Finery Markets, a leading provider of OTC trading solutions for institutions and crypto businesses, has announced the launch of FM Liquidity Match, the first-ever electronic OTC-as-a-service for digital assets. Floating Point Group will become its first user.

FM Liquidity Match is a ready-to-deploy trading solution with a proprietary matching engine that enables market players to launch a fully electronic OTC trading business and manage client relations throughout the entire trade cycle.

According to Konstantin Shulga, CEO and co-founder of Finery Markets,

"We believe that our platform is the future of institutional crypto trading, and we're excited to be a part of it. Our team has been working hard to reimagine the way institutional crypto trading operates in the post-FTX era. Through our FM Liquidity Match, market professionals can provide their customers with a "no last look" trading model, ensuring the best execution. Thanks to the proprietary matching engine, market participants can even create their own ECN and customized liquidity pools, internalize customer flows, or simply resell global OTC liquidity to their end-customers."

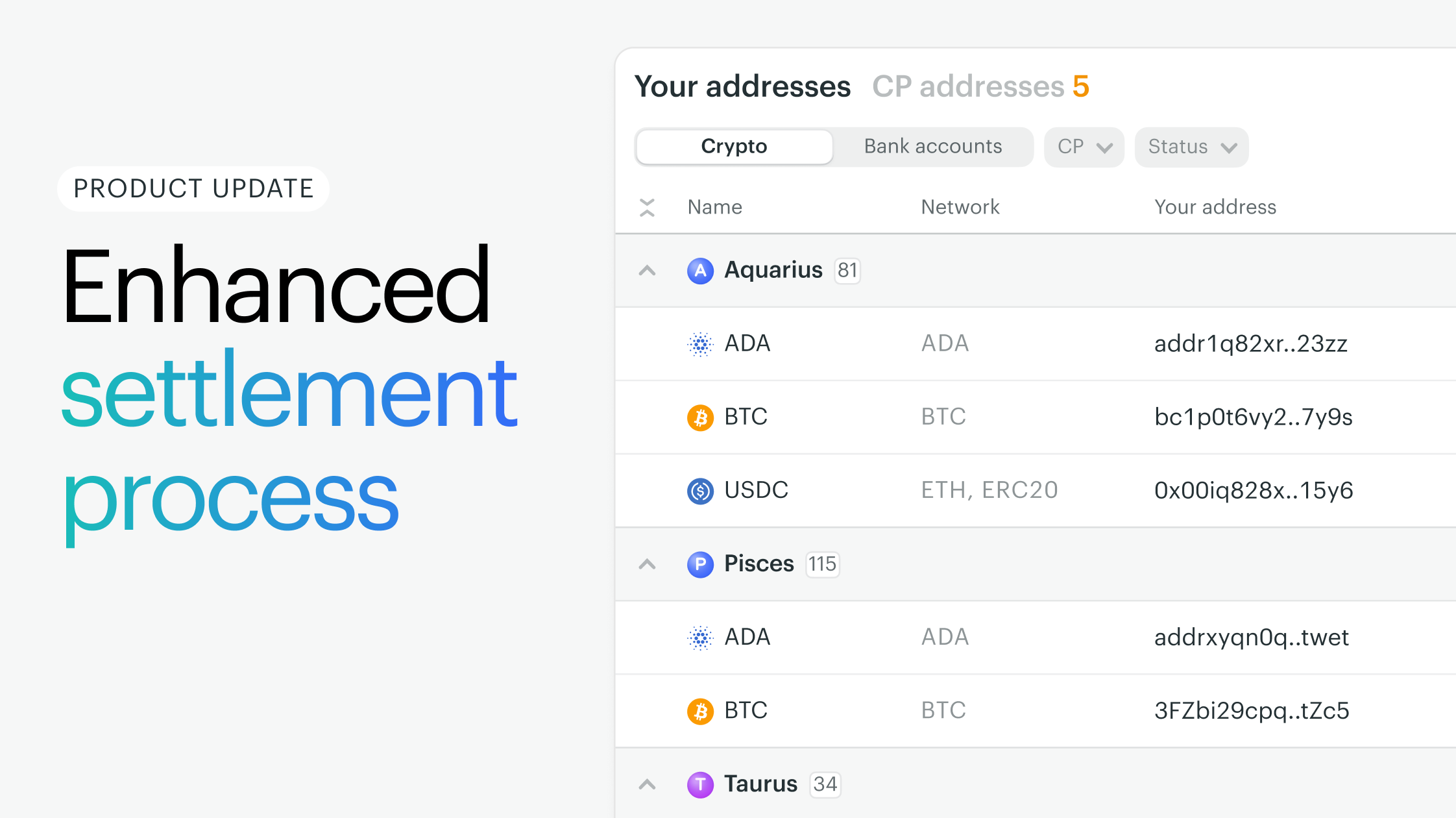

FM Liquidity Match operates through a sub-account model with a master account created by a broker, prime-broker, OTC-desk, or liquidity provider, which then creates multiple sub-accounts to serve its clients via GUI or API. Each sub-account functions as a separate trading account with its own balance, positions, and trading history. It operates within specific risk limits and settles with the master account. The master account manages user access, risk limits, position rollover, mark-ups and spreads across all sub-accounts.

The solution, which is available through a GUI or API (FIX 4.4, REST, or WebSocket), boasts an array of cutting-edge features that will elevate the trading experience to a whole new level. These features include:

-

A seamless electronic onboarding process

-

A role-based access system

-

Pre-trade risk management controls and account limits

-

Post-trade settlement and travel-rule compliant reporting.

-

Firm liquidity across 12 liquidity providers with “no last look” execution

“With Finery Markets' new FM Liquidity Match solution, Floating Point Group's clients have deeper liquidity than ever before without the risk presented by digital asset exchanges. With fully electronic OTC capabilities, we make a small step in the transition to a more mature market,"

said Kevin March, cofounder of Floating Point Group

Michael Rabkin, Global Head of Business Development at DV Chain said,

“It's natural for newer asset classes to undergo a process of defragmentation facilitated by market structure elements like prime-brokerage services. We're pleased to be among the first liquidity providers to collaborate with FPG in their capacity as a prime-broker for digital assets, enabling their clients to tap into our world class liquidity."

Boris Sebosik, the Head of OTC Trading at Wincent added:

"We are excited to utilize our expertise in quantitative trading and technology to offer top-notch liquidity to FPG's clients," "Providing liquidity for prime-brokers in the crypto industry will enable us to access a wider range of clients and markets, further increasing our competitive position."

About Finery Markets

Finery Markets is a leading OTC multi-dealer electronic marketplace for institutional customers and a trading solutions provider for crypto markets.

Serving clients since 2019 Finery Markets provides solutions throughout the whole trade lifecycle:

-

High performance execution venue with deep institutional liquidity and firm quotes

-

Price intelligence and pre-trade risk management tools

-

Position management, risk controls, reporting tools and cost analysis, as well as flexible settlement based on a non-custodial model

-

Single entry-point to aggregated liquidity from global liquidity providers via API and GUI

-

Robust infrastructure: 99.99+% uptime and full automation

Finery Markets platform is also available as a white-label solution for prime-brokers, OTC desks and exchanges that are looking to develop and expand client business. For additional information please visit https://finerymarkets.com/

About FPG

Floating Point Group (“FPG”) is a prime brokerage that removes the barriers to access liquidity across a broad set of markets in order to deploy advanced cryptocurrency-centric strategies at scale. The company runs the largest global digital asset agency trading desk, partnering with funds and blockchain foundations to efficiently execute their trades. FPG is regulated in the U.S. and the Cayman Islands.

Floating Point Group is backed by Tribe Capital, Coinbase Ventures, Anthony Scaramucci, FAST by GettyLab, Borderless Capital, CapitalX, Formulate Ventures, BoxOne Ventures, Seabury Global Markets, AngelList’s Naval Ravikant, and a host of angel and institutional investors.

For more information, visit floating.group.

About DV Chain

DV Chain provides world-class cryptocurrency trading and technology. From easy-to-use, web-based charting and click trading to white glove, specialized algorithmic orders, institutions around the globe depend on DV Chain’s robust, stable tech stack to power and scale their businesses.

DV Chain is an affiliate of DV Trading, a Chicago-based proprietary trading firm and also an affiliate of Independent Trading Group, a Canadian broker-dealer. In 2016, the founders of DV Trading launched DV Chain to adapt the technology and trading strategies employed by DV Trading to bring liquidity to cryptocurrency markets. Since then, DV Chain has become one of the world’s global crypto leaders providing reliable, accessible, and technologically advanced cryptocurrency liquidity solutions.

About Wincent

Wincent is a leading crypto market maker with $3B+ daily volume and 300K+ daily transactions. Our mission is to enable, empower and advance a truly decentralized world for more transparent, fair and efficient markets and products. For additional information visit https://www.wincent.co/