Takeaways:

- Amazon Shareholders Advocate Bitcoin Allocation: A proposal urges Amazon to diversify reserves by investing 5% in Bitcoin, mirroring strategies used by firms like MicroStrategy to hedge inflation and enhance shareholder value.

- Microsoft Shareholders Reject Bitcoin Proposal: A similar Bitcoin investment proposal at Microsoft was voted down, with the board emphasizing its current asset evaluation process and cautioning against volatility.

- Bitcoin Faces $1.6B Liquidation Reset: A sharp BTC price dip below $95,000 triggered the largest liquidation event since 2021, wiping out overleveraged long positions and marking a market “reset.”

- Ripple's RLUSD Stablecoin Approved: Ripple’s RLUSD stablecoin received regulatory approval from NYDFS, positioning it for listings on key partner exchanges and further expansion into the stablecoin market.

- Hong Kong Expands Crypto Licensing: Hong Kong accelerates its licensing framework to attract global crypto firms, balancing innovation with robust investor protections to stay competitive against other jurisdictions.

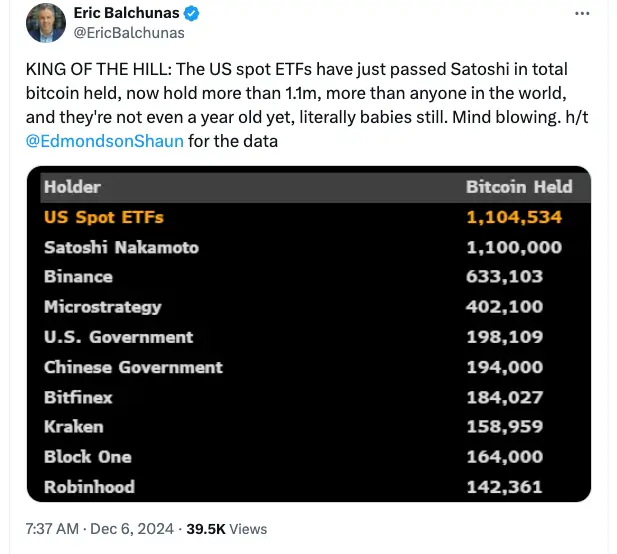

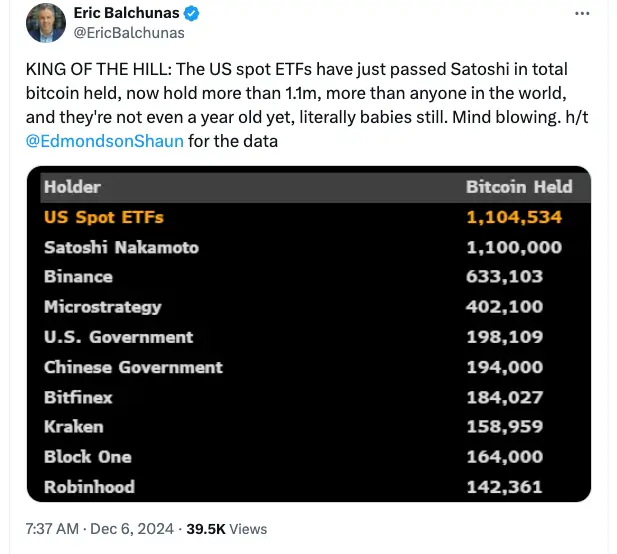

- Bitcoin ETFs Surpass Satoshi’s Holdings: US Bitcoin ETFs now collectively hold over 1.1 million BTC, surpassing Satoshi Nakamoto’s estimated stash and highlighting institutional demand for crypto investments.

- Cardano Foundation X Account Hacked: A security breach on the Cardano Foundation’s X account promoted a scam token, causing financial losses and raising concerns about persistent social media vulnerabilities in crypto.

Amazon Shareholders Urge 5% Bitcoin Allocation for Treasury Diversification

Amazon is under pressure from its shareholders to follow companies like MicroStrategy and Tesla by adding Bitcoin to its balance sheet. A proposal by the National Center for Public Policy Research (NCPPR) recommends allocating at least 5% of Amazon's reserves to Bitcoin, arguing that it could hedge against inflation and deliver long-term shareholder value.

The proposal highlights Bitcoin's 134% surge this year, outpacing major assets like gold and the S&P 500. Shareholders also noted the exceptional performance of MicroStrategy, whose Bitcoin-backed strategy has driven a 500% stock price increase compared to Amazon’s 49% rise this year. While Amazon holds $88 billion in cash, cash equivalents, and securities, shareholders believe diversifying with Bitcoin could better safeguard value against inflation and volatility.

This move mirrors similar shareholder actions at other major tech companies. Should Amazon consider Bitcoin adoption, it would mark a significant step in institutionalizing cryptocurrency within corporate treasuries.

Microsoft Shareholders Reject Bitcoin Investment Proposal Despite Advocates’ Push

Amazon wasn’t the only company due to decide on the future of their corporate finances and the integration of a potential Bitcoin strategy. On Tuesday, Microsoft shareholders voted against a proposal to explore investing in Bitcoin, following strong opposition from the company’s board. The proposal, also submitted by the NCPPR, suggested Bitcoin could serve as a valuable diversification tool for Microsoft’s treasury. However, the board argued that the company already evaluates a broad range of assets, including cryptocurrencies, and dismissed the proposal as redundant.

Bitcoin advocate Michael Saylor made a high-profile appeal to Microsoft’s leadership, urging the tech giant to embrace Bitcoin to drive stock price growth and shareholder value. Despite his claims that Bitcoin could create trillions in enterprise value, the board highlighted cryptocurrency’s volatility as incompatible with corporate treasury needs, which require stable, predictable investments. Microsoft reiterated its commitment to ongoing monitoring of cryptocurrency trends but affirmed its current treasury strategy as sufficient.

As Amazon shareholders press their case, the contrasting outcomes of these proposals underscore the ongoing debate over Bitcoin’s role in corporate finance and whether its adoption is a prudent move for global giants navigating volatile economic landscapes.

Record Liquidations in Bitcoin as Overleveraged Traders Face $1.6B Reset

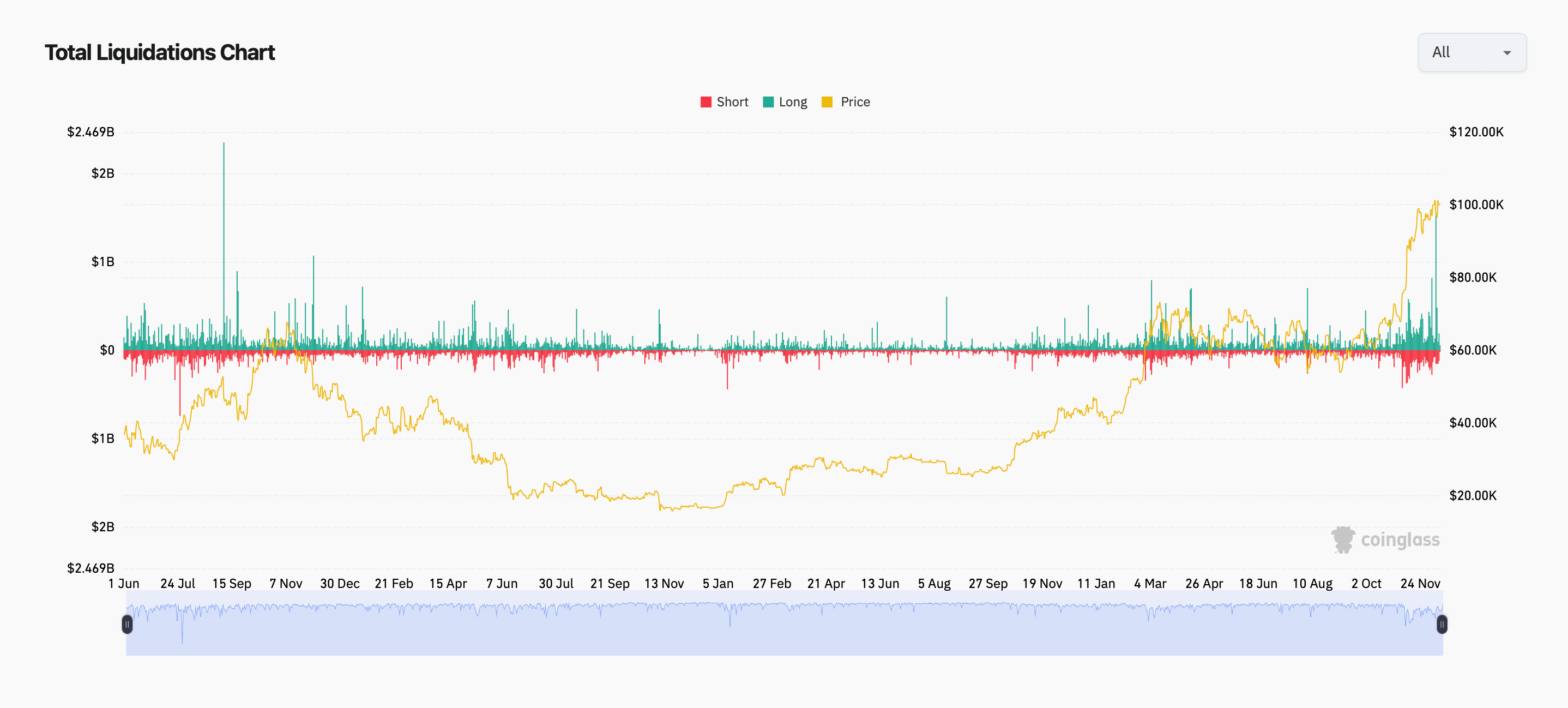

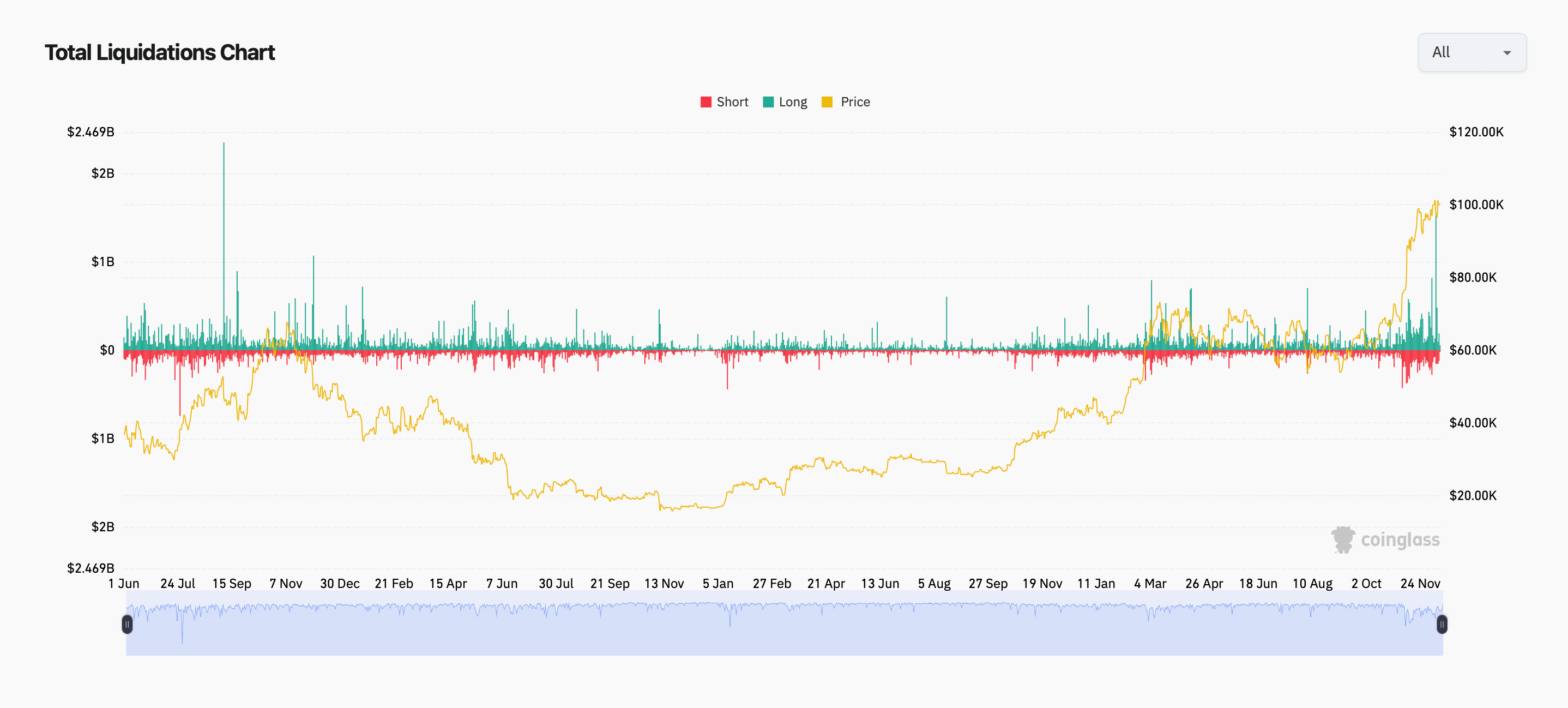

The cryptocurrency market faced unprecedented turbulence earlier this week, with Bitcoin’s price dropping below $95,000 and triggering liquidations totaling $1.6 billion across digital assets—the highest level since September 2021. This marked a significant correction in Bitcoin's bull cycle, as overleveraged long positions dominated the market. Analysts at CoinGlass reported $1.39 billion in long liquidations compared to just $183.63 million in shorts, reflecting traders’ overconfidence in Bitcoin breaking the $100,000 milestone.

Source: Coinglass

The cascade of liquidations was catalyzed by aggressive selling on Coinbase, which began nearly an hour before the broader market downturn. This selling pressure pushed Bitcoin to breach critical support levels near $97,700, triggering a cascading effect on heavily leveraged positions. Altcoins also suffered, with assets like Ethereum and XRP experiencing significant sell-offs. Despite the “carnage,” some analysts view this reset as a cleansing event, potentially setting the stage for more stable market conditions.

The steep reduction in leveraged positions could signal a short-term recovery as sell-side pressure eases. Market observers highlight that while this event exposed vulnerabilities in trading strategies, it also underscored the need for prudent risk management in highly volatile environments.

Ripple’s RLUSD Stablecoin Secures Final Approval from NYDFS

Ripple’s RLUSD stablecoin has received final approval from the New York State Department of Financial Services (NYDFS), marking a pivotal moment for the company’s expansion into the stablecoin market. Ripple CEO Brad Garlinghouse shared the news on Tuesday, noting that listings on partner exchanges would follow soon. The announcement comes on the heels of Ripple CTO David Schwartz expressing optimism about RLUSD’s launch by year-end during The Block's Emergence conference in Prague.

Initially announced in April, RLUSD will operate on both the XRP Ledger and Ethereum blockchain. Testing began in August, and Ripple has already partnered with prominent exchanges like Uphold, Bitstamp, Bitso, and Bullish for its rollout. Liquidity support will be provided by market makers B2C2 and Keyrock, ensuring a robust launch framework. Ripple’s foray into the stablecoin space comes at a time when institutional interest in digital asset-backed tokens is growing, and this regulatory green light positions RLUSD as a key player in the stablecoin ecosystem.

Hong Kong Races to Strengthen Its Crypto Licensing Framework

Hong Kong is ramping up its efforts to become a global cryptocurrency hub, announcing plans to streamline the licensing process for crypto trading platforms. This initiative comes amid increasing global competition from jurisdictions such as Singapore, which recently approved Gemini’s services for its clients. The Hong Kong government and regulators aim to create a regulatory framework that balances innovation with financial stability, following the principle of “same activities, same risks, same regulations.” This approach seeks to foster sustainable growth in the digital asset sector while safeguarding investors.

Addressing Hong Kong’s parliament, Acting Secretary for Financial Services and the Treasury Bureau Joseph Chan emphasized the government’s commitment to expediting the licensing process. Since the introduction of the crypto licensing regime in June 2023, exchanges like OSL, HashKey, and HKVAX have obtained regulatory approval, enabling them to offer retail trading services. The government is also preparing to regulate stablecoins and custody services, ensuring a comprehensive approach to crypto oversight. As Hong Kong establishes consultative panels and expands its regulatory reach, it strengthens its appeal to global crypto firms and institutional investors, positioning itself as a leader in the digital asset industry.

US Bitcoin ETFs Now Hold More BTC Than Satoshi Nakamoto’s Estimated Stash

For the first time, US spot Bitcoin ETFs collectively hold more Bitcoin than Satoshi Nakamoto, the pseudonymous creator of the cryptocurrency. As of December 5, US Bitcoin ETFs surpassed 1.1 million BTC in holdings, according to market data from HODL15Capital. This milestone marks a significant shift in the Bitcoin market, with ETFs now holding approximately 5.2% of Bitcoin’s total 21 million coin supply. Analyst Eric Balchunas described the development as "mind-blowing," noting that these ETFs are less than a year old but already dominate the market.

This achievement underscores the rapid adoption of Bitcoin ETFs since their US launch in January 2024. The ETFs now hold 63% more Bitcoin than MicroStrategy, the largest corporate BTC holder, and 42% more than global exchange Binance. Satoshi Nakamoto’s estimated holdings of around 1.1 million BTC, long seen as a benchmark in the Bitcoin ecosystem, have now been exceeded, highlighting the growing institutional appetite for regulated crypto investment products.

Cardano Foundation’s X Account Hacked, Scam Token Promoted and Removed

On December 8, the Cardano Foundation's X account was compromised by a malicious actor who used it to promote a fraudulent token named "ADAsol" and falsely claimed that the foundation would cease supporting ADA, Cardano's native cryptocurrency. Cardano founder Charles Hoskinson confirmed the hack, but not before the scam token generated $500,000 in trading volume and subsequently crashed by 99%. The foundation has since removed the fraudulent posts and is working to secure the compromised account.

The Cardano Foundation emphasized that no other parts of its ecosystem were affected and advised users to avoid clicking on links from the hacked account until further notice. The incident highlights the persistent threat of social media hacks in the crypto industry, with similar attacks previously targeting prominent entities like Compound Finance, EigenLayer, and even public figures such as rapper Wiz Khalifa. In most cases, these scams leverage phishing tactics to steal funds, reinforcing the need for heightened vigilance among users.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or legal advice. Always conduct your own research and consult with professional advisors before making any investment decisions. Finery Markets assumes no liability for any actions taken based on this information.