The market crash of October 10-12, 2025 was marked by a massive sell-off and stablecoin depeg event. Institutions faced a critical infrastructure choice.

CEXs with visible order books amplified panic through liquidation cascades, collateral mispricing based on isolated exchange prices, and bank-run dynamics that accelerated during stress events.

The problem wasn't just price dislocations. It was structural fragility that could transform a localized issue into systemic failure. Institutions needed infrastructure that could absorb shocks without broadcasting panic signals across the market.

That's where Finery Markets' OTC private rooms came in.

OTC as a crisis response infrastructure

- Crisis Detection: Ethena's USDe stablecoin briefly crashed to $0.65 on Binance while holding $0.92 on Bybit, creating collateral evaluation risk. Binance's reliance on its own local spot price for collateral evaluation posed potential for exploited liquidation spirals.

- Institutional Migration: Capital rapidly shifted to Finery Markets' OTC private rooms, where off-screen liquidity and bilateral pricing isolated trades from visible order book panic.

- Containment: Private room architecture prevented contagion by absorbing price shocks within discrete trading relationships rather than broadcasting them across public venues, while USDe redemptions continued functioning smoothly on primary platforms.

Finery Markets OTC: Battle-Tested Market Design

Finery Markets' private room infrastructure delivered resilience across four critical dimensions:

Unlike centralized exchanges with visible order books, each OTC private room operates as a unique liquidity environment for individual takers. Off-screen execution prevented panic-driven information cascades, significantly reducing systemic risk propagation.

This infrastructure acts as a firewall against systemic contagion due to the fundamental difference in order book structure:

| STRUCTURE |

CEX |

OTC PRIVATE ROOMS |

IMPACT ON RISK |

| Order Book |

Central, Visible liquidity |

Unique to each taker,

Off-screen liquidity |

Dark liquidity significantly reduces the spread of systemic risk. |

| Panic |

Visible panic accelerates “bank-run” like dynamics. |

Private rooms effectively contain price shocks. |

|

Private rooms functionally isolated price shocks. While exchange order books amplified selling pressure through visible liquidation waves, OTC infrastructure absorbed volatility without broadcasting stress signals across the broader market.

- Liquidity commitment under stress

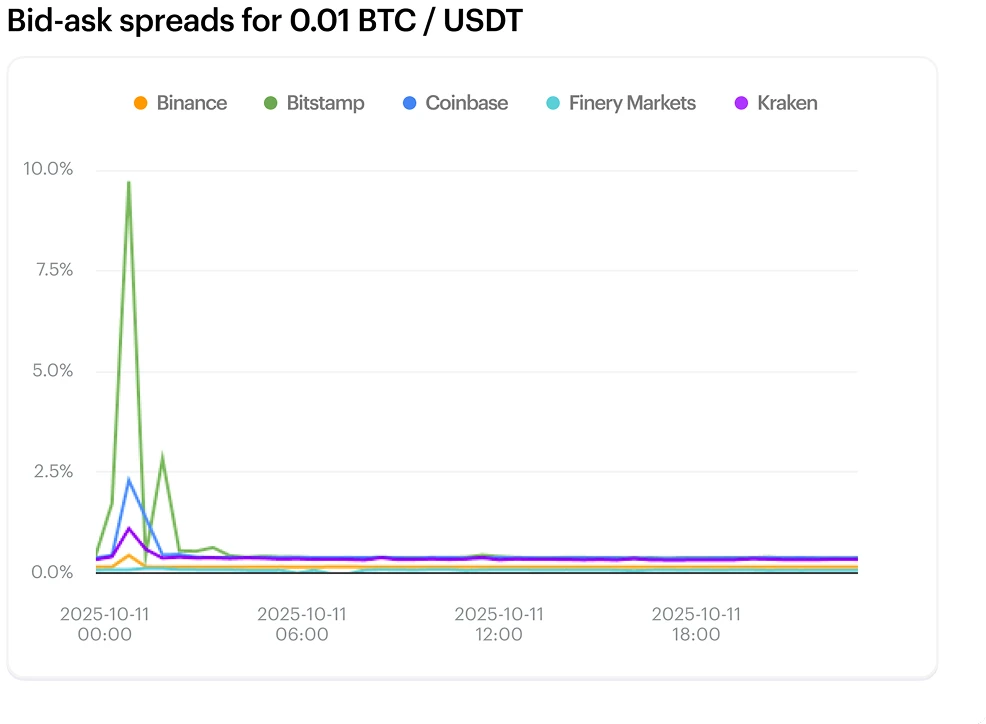

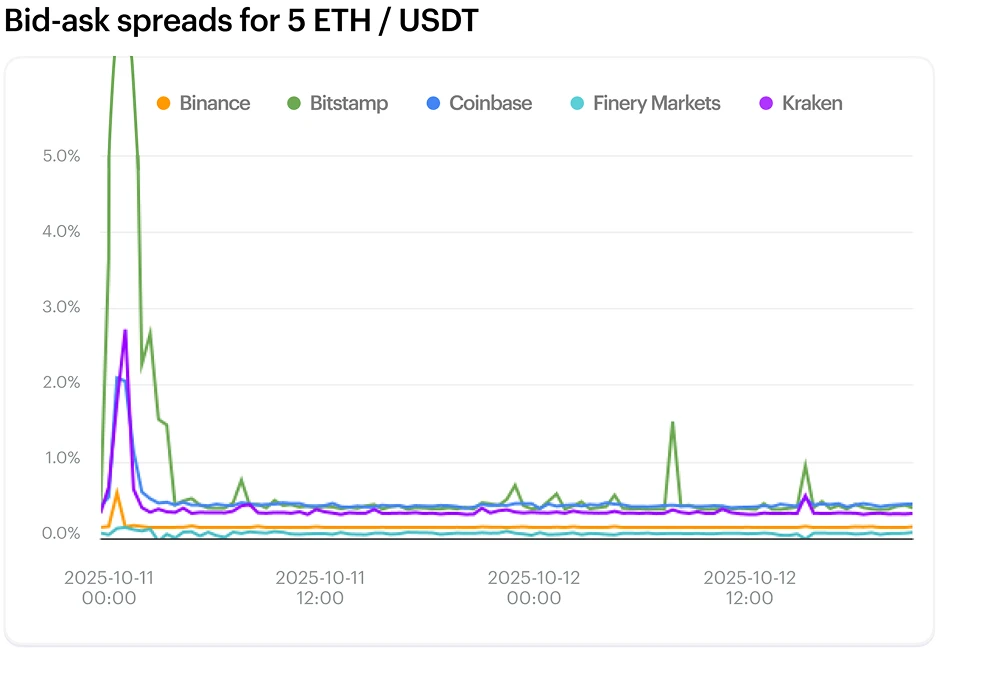

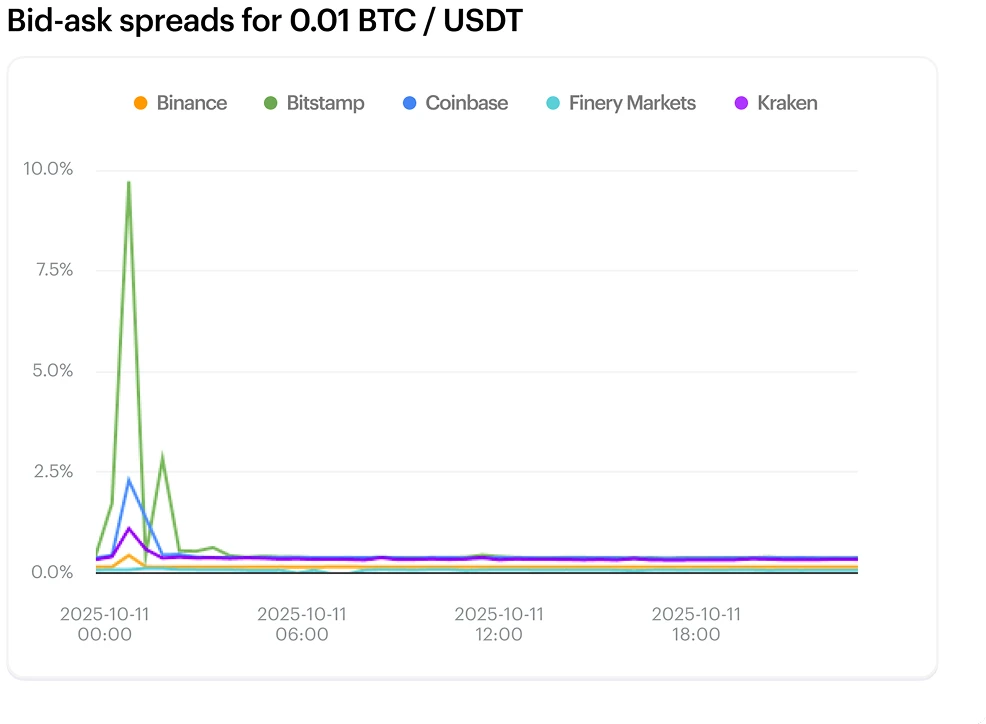

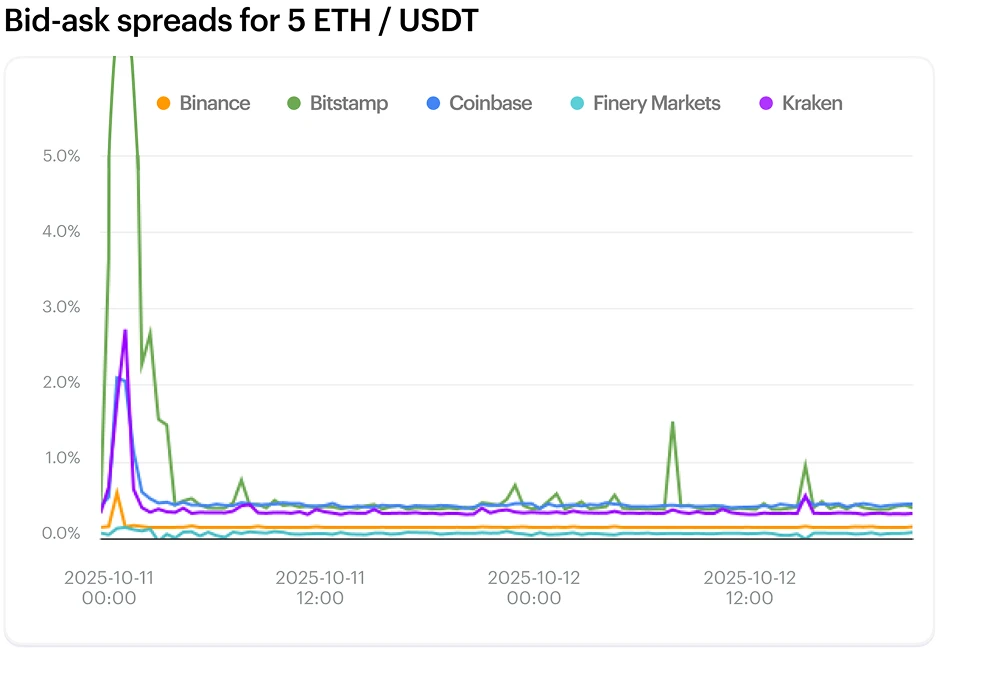

During peak crisis periods (October 10-12), OTC spreads remained substantially narrower than exchange spreads, which jumped significantly. This demonstrated superior capital commitment when institutions needed it most.

Institutional switch to OTC

The operational performance of Finery Markets' OTC infrastructure during the crisis period validated its markets design advantages

- +107% volume growth (WoW) for BTC/USDT and ETH/USDT pairs in OTC private rooms versus +48% on exchanges.

- Substantially narrower spreads maintained throughout the crisis while exchange spreads deteriorated significantly, proving superior liquidity quality during peak stress

- Zero systemic contagion

from USDe depeg. OTC infrastructure successfully contained what could have been a cascade across leveraged positions

- Continuous market function with off-screen liquidity pools maintaining orderly execution as exchange order books fragmented across venues

A Proven Risk Mitigation Framework

Finery Markets' OTC private rooms provided institutions with structural insulation from exchange-driven contagion. By isolating bilateral trades from visible order book dynamics, the infrastructure prevented localized price dislocations from propagating systemwide.

The USDe incident demonstrated the critical importance of this design. Had institutional volume remained concentrated on exchanges with visible liquidation cascades, isolated price crash could have triggered collateral mispricing across platforms, creating a self-reinforcing liquidation spiral.

Instead, OTC infrastructure absorbed the shock through dark liquidity pools that maintained pricing integrity and prevented panic amplification.

Strategic Outcomes

Finery Markets provides institutions with OTC technology to build an off-screen execution layer. During the October 2025 crisis, it delivered:

- Systemic risk firewall that contained exchange dysfunction

- Superior liquidity quality during peak volatility

- Collateral integrity protected from single-exchange price distortions

- Continuous market access when public venues fragmented

- Validated execution advantage

.png)