Welcome to a new edition of the Institutional Weekly. Here's what moved the markets this week: Bitcoin rebounded above $105,000 after a Trump-Musk spat triggered nearly $1 billion in liquidations. Hyperliquid hit a record $248 billion in perpetual volume, and Ethereum ETFs saw their longest-ever 15-day inflow streak. Gemini filed for an IPO as Big Tech giants explore stablecoins for cheaper payments. The UK’s FCA plans to lift its crypto ETN ban, while Metaplanet launched Asia’s largest-ever $5.4 billion raise to supercharge its Bitcoin strategy.

Bitcoin Bounces Back As Trump-Musk Scandal Cools Down

Bitcoin re-entered the $105,000 price level on Saturday after a turbulent Thursday session saw nearly $1 billion in liquidations sweep across crypto markets, driven by a public spat between U.S. President Donald Trump and Tesla CEO Elon Musk. Tesla shares plunged 15%, dragging risk assets — including Bitcoin — lower, with BTC testing its key $100,000 support level. While mainstream headlines fixated on the clash between two of the world’s most prominent figures, analysts argued the market reaction was driven by deeper fears about Trump’s tax and spending plans, the debt ceiling, and labor market data showing eight-month-high jobless claims.

Despite the panic, some traders saw opportunities. OTC desk Wintermute reported that while $345 million in BTC and $284 million in ETH were liquidated during Thursday’s session, volatility remained contained — a sign of an “orderly flush” rather than panic selling.

Hyperliquid Tops $248 Billion in Perp Volume for May

Hyperliquid achieved a record-breaking milestone in May, processing over $248 billion in perpetual futures volume — a 51.5% increase from April’s $187.5 billion, according to internal protocol data. The milestone cements Hyperliquid’s position as the dominant player in the onchain perpetuals market, outpacing its growth trajectory from May 2024 when it recorded just $26.3 billion — marking an 843% year-over-year surge. This explosive expansion highlights the platform’s ability to deliver centralized exchange-level performance with the benefits of native crypto infrastructure.

A key metric to watch is Hyperliquid’s growing share of global perpetuals volume relative to Binance. In May, Hyperliquid’s monthly ratio to Binance’s perps flow reached a new high of 10.54%, surpassing the previous 9.76% peak set in April. The protocol’s rising market share underscores the increasing appetite for decentralized derivatives platforms, driven by Hyperliquid’s seamless user experience, advanced liquidity models, and community engagement. Season 2 of its points campaign has kept traders engaged following the highly successful Season 1 airdrop, adding further momentum to the protocol’s growth.

Ethereum ETFs Extend Record 15-Day Inflow Streak as Price Climbs 40%

U.S. spot Ethereum ETFs have hit their longest streak of positive net inflows since their launch last July, logging 15 consecutive trading days of inflows amid a nearly 40% price surge for ETH. BlackRock’s ETHA fund led the pack, pulling in nearly $600 million since May 16, according to SoSoValue. Across all nine U.S. spot Ethereum ETFs, cumulative inflows reached $3.33 billion by Friday’s close — an $820 million increase during the streak. Daily inflows moderated slightly on Thursday and Friday, yet remained positive, signaling sustained investor appetite.

The surge follows Ethereum’s recent Pectra upgrade, which has attracted institutional interest but has yet to translate into increased user activity on the network, JPMorgan analysts noted. The trend mirrors Bitcoin’s own institutional adoption story, where ETFs and corporate treasuries have strengthened the asset’s market positioning. BlackRock’s ETHA fund remains the single largest by AUM, but Grayscale’s two spot Ethereum ETFs collectively surpass it at $4.09 billion, followed by Fidelity’s ETH product at $1.09 billion.

Gemini Files Draft Statement for IPO

Gemini, the cryptocurrency exchange founded by Cameron and Tyler Winklevoss, has confidentially filed a draft registration statement with the U.S. Securities and Exchange Commission, setting the stage for a potential IPO. The number of shares and price range have not yet been disclosed, but the move reflects the growing momentum among crypto firms seeking to go public in the United States as the regulatory landscape becomes more accommodating.

The Winklevoss twins, long-time Bitcoin advocates and early backers of President Trump’s crypto-friendly stance, are betting on the administration’s regulatory shift to boost investor confidence. The filing follows stablecoin issuer Circle’s own IPO last month and Kraken’s reported plans to file soon. Under the previous SEC administration, Gemini faced legal challenges related to its Earn program, but since then, the SEC and Gemini have filed a joint motion seeking a potential resolution.

Big Tech Eyes Stablecoins for Cheaper Cross-Border Payments

Tech giants Apple, X (formerly Twitter), Airbnb, and Google are exploring stablecoin integrations to reduce transaction costs and enhance cross-border payments, according to a Fortune Crypto report. The move would follow earlier efforts by Meta and Uber to evaluate stablecoins as a cheaper alternative to traditional payments. Elon Musk’s X has already dabbled in blockchain and crypto, laying the groundwork for payments features akin to China’s WeChat, while also deepening its crypto development team even before Musk’s acquisition.

The conversations reflect the maturing stablecoin sector, which saw on-chain Ethereum-based stablecoin volume reach $1.42 trillion in May, with Circle’s USDC making up 41.5% of that. Meanwhile, Circle’s successful IPO this week boosted its stock nearly 200% above the listing price, highlighting investor appetite. As more firms integrate stablecoins, the dollar-pegged assets could further cement the U.S. dollar’s dominance globally, driving both market liquidity and demand for U.S. treasuries.

UK’s FCA Proposes to Lift Ban on Crypto ETNs for Retail Investors

The UK’s Financial Conduct Authority is considering lifting its ban on crypto exchange-traded notes (ETNs) for retail investors, signaling a potential shift in how everyday consumers can access crypto investments. The move would bring the UK closer to the regulatory frameworks of the U.S., Canada, Hong Kong, and the EU, which already allow crypto ETNs on regulated exchanges. FCA-registered platforms would be required to ensure appropriate disclosures and risk warnings to protect retail investors.

“This consultation demonstrates our commitment to supporting the growth and competitiveness of the UK's crypto industry,” said David Geale, the FCA’s executive director of payments and digital finance. The proposal comes amid the FCA’s broader crypto regulatory push, which includes recent stablecoin guidance and plans to develop rules covering staking, lending, and custody. Notably, the ban on direct crypto derivatives for retail remains in place.

The proposal could open new avenues for retail investors to participate in crypto markets through products that track digital assets’ prices without requiring direct ownership. Kraken UK’s General Manager Bivu Das called it a “major milestone,” emphasizing the importance of balancing investor access with education and protections. The FCA’s move highlights the UK’s ambition to remain competitive in the digital asset sector while ensuring consumers have the tools to navigate crypto’s high-risk environment responsibly.

Metaplanet’s $5.4 Billion Raise Accelerates Bitcoin Strategy

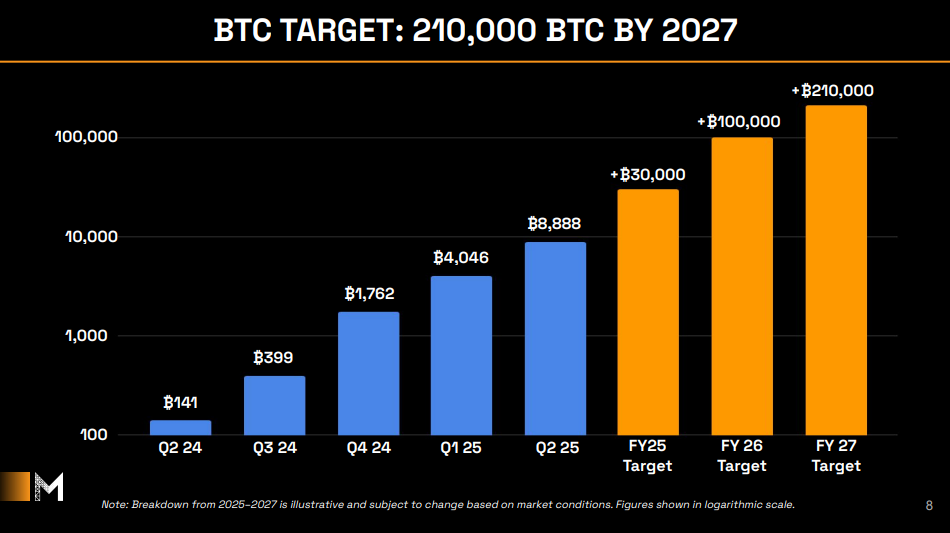

Japanese investment firm Metaplanet is doubling down on its Bitcoin strategy with a massive $5.4 billion equity raise — the largest of its kind in Asia — to fund additional BTC acquisitions. Announced Friday, the raise will be executed through Japan’s “moving strike warrant” structure, selling shares gradually to minimize market impact. The plan, dubbed the “555 Million Plan,” aims to increase Metaplanet’s BTC holdings from 10,000 to 30,000 by year-end 2025, and to 210,000 by 2027, pushing the company into the exclusive “1% Club” of BTC holders.

Metaplanet’s rapid accumulation strategy mirrors Michael Saylor’s at Strategy, with both firms betting on Bitcoin’s potential to outperform traditional store-of-value assets. Metaplanet currently holds 8,888 BTC valued at around $920 million, with the company reporting paper gains of approximately $71 million since it began its acquisition strategy. The firm’s year-to-date BTC yield stands at 225.4%, underscoring the conviction behind its high-risk, high-reward strategy.