Against a backdrop of accelerating OTC growth, regulatory convergence, and rising demand for stablecoin-based execution, Finery Markets strengthened its position as the core infrastructure layer for professional participants in 2025. From record trading volumes and major partnerships to security milestones and product expansion, this special edition of The Digest brings together the most important developments of the last year.

Business Development & Partnerships

Institutional connectivity expanded significantly in 2025 through a series of high-impact partnerships. Zodia Markets, backed by Standard Chartered, joined the Finery Markets ecosystem to deliver RFQ-based access to digital asset and FX liquidity with T+0 settlement. The integration simplified onboarding while extending institutional-grade pricing across FM Marketplace, Liquidity Match, and White Label environments.

Liquidity depth and execution optionality were further strengthened through collaborations with Sage Capital, Gold-i, Wintermute, Hidden Road, Monerium, and B2BROKER. Together, these partnerships strengthened coverage across 200+ assets, introduced quote streams as a third execution method alongside RFQ and order books, and expanded clearing flexibility via give-up setups. Also, Caladan, an institutional trading firm processing over $170B annually, selected Finery Markets to scale distribution amid a 112% surge in global OTC activity.

These integrations collectively reduced fragmentation across liquidity, clearing, and connectivity. By consolidating execution, pricing, and post-trade workflows into a unified ECN environment, Finery Markets helped institutions replace multi-vendor stacks with a single access layer designed for scale and regulatory alignment.

Security, Compliance & Regulatory Readiness

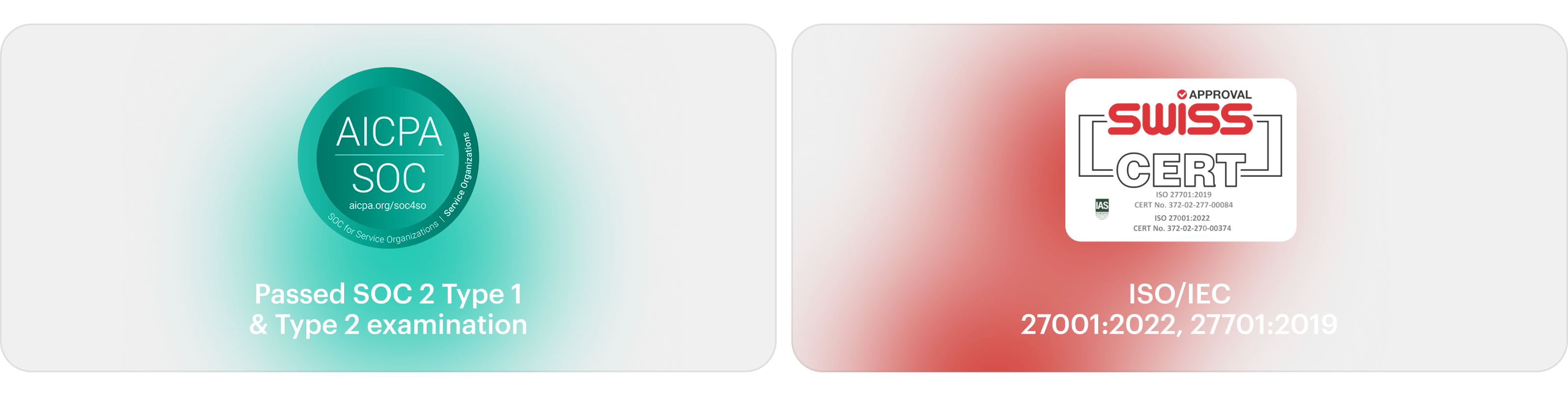

Security and operational resilience remained a foundational priority throughout the year. Finery Markets successfully completed its SOC 2 Type 2 examination, validating the effectiveness of its internal controls over time and building on the earlier SOC 2 Type 1 milestone. The assessment reinforced the platform’s ability to protect sensitive institutional data across a non-custodial, global trading infrastructure.

Our platform also aligned the requirements of the EU's recently introduced Digital Operational Resilience Act (DORA). With established practices around ICT risk management, third-party oversight, penetration testing, and incident response, the platform is positioned to support institutional clients navigating DORA-driven due diligence and vendor assessments.

These efforts culminated in the achievement of ISO/IEC 27001:2022, further strengthening Finery Markets’ security posture. Together, SOC 2 Type 2, ISO 27001, and DORA readiness form a compliance stack increasingly expected by banks, brokers, and regulated financial institutions entering digital asset markets.

Market Data, Research & OTC Growth

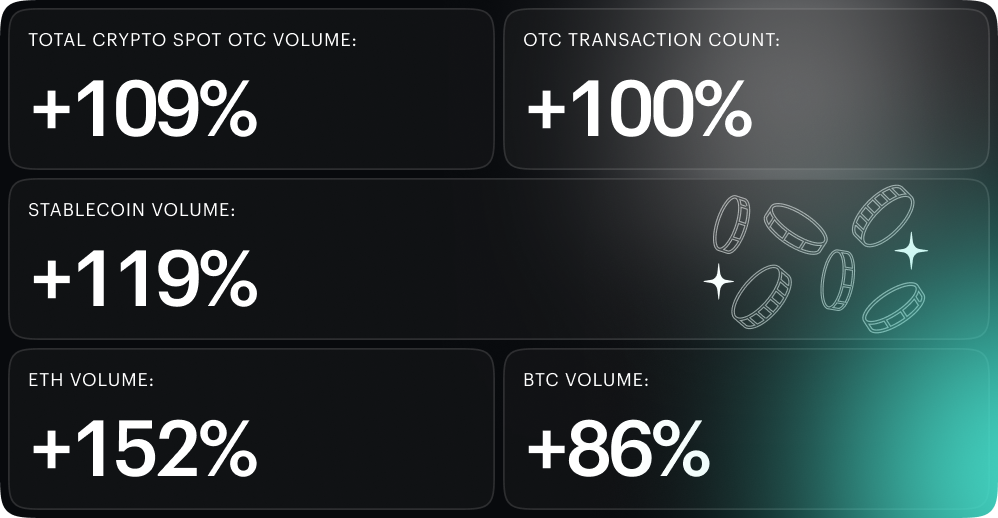

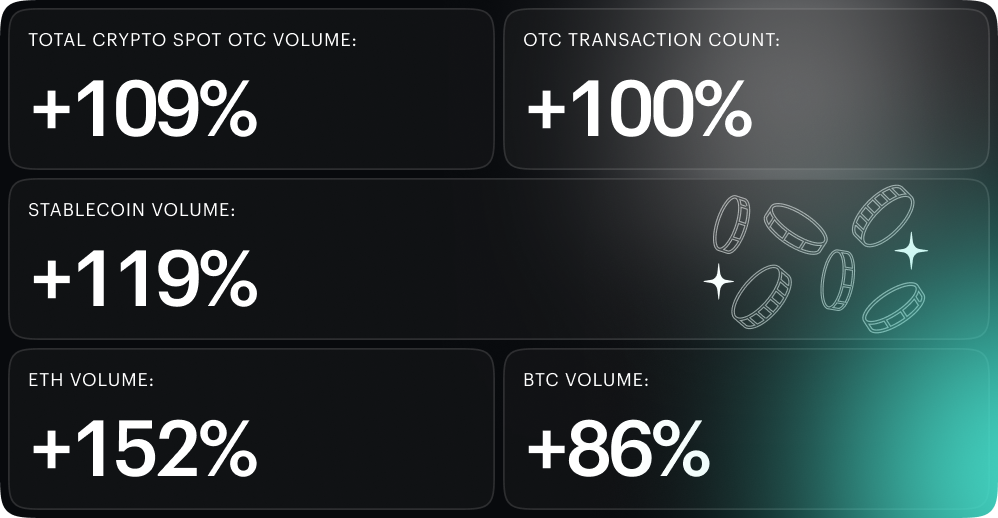

In 2025, Finery Markets’ research increasingly pointed to a structural reconfiguration of institutional crypto trading. The newly released Crypto OTC Report 2025 analyzed 15+ million institutional spot trades executed across 2024–2025, revealing that OTC growth was not cyclical but systemic. Crypto spot OTC volumes grew 109% YoY, while Top-20 CEX spot OTC volumes rose just 9%, signaling a clear migration away from exchange-led liquidity toward off-screen execution models optimized for capital efficiency, settlement flexibility, and risk control.

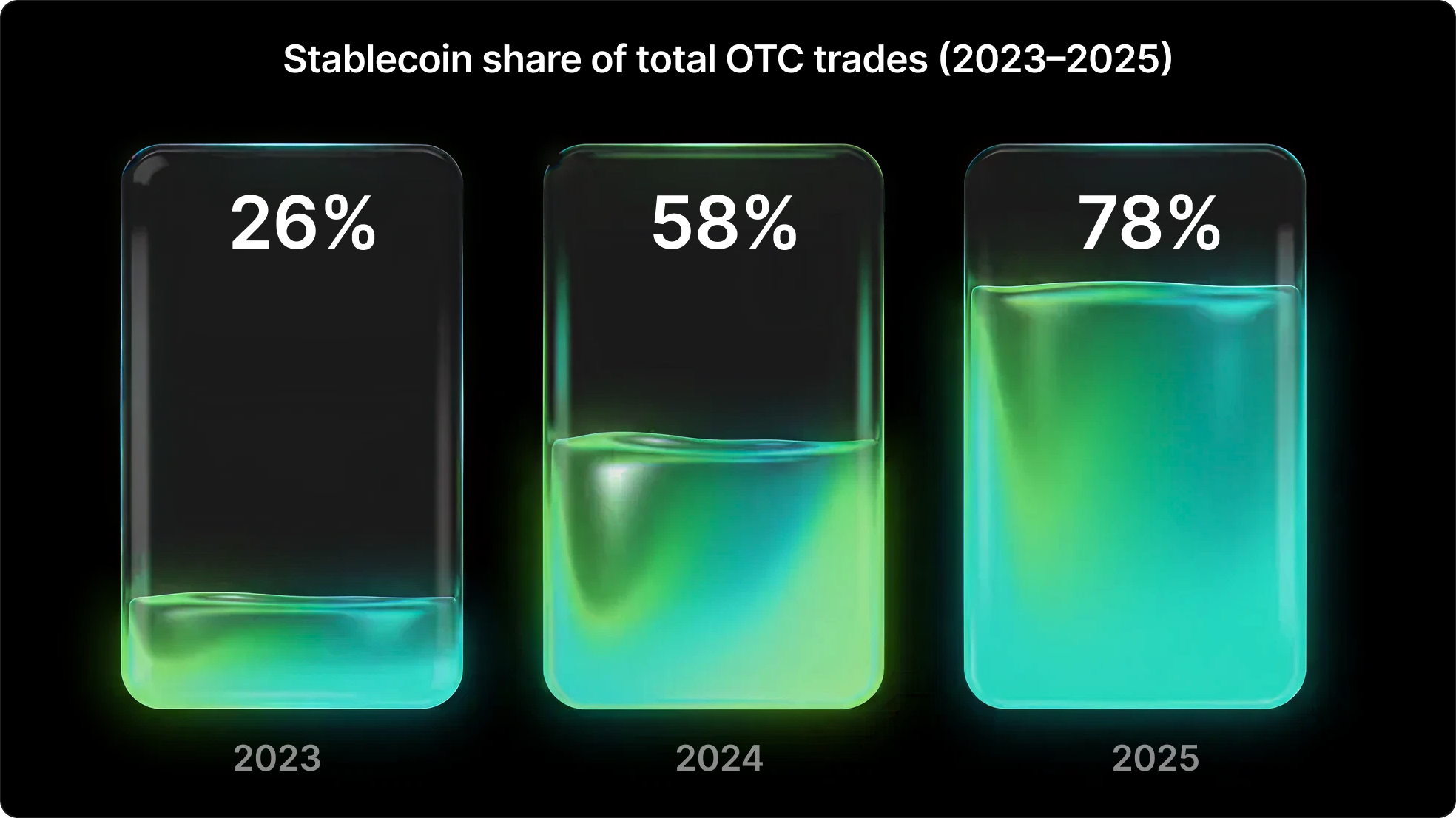

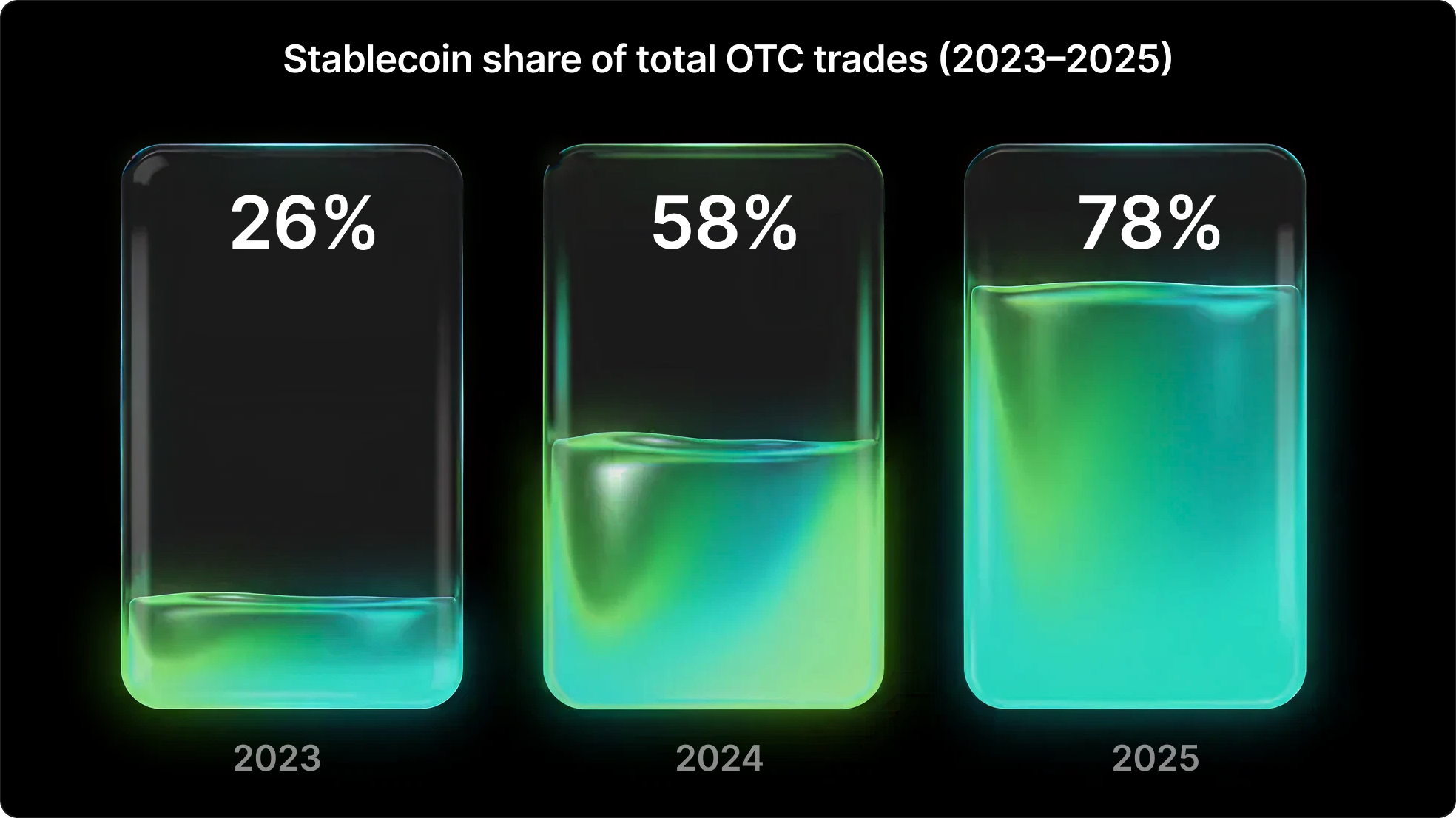

Stablecoins emerged as the dominant settlement layer in this transition. According to data, stablecoins accounted for 78% of all OTC trades, up from 26% in 2023, with volumes growing 119% YoY. Crypto-to-stablecoin flows increased 171%, materially outpacing crypto-to-fiat conversion and indicating that institutions are increasingly operating natively on digital rails rather than treating crypto markets as fiat on/off ramps. This shift was reinforced by rising demand for private-room trading and deeper secondary market liquidity to manage depeg and collateral risks.

Asset-level data further underscored the role of market structure over price cycles. ETH volumes grew 152% YoY, outpacing BTC’s 86%, not as a rotation away from bitcoin, which remains the largest asset by total volume, but as a reflection of Ethereum’s expanding role in tokenization, L2 ecosystems, and institutional ETF flows. Market stress events reinforced these dynamics: during the October 2025 liquidation, where $20B was liquidated in 48 hours, visible order books amplified volatility, while OTC private rooms absorbed flows through bilateral pricing and off-screen liquidity. The findings reinforced a core conclusion of the report: in institutional crypto, execution design itself has become a primary risk and performance driver.

Product & Infrastructure Expansion

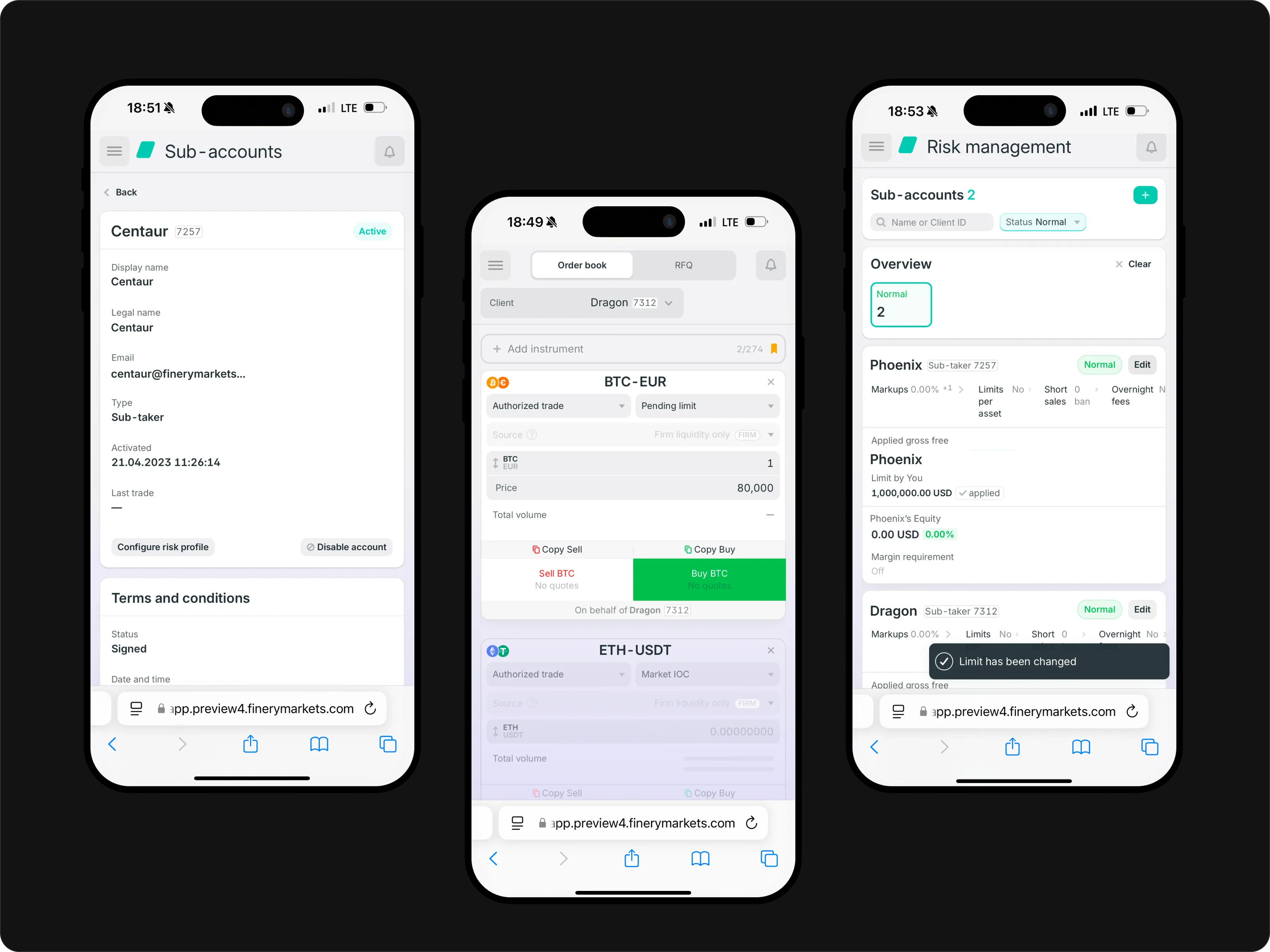

Product development in 2025 focused on execution quality, control, and institutional scalability. Finery Markets introduced Test Drive execution previews, allowing prospective clients to view live pricing before onboarding, alongside expanded RFQ workflows, authorized trading via quote streams, and newly launched liquidity pools for master accounts. These features gave brokers and OTC desks finer control over how liquidity is sourced, distributed, and priced.

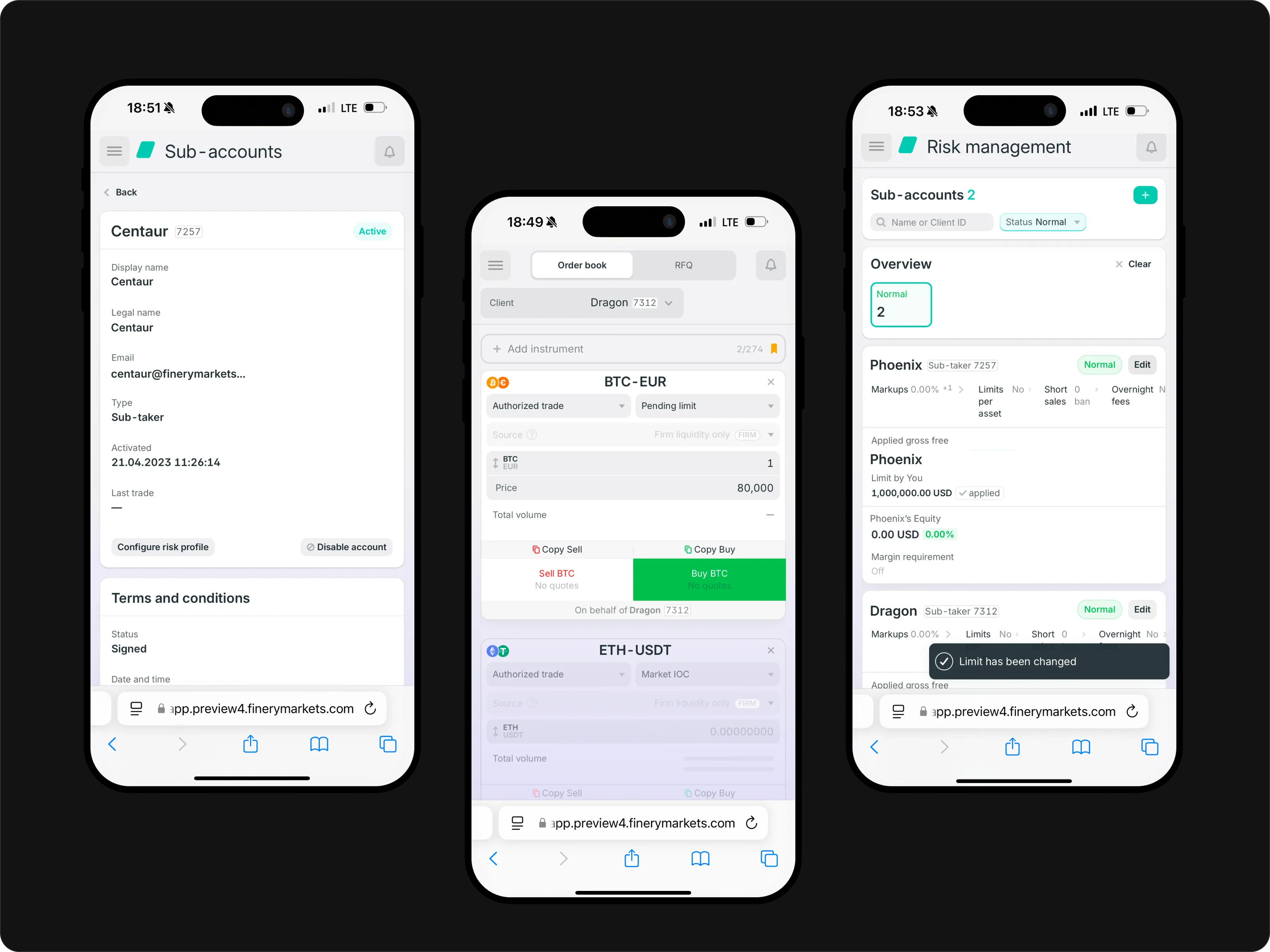

Operational tooling also advanced meaningfully. Our clients gained access to mobile-friendly trading and back-office functionality, consolidated trading and settlement history standardized to UTC, and a redesigned order management interface with real-time controls and kill-switch functionality for market makers. API reference documentation for sub-accounts enabled independent automation of trading and settlement workflows at scale.

Stablecoin infrastructure became a core product pillar. Private-room execution for asset–stablecoin pairs enabled issuers to launch secondary markets within 24 hours, while the integration of Yield.xyzembedded access to over 1,000 DeFi and staking opportunities across 75 blockchains. Together, these upgrades positioned Finery Markets as a stablecoin-first ECN designed for institutional capital markets use cases.

Community, Media & Industry Recognition

Our efforts in the product and business development areas also resulted in meaningful industry recognition. Finery Markets was named among the CNBC × Statista Top 300 Fintech Companies, recognizing our role in building long-term digital asset infrastructure.

Community engagement remained a priority with the third edition of Fintech Unplugged in Limassol, hosted alongside Cryptopay and DLT Law during iFX EXPO. The event brought together over 200 professionals from trading, payments, and legal sectors to exchange perspectives on market structure, regulation, and stablecoin adoption.

The second season of The Flow, our flagship podcast, featured in-depth conversations with leaders from BitGo, GSR, TP ICAP, 3Commas, GTN, and others. These discussions explored ECNs, hybrid execution models, and the future of institutional crypto, extending Finery Markets’ role beyond technology into market education.

Looking Ahead: January Product Updates

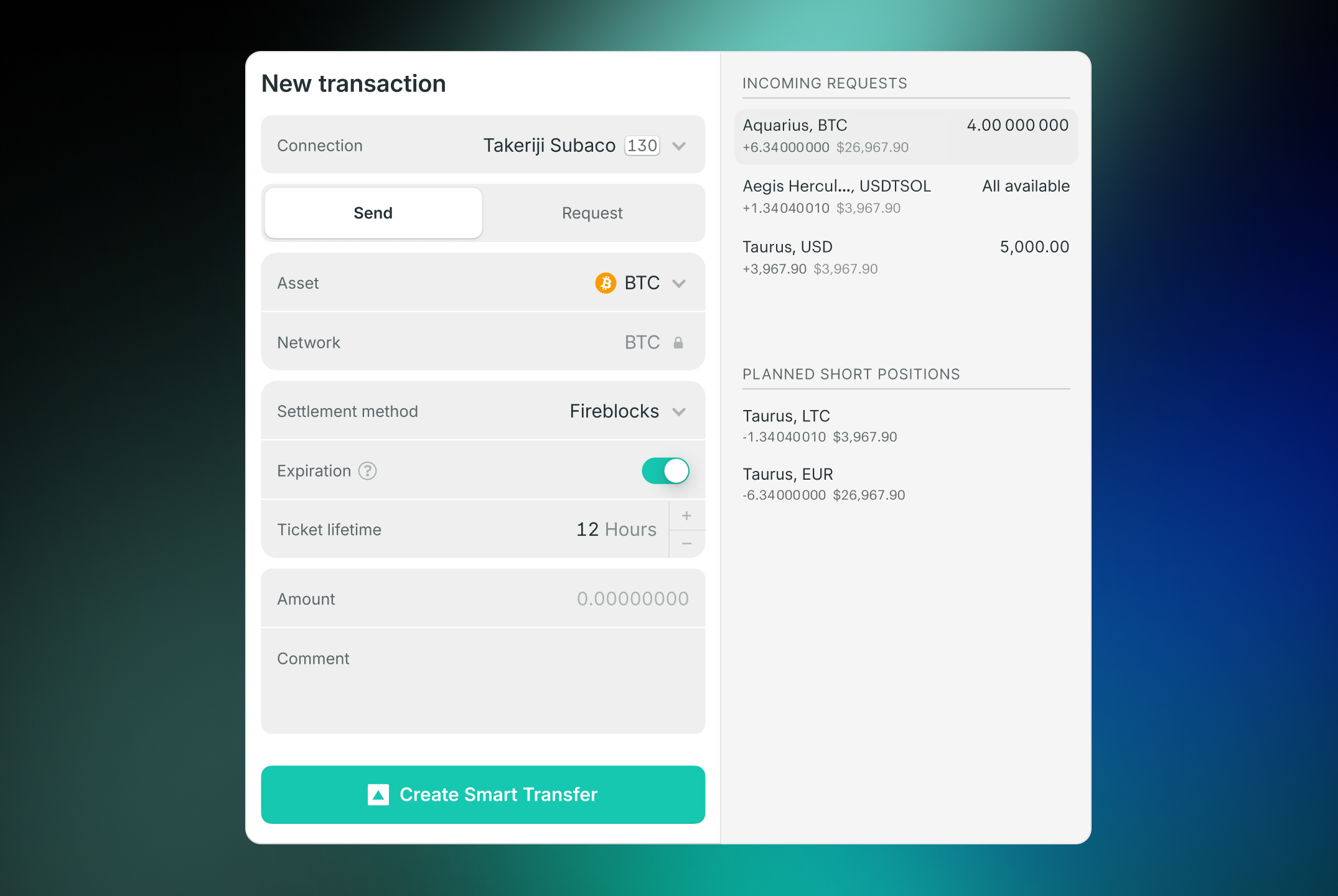

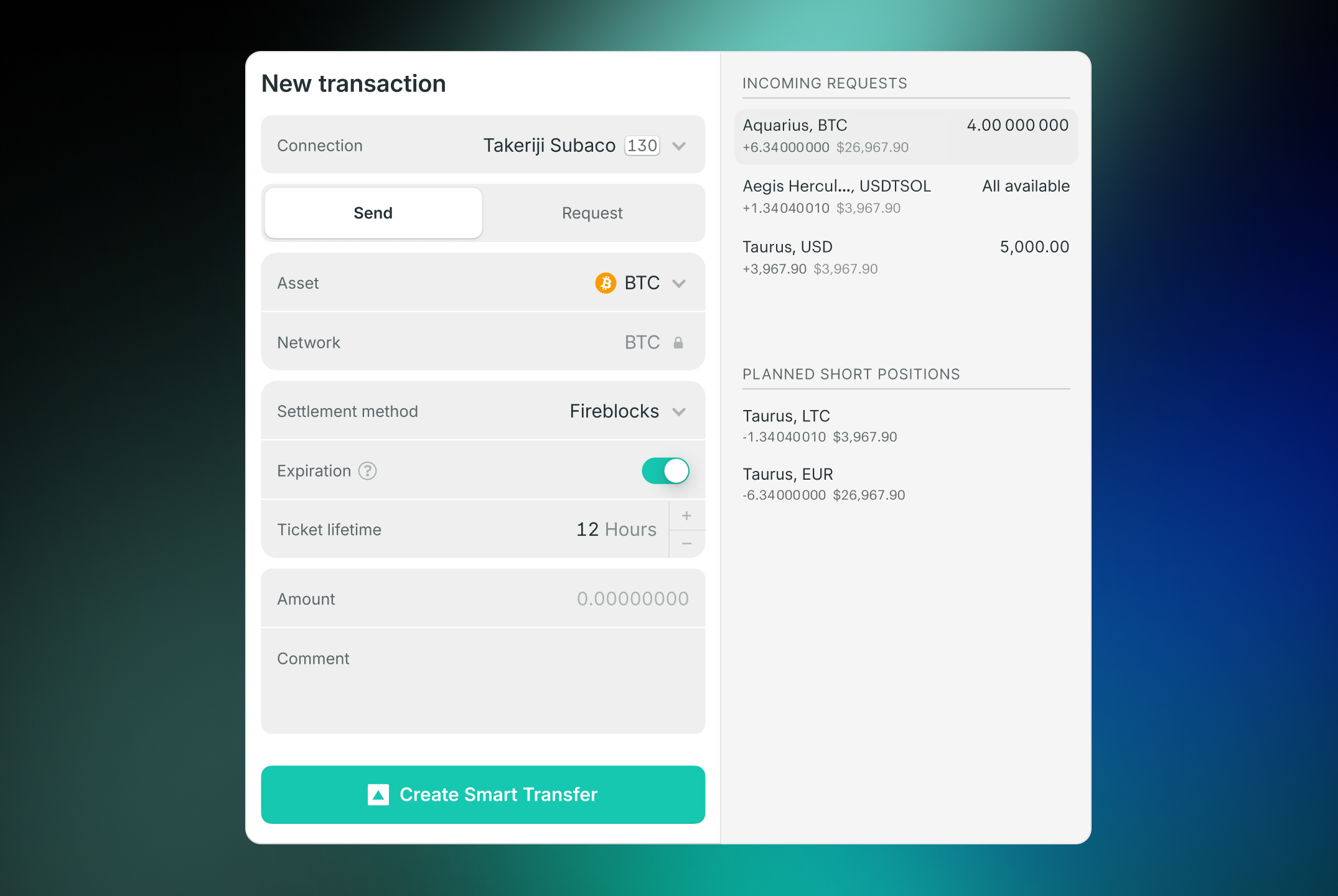

Finery Markets now offers a seamless bridge to your Fireblocks infrastructure. Clients using Fireblocks as their custody software provider can now initiate settlements directly within the Finery Markets interface. This integration automates the data flow between your trading infrastructure and your vault, so no more manual data entry or switching between tabs to initiate transfers. Positions and credit limits are always accurate and reconciled against custody data on a daily basis. extending Finery Markets’ role beyond technology into market education.

How it works:

- Initiation: Start the settlement process on Finery Markets.

- Execution: Select your vault and authorize the transaction via the Fireblocks signing/multi-sig infrastructure.

- Syncing: Once confirmed by Fireblocks, Finery Markets automatically updates your positions and limits in real-time.

- Reconciliation: We perform a daily reconciliation of all transactions, using Fireblocks as the "golden source" of truth.