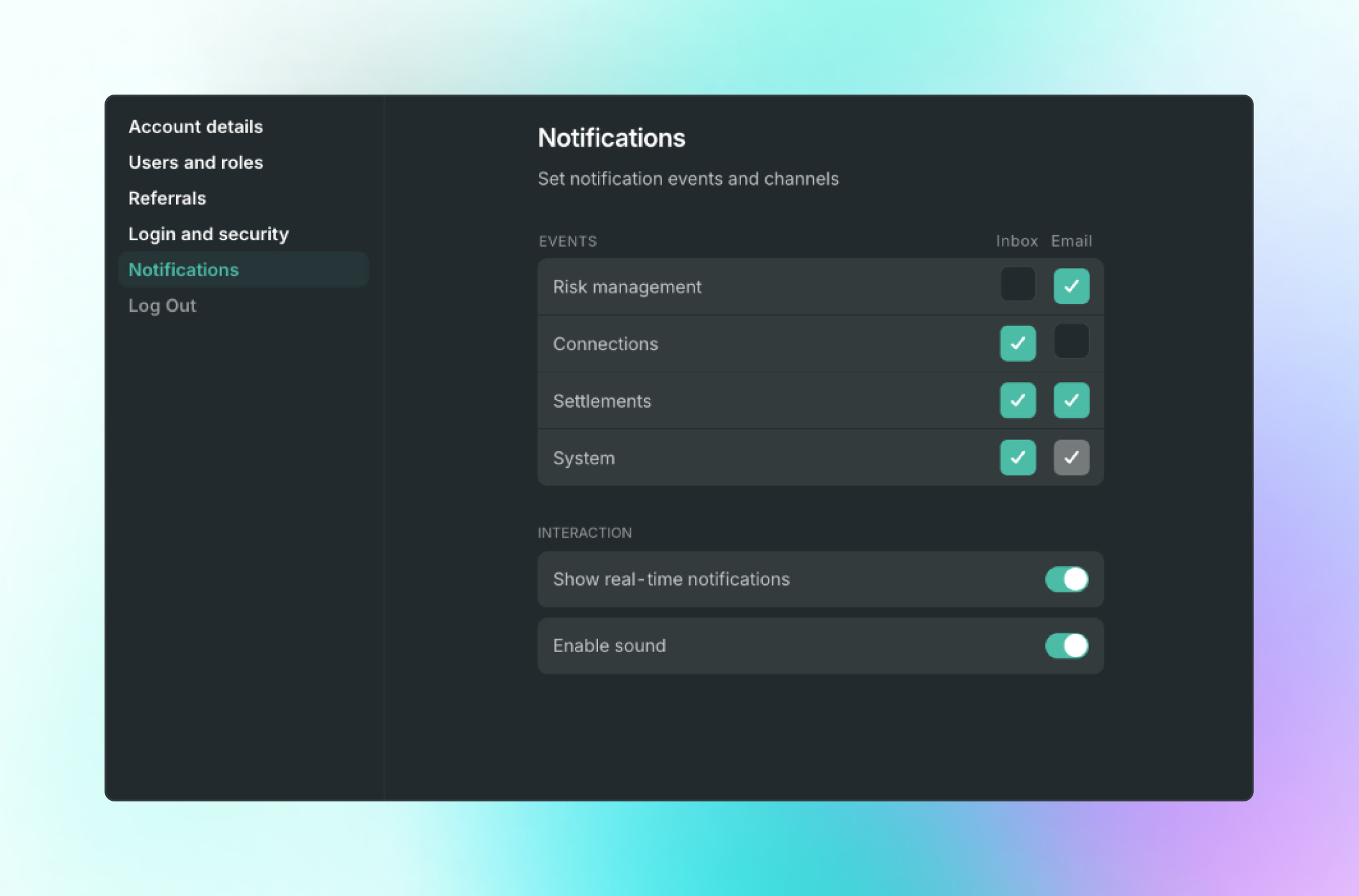

Precision Communication for Institutional Workflows

To complement our enhanced trading capabilities, we've significantly upgraded our platform's notification system. This update streamlines operations and elevates communication across FM Marketplace, FM Liquidity Match, and FM Whitelabel. Institutions now have granular control over critical alerts, including client connection requests (from new inquiries to acceptance/rejection statuses) and crucial settlement requests.

Notifications can be precisely tailored by user role and channel, ensuring front-office and back-office teams receive only the most relevant, timely information via email and the intuitive GUI. This refined communication framework, paired with the convenient centralization of all necessary settlement details in the Settlement Address Book, fosters a highly efficient and seamless workflow, reinforcing our commitment to institutional excellence.

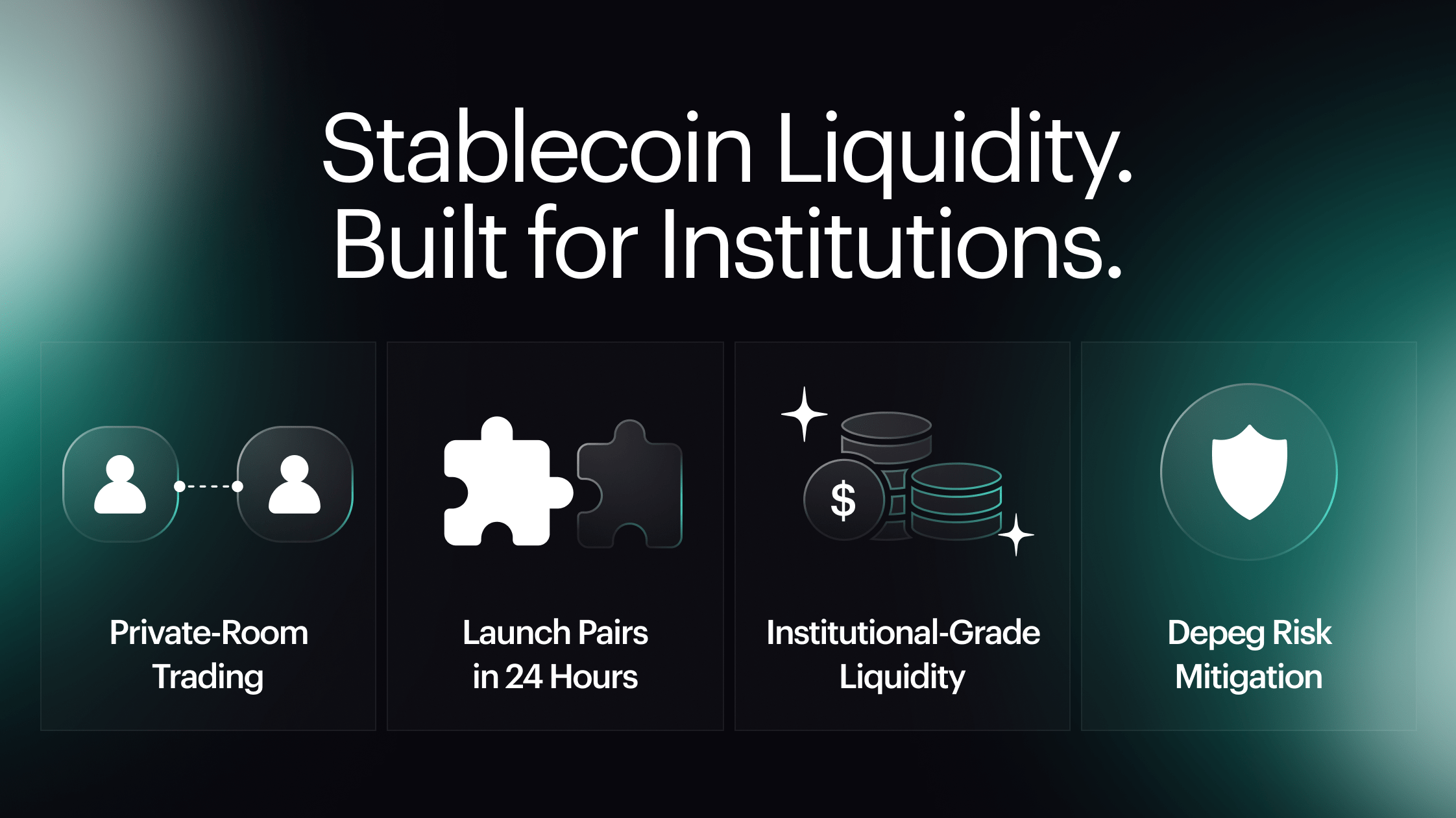

Introducing Stablecoin-First Private Room Infrastructure

In response to growing institutional demand for stablecoin utility beyond payments, we are introducing a dedicated stablecoin trading infrastructure centered on private room execution. The solution allows stablecoin issuers to establish API-based liquidity for asset-stablecoin pairs within 24 hours, bypassing traditional listing barriers and enabling capital-efficient distribution.

This infrastructure directly addresses market fragmentation and the risks of depeg contagion by isolating trades while maintaining access to a robust liquidity network. With more than 150 institutional participants and 20+ fiat currencies already supported, Finery Markets is building the infrastructure needed to support stablecoins as core financial instruments in capital markets.

As CEO Konstantin Shulga notes, “For stablecoins to become a backbone of global financial plumbing, they must thrive in secondary markets. That’s what we’re enabling—an institutional-grade environment designed for compliant, efficient stablecoin operations.”

Learn more about our solution

Fintech Unplugged 2025: Industry Leaders Connect in Limassol

This year’s Fintech Unplugged—our third consecutive edition—brought together over 200 industry professionals during iFX EXPO Limassol. Co-hosted by Finery Markets, Cryptopay, and DLT Law, the event created a space for meaningful conversations across the trading, legal, and payments ecosystem.

The evening combined sharp insights with a relaxed setting, offering attendees an opportunity to network and exchange views on the evolving digital asset landscape. As the stablecoin narrative continues to unfold, gatherings like this play a pivotal role in aligning market participants around shared challenges and opportunities.

See the photo gallery

PS: Don’t forget to tag Finery Markets and use #FintechUnplugged when posting

The Flow Podcast: TradFi Infrastructure Meets Crypto Innovation

In our latest episode of The Flow, Finery Markets CEO Konstantin Shulga is joined by Damian Bunce, CEO of GTN Middle East, to discuss how decades of experience in traditional finance are shaping the next generation of digital markets. From early career lessons at Barings Bank to building global infrastructure at GTN, Damian reflects on key market structure milestones and the rise of embedded finance.

The conversation explores the shift from legacy tech stacks to infrastructure-as-a-service, the impact of ECNs and smart order routing on market efficiency, and how crypto can adopt similar principles to meet institutional standards. As digital assets mature, insights from TradFi are increasingly shaping how platforms like Finery Markets evolve.

Watch the full episode on YouTube

In The News: Bridging the Infrastructure Gap for Stablecoin Markets

In a recent interview with FinanceFeeds, Finery Markets CEO Konstantin Shulga addressed one of the most pressing challenges in digital finance: infrastructure gaps in stablecoin trading. While regulation has advanced, fragmentation and lack of secondary market connectivity remain significant hurdles to institutional adoption.

Konstantin emphasized the need for off-chain bridges, unified settlement networks, and private execution environments to scale stablecoin liquidity without relying on public listings. Finery Markets’ new stablecoin infrastructure is a direct response to this need, offering compliant, scalable, and capital-efficient solutions for issuers and institutional participants alike.

Watch the interview | Read the article

.png)