.png)

In a recent, thought-provoking livestream hosted by Finery Markets, a panel of fintech experts delved into the complex world of OTC trading efficiency, spotlighting the groundbreaking FM Liquidity Match. The session, expertly moderated by Sergey Klinkov, Managing Director at Finery Markets, featured Leo Hmelnitsky from Finery Markets and Samuel Rondot from DAMEX, who offered their seasoned perspectives on the evolving digital asset space and the role of technology in reshaping fintech's future.

Sergey Klinkov introduced the session, highlighting the crypto industry's rapid evolution amidst regulatory shifts and market upheavals like the FTX collapse. This set the stage for a rich discussion on the intricacies of today's trading environment and the innovative solutions that are emerging.

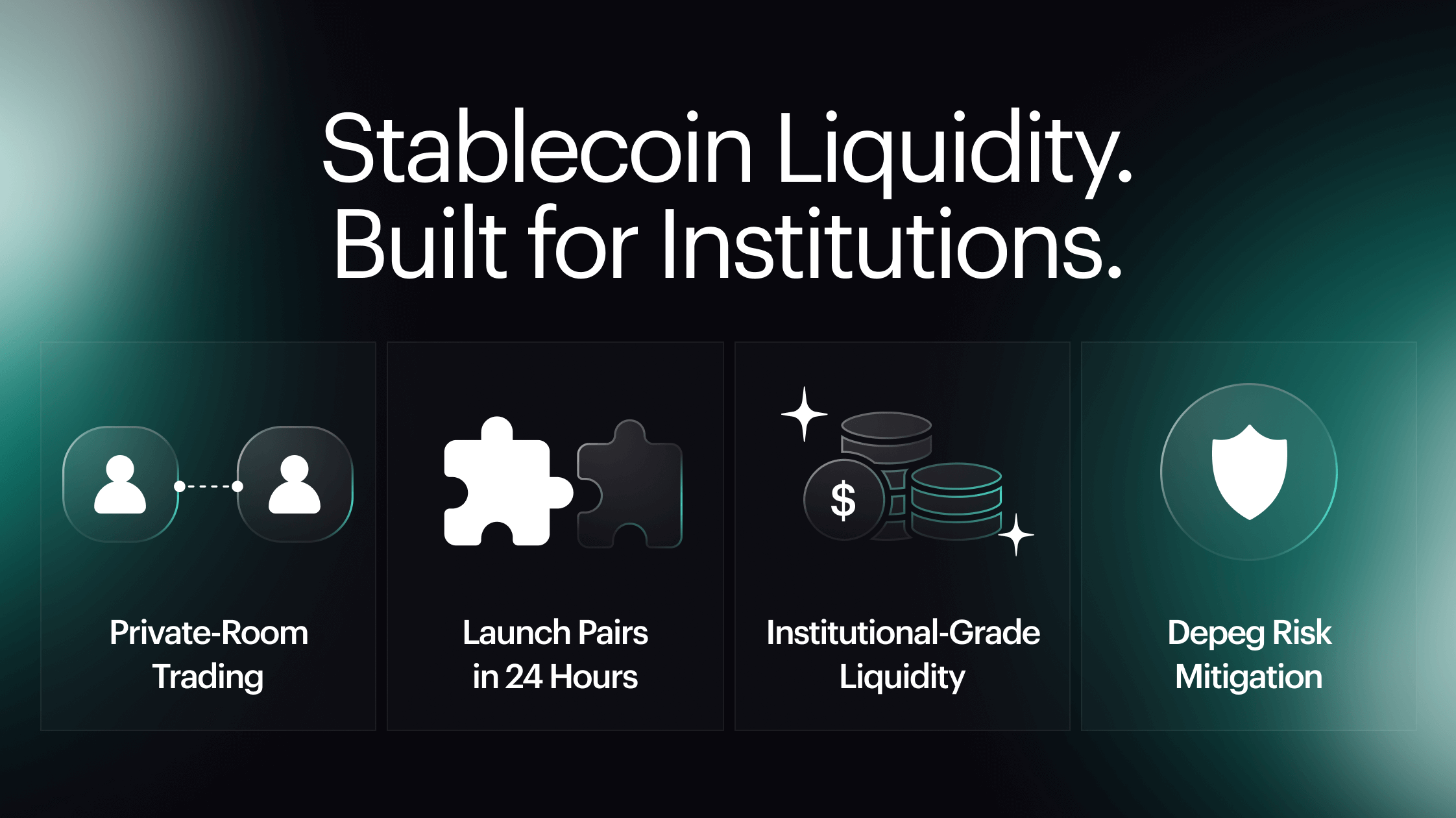

Leo Hmelnitsky provided a deep dive into the current liquidity trends, noting, "What we've seen with Bitcoin nonetheless is that it has appreciated 126% year to date." He elaborated on how Finery Markets is navigating these shifts, observing a slowdown in crypto-to-crypto trading but an uptick in stablecoin activities. This insight underscored the dynamic nature of the current trading landscape.

From DAMEX's perspective, Samuel Rondot highlighted the significant growth in cryptocurrency adoption. He shared, "This year we've traded about 25% more than last year," emphasizing the burgeoning use of cryptocurrencies in payments and expressing optimism about the industry's growth trajectory. Rondot also touched on the changing institutional behavior towards crypto, remarking, "For the very first time, I can say that we have significant change in the behavior of institutional players," indicating a notable shift in the market's maturity.

A critical part of the discussion centered around FM Liquidity Match and its role in revolutionizing OTC trading. Sergey Klinkov posed a question about the challenges that led to the adoption of this solution. In response, Rondot detailed the journey towards more automated, client-focused solutions, "For the last couple of years, we have been concentrating on serving our client with bespoke solutions." He highlighted how FM Liquidity Match addresses the need for more granularity in order processing and the demand for regulated, client-facing interfaces.

Expanding on the diverse applications of FM Liquidity Match, Leo Hmelnitsky explained, "LPs looking for proprietary ECN solutions, we have custodians, we have payment providers." He emphasized the platform's versatility, catering to a broad range of clients and the growing set of liquidity providers, thereby offering a comprehensive solution that spans across various market participants.

Looking to the future, Hmelnitsky expressed optimism about the potential for growth, especially considering the impending launch of crypto ETFs. "I think the ETFs, now being held by regulators, will definitely provide a big jump higher," he said, highlighting the collaborative efforts with entities like DAMEX and the development of features that bridge traditional finance and the decentralized finance (DeFi) world.

In summary, the "Improving OTC Trading Efficiency with FM Liquidity Match" livestream offered valuable insights into the evolving landscape of digital asset trading. The perspectives shared by Leo Hmelnitsky and Samuel Rondot, guided by Sergey Klinkov's moderation, painted a comprehensive picture of the current market dynamics, the innovative solutions like FM Liquidity Match driving the market, and an optimistic outlook on the future of digital assets and fintech.

.png)

.png)