Stablecoins have come a long way—from a niche crypto experiment to a serious player in payments. Just look at the numbers: last year alone, they handled over $5.5 trillion in adjusted volume across 1.2 billion transactions, according to Visa’s onchain dashboard. That’s not just traders swapping tokens—Visa filters out the noise to focus on real usage.

And the momentum is only picking up. In the first few months of 2025, stablecoins already moved more than $2 trillion in volume through over 300 million transactions. At this rate, we’re on track for a potential $6 trillion year. This isn’t some fringe part of crypto anymore.

It’s not just Visa’s data that shows this shift. At Finery Markets, we’ve seen our stablecoin volumes jump. Demonstrating unparalleled growth, we've facilitated over $2 billion in stablecoin transactions per month so far this year — a substantial 157% jump compared to last year. This massive adoption is evident across clients spanning 35 countries, solidifying stablecoins as a transformative force in global finance." It’s not just a trend; it’s a new way to move money.

Institutional adoption on the rise. But why the rush?

A recent Fireblocks report surveyed 295 execs from banks, fintechs, and payment companies. Turns out, 90% are either using stablecoins or exploring how to integrate them. Almost half already use stablecoins for payments, 23% are testing pilots, and 18% are in the planning stages. Only 10% are still on the fence.

That’s a big shift. The stablecoin conversation has moved from “Should we?” to “How fast can we?” As Fireblocks put it, it’s about keeping up with customers and technology that’s moving at full speed.

Cross-border B2B payments fueled by stablecoins

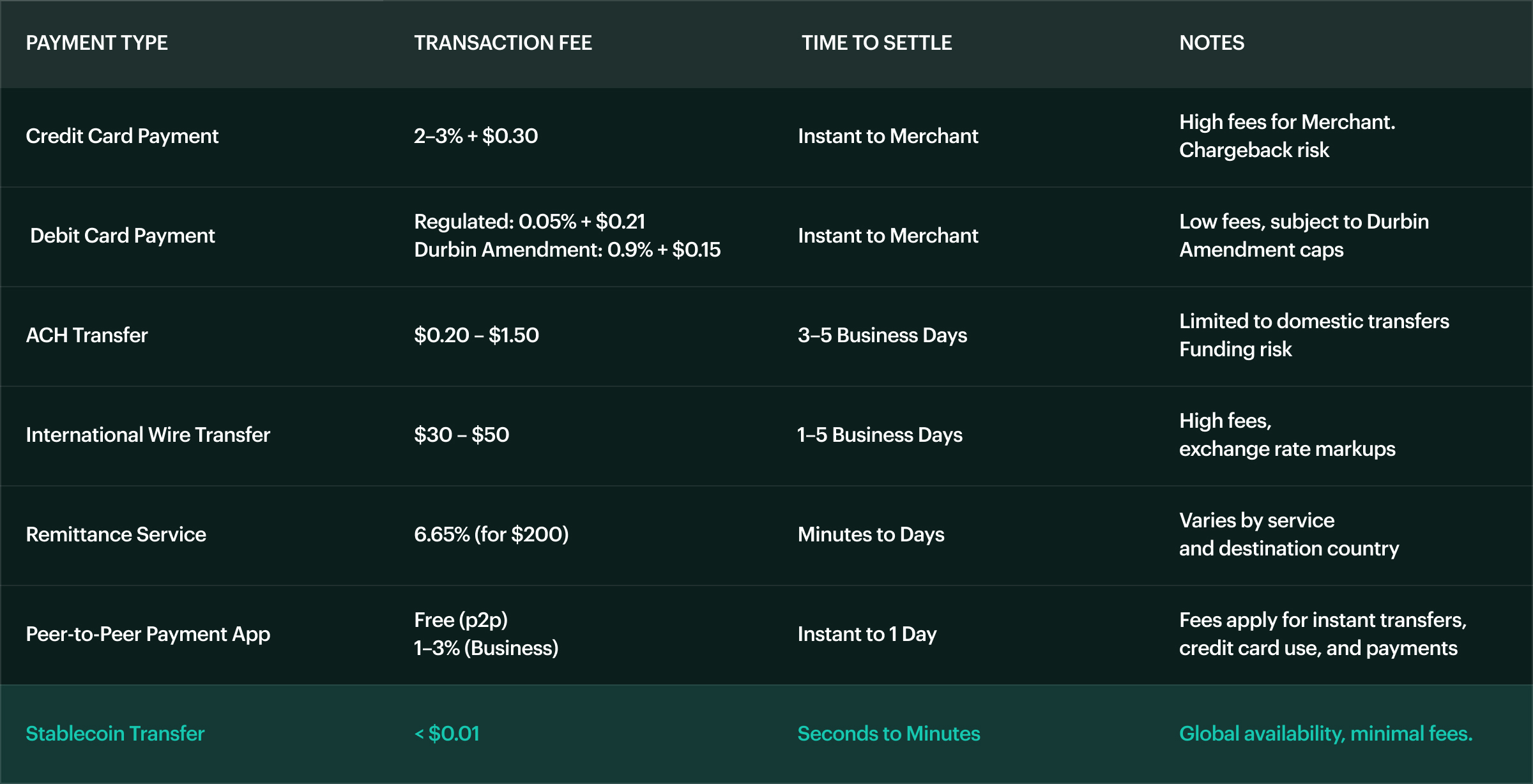

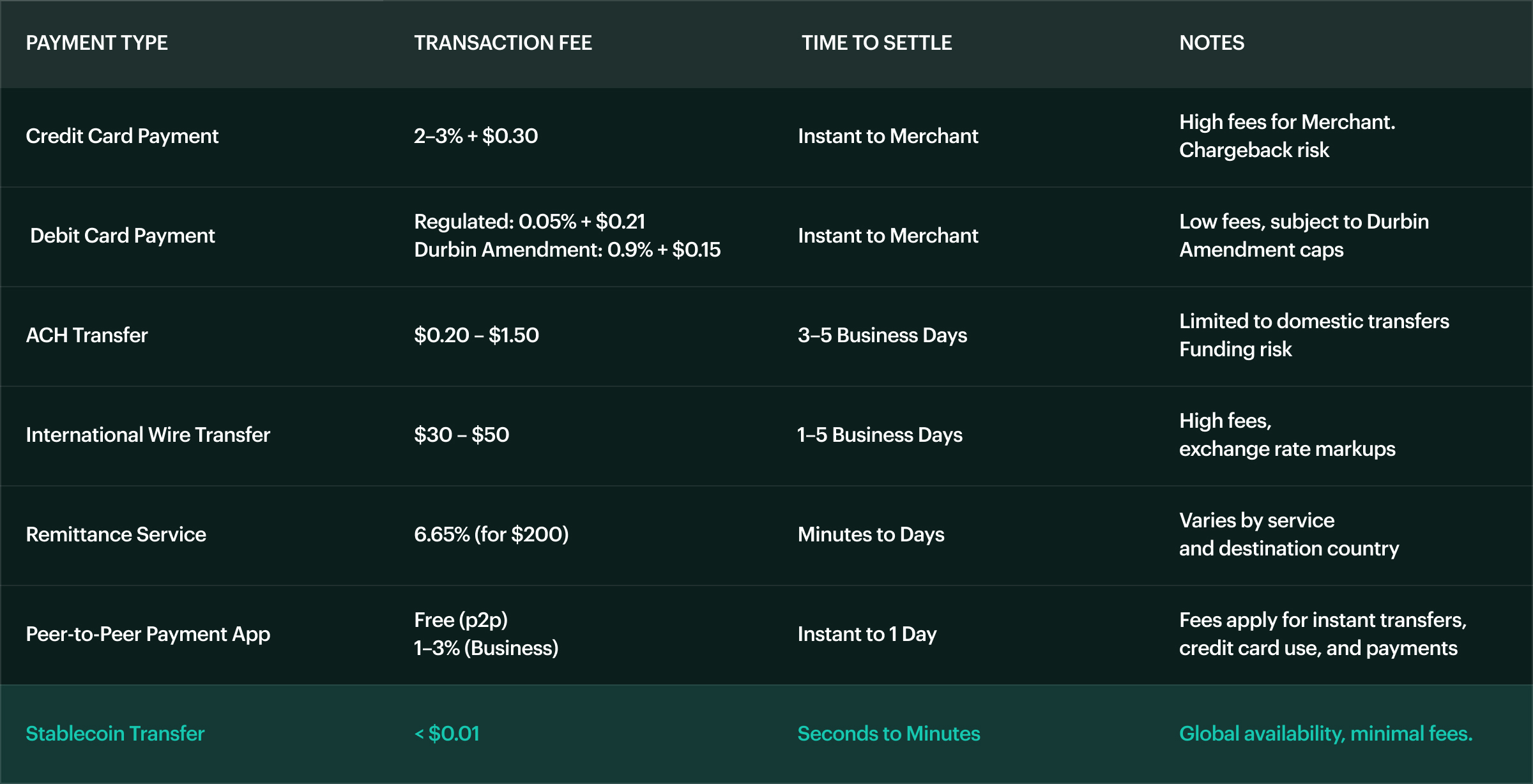

One of the biggest opportunities? B2B payments—especially cross-border. Traditional systems can be slow, expensive, and complicated. Stablecoins offer a faster, cheaper option that fits seamlessly into the digital world.

Fireblocks found that 58% of banks are already using stablecoins for cross-border transactions. Another 28% are accepting payments in stablecoins, with others using them for liquidity management and merchant settlements.

Why are they so appealing? Stablecoins are pegged to fiat currencies, which makes them easier to integrate into existing treasury systems. Banks can modernize their payment infrastructure without rebuilding everything from scratch—and stay competitive with fintechs chipping away at their market share.

Go faster, go cheaper, go wider

Banks use stablecoins to recapture cross-border volume while preserving their existing processes. Meanwhile, fintechs and payment gateways see them as a way to improve margins and expand revenue.

Survey data shows that faster settlement times are the biggest draw—mentioned by nearly half of respondents. Other benefits include increased transparency, better liquidity management, seamless payment flows, stronger security, and lower fees.

According to Ran Goldi at Fireblocks, stablecoins are no longer just about cutting costs. They’ve become a strategic growth driver. “Our research shows that 90% of firms are moving forward with stablecoin adoption because they see it as a key lever for growth,” he told Cointelegraph.

Goldi also noted that institutions are motivated by the chance to enter new markets, respond to customer demand, and unlock new revenue streams. “Stablecoins have become an enabler of business innovation, not just an efficiency play,” he added.

Stablecoins lower transaction costs to nearly zero, opening the door to more competition among payment providers. That kind of cost savings is a game-changer for businesses currently stuck with expensive, slow payment systems. Adoption will likely start with the companies hit hardest by today’s legacy systems—triggering a wider shake-up in the payments landscape.

Market decoupling — this time is different

Stablecoins have become the most affordable way to move money across borders. People in almost every country use them to store and spend value cheaply, safely, and without worrying about inflation. Alongside cash and gold, stablecoins are one of the few global payment rails that work outside the control of banks. They’re programmable too—anyone can build on top of them, extending their reach and usability.

Stablecoins stand out as one of crypto’s biggest success stories, and venture capitalists have taken notice. These digital dollars are moving billions every day, finding real adoption across payments, savings, and business transactions. Investors now see them as crypto’s bridge to the real economy.

One milestone that grabbed VCs’ attention was Stripe’s $1.1 billion acquisition of Bridge last October—the biggest crypto M&A deal so far. For many, it marked a turning point: a fintech heavyweight rolling stablecoin infrastructure into its payments ecosystem. Juan Lopez at VanEck Ventures pointed to Stripe’s $1 trillion in total payment volume as a sign of what’s possible. If Stripe can shift even a slice of that onto its own stablecoin, the opportunity could be worth around $40 billion a year in net interest margins—assuming yields hold around 4%.

What’s different now is that stablecoin growth is happening at scale—and it’s not tied to crypto’s market cycles. The Block’s Data Dashboard shows stablecoin supply has climbed from about $125 billion at the start of 2024 to nearly $230 billion today—an 84% jump. Meanwhile, Dragonfly reports that cross-border payments on stablecoin rails now hit up to $50 billion a month, up from nearly zero just fifteen months ago. That kind of real-world adoption—beyond just trading—explains why stablecoins are no longer just an extra layer of crypto, but a core part of how money moves in the digital age.

Infrastructure: a key challenge for stablecoin issues

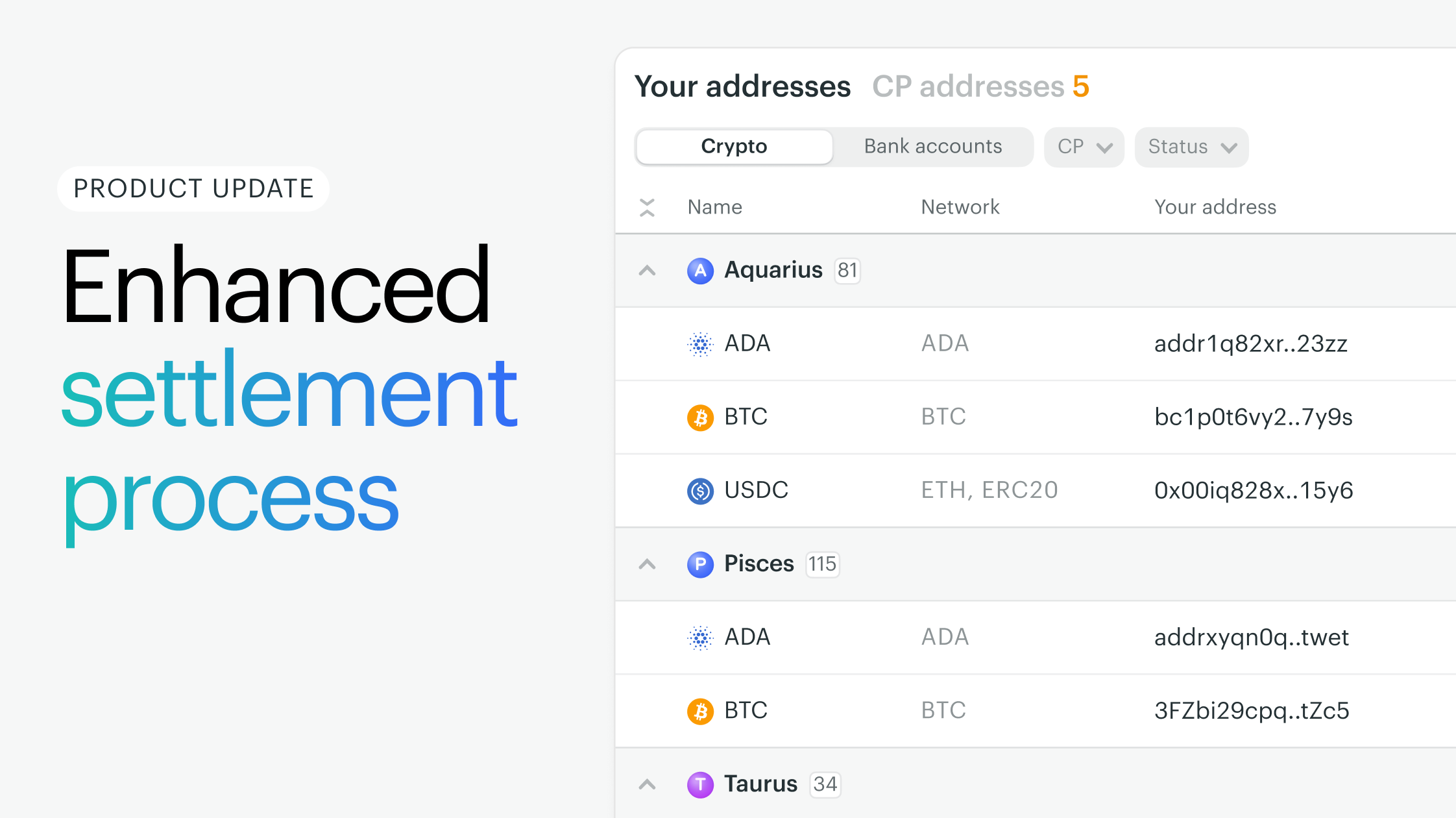

No question about it — stablecoins have proven their value in retail payments and cross-border transactions, yet they still face a critical challenge: building reliable, regulated liquidity for institutional secondary markets. That’s where Finery Markets steps in.

Our OTC trading solution bridges this infrastructure gap by empowering stablecoin issuers to quickly launch new asset pairs—often in under 24 hours—without capital or listing requirements. Once live, issuers can connect to a deep pool of over 140 institutional liquidity takers and 15 regulated liquidity providers, enabling multi-chain liquidity with real-time settlement.

We know depegging can be a serious risk in volatile markets, which is why our platform offers a non-custodial model with private rooms trading to help mitigate these challenges. For issuers looking to expand globally, we also support FX settlement in 20 fiat currencies, making it easier to scale operations and reach new markets.

Whether you’re preparing to launch a stablecoin or looking to grow one at scale, Finery Markets offers the trading infrastructure needed to build a thriving, institutional-grade market.