This year has been a remarkable one and we’ve achieved many milestones in terms of product development and innovation for our clients. We would like to take this opportunity to thank you for your continued partnership and to give you a recap of some of the new features that we released in 2022:

- Non-Deliverable Trading: In addition to spot trading products, we also introduced non-deliverable products that offer overnight rates for clients who want exposure to markets without having to physically own/deliver the underlying assets.

- FIX API: We have implemented a FIX 4.4 (Financial Information Exchange) protocol into our system which allows for smoother and faster communication between institutional participants and market makers, improving overall trading efficiency.

- Enhanced Risk Management: To further protect our customers, we upgraded our risk management system by introducing per-counterparty & per-asset risk limits, margin controls and real-time monitoring capabilities which enable to detect abnormal patterns as well as alert users when certain thresholds are met or exceeded.

- Multi-Roles: With the launch of role-based user access controls, Finery Markets now offers granular permissioning capabilities so institutions can customize user entitlements based on individual roles within their organization. This feature helps organizations achieve better oversight and compliance with their internal processes while still allowing users to collaborate effectively within the platform.

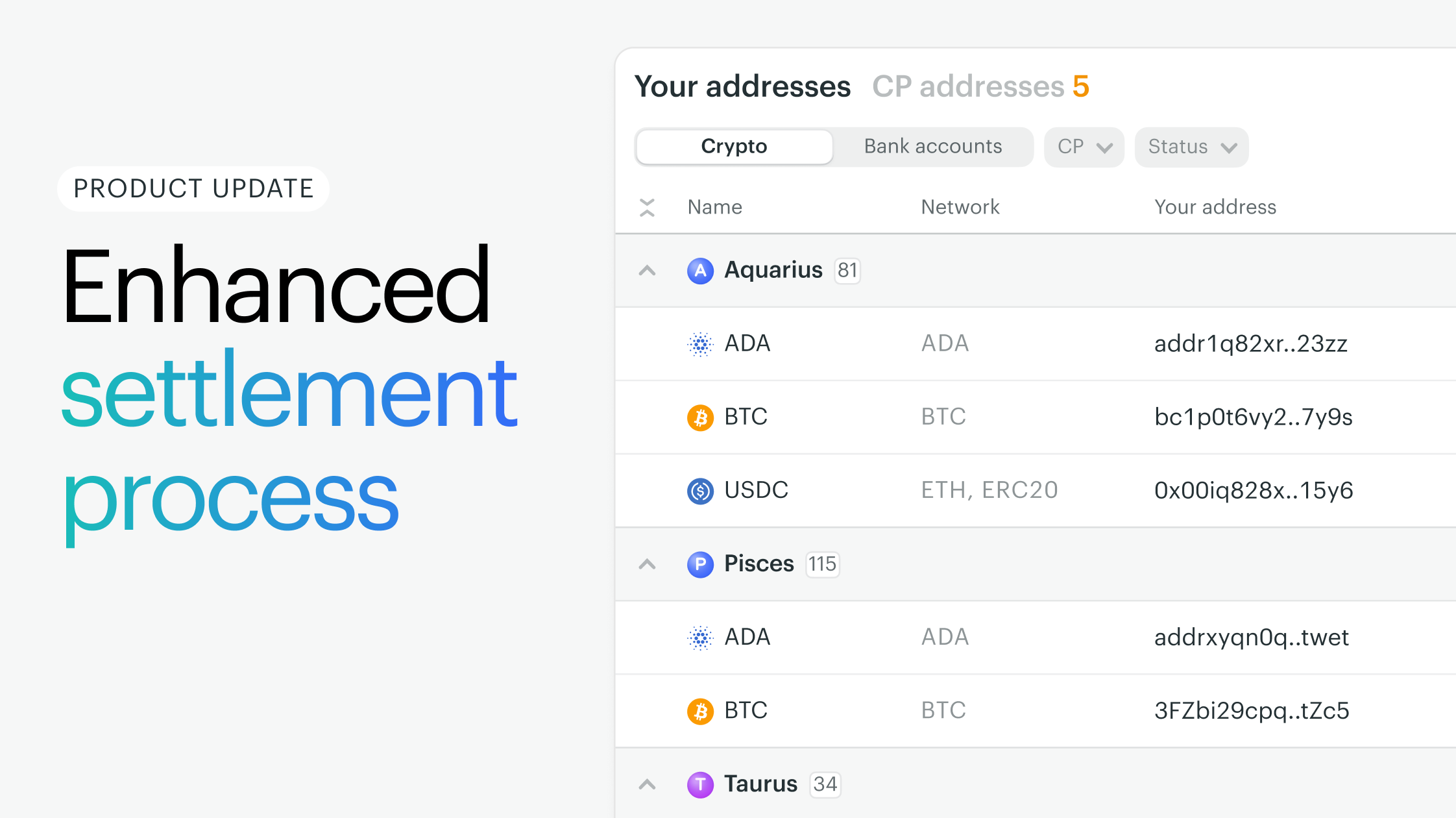

- Clearing & Settlement Optionality: We’ve partnered with HiddenRoad and ClearJunction to deliver an unprecedented experience. We supported HiddenRoad industry-first over-the-counter (OTC) prime brokerage services and provide their counterparties with an access to our OTC multi-dealer execution platform. Through our partnership with Clearjunction, we provide an innovative DvP mechanism for institutional crypto-fiat settlements — dramatically reducing counterparty risk associated with this process.

- Finery Markets Pulse: Lastly, our analytics platform “Pulse” was released this year. Interactive visuals allow users to compare spread data across different venues for informed decision making about their trading execution. The integrated spread calculator also serves as a useful tool for market participants looking for an edge in understanding how spreads move and how they can capitalize on short opportunities when needed. More: https://pulse.finerymarkets.com/

We hope these developments have made your trading operations smoother and more effective this year, and we look forward to continuing delivering great value through innovative solutions next year too! Wishing you all happy holidays from all at Finery Markets!

More: https://finerymarkets.com/